Why Might I Be Wrong About Trend GDP?

Image source: Pixabay

In recent years, I’ve suggested that the trend RGDP growth is around 1.8%, which implies a 3.8% NGDP figure in order to achieve the Fed’s inflation target. Recent strong GDP growth, combined with the Atlanta Fed’s current 4.2% RGDP estimate for Q1, suggests that trend growth might be stronger than I assumed. Why might that be?

In theory, faster-than-expected trend growth could be due to either productivity or labor force growth. But if I was wrong about GDP, it was probably related to a similarly over-pessimistic assumption about labor force growth.

In theory, the recent strong jobs numbers might reflect a variety of factors:

1. Falling unemployment.

2. Discouraged workers re-entering the labor force.

3. Immigration.

I lean toward the third explanation. The unemployment rate has not fallen over the past 20 months, so the first explanation won’t work. In theory, the correct explanation should be growing labor force participation, as the Census Bureau claims that recent population growth has been very slow (0.4% and 0.5% over the past two years.)

But I’m skeptical of the population growth figures. There’s a lot of anecdotal evidence of a surge in illegal immigration. We are seeing big increases in illegal migrant detentions, even from far-flung places like China, India and Russia, not just Latin America. While migrant detentions don’t tell us how many people slipped through the net, the two figures are widely assumed to be highly correlated.

I suppose this is good news for monetary policy, as this view suggests that the recent strong jobs figures don’t necessarily imply overheating. But in order for immigration to prevent overheating, we need it to prevent strong nominal wage growth. And on that score the 0.6% figure for January is worrisome:

Wages skyrocketed on the month and from the prior year, both above what economists expected to see. Average hourly earnings were up 0.6% from the prior month, double the average estimate, and rose 4.5% from the prior year. Part of the outsize gains could be attributed to reduced hours, which tend to distort pay. Hours worked fell to the lowest since March 2020.

The report clearly shows that demand and wage pressures are far from cooling. That is consequential for the Federal Reserve, which has been signaling that the strength in the labor market shows inflationary pressures are still in the system, and that’s something policymakers will keep in mind before pivoting to rate cuts. Wage growth in particular points to additional fuel for consumers.

The bond market also seemed a bit worried about the wage figures, as interest rate futures jumped on the news. Still, it’s just a single month, and the longer-run trend still points to an increasing prospect of a soft landing.

This is one of those odd periods where both hawks and doves seem to have missed something important. Hawks warned that inflation would stay high if we avoided recession, and it’s come down quite a bit. Doves warned that the Fed was holding rates high for too long—but there is little sign of the recession they feared would result from that mistake.

I still say that monetary policy is not tight, just a bit less loose than back in 2021 and 2022. People have consistently put too much weight on interest rate increases, but as Larry Summers recently pointed out, the neutral rate is probably higher than we’ve been assuming:

Former Treasury Secretary Lawrence Summers said the economy’s enduring strength in the face of vigorous Federal Reserve tightening makes it increasingly likely that neutral interest rates have risen.

It’s also increasingly clear that the strong labor market of the late 2010s had relatively little to do with Trump. We have an equally strong labor market under Biden. And he also deserves zero credit.

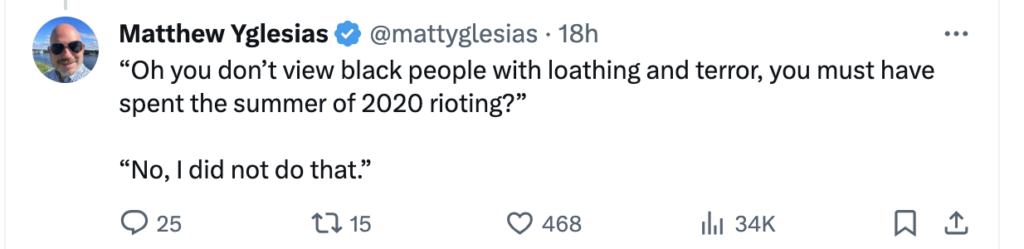

Speaking of politics, Matt Yglesias linked to a 5-minute clip of a Sam Harris interview. I cannot think of a single person who’s political views are closer to my own. Except Sam Harris is far more eloquent.

To give you an idea of how bizarre our politics has become, I have no idea whether that tweeter is attacking Harris from the left or the right.

And I feel a bit better knowing that Yglesias has exactly the same sort of nuts in his comment section that I have over here:

That’s what I find so funny about my trolls. They are not even aware of how others see their posts. And that “@harvard.edu” email address doesn’t fool anyone.

More By This Author:

What About Gradualism?Poorly Defined Concepts In Macroeconomics

The Weird And Depressing Debate Over AS/AD