Why Isn’t The U.S. Rolling Over Into Recession?

The most important thing for investors to understand about the economy is that “it is different this time.”

We’ve already assessed how multiple previously accurate recession indicators (yield curve inversion, Sahm Rule trigger, etc.) have registered false positives in this cycle.

Why is this happening?

For one thing, the U.S. has never voluntarily shut down its economy. It’s also never pumped $11 TRILLION (an amount equal to over 50% of GDP at the time) into its financial system in the span of 20 months.

But surely both of those items have been factored into the data by now, right?

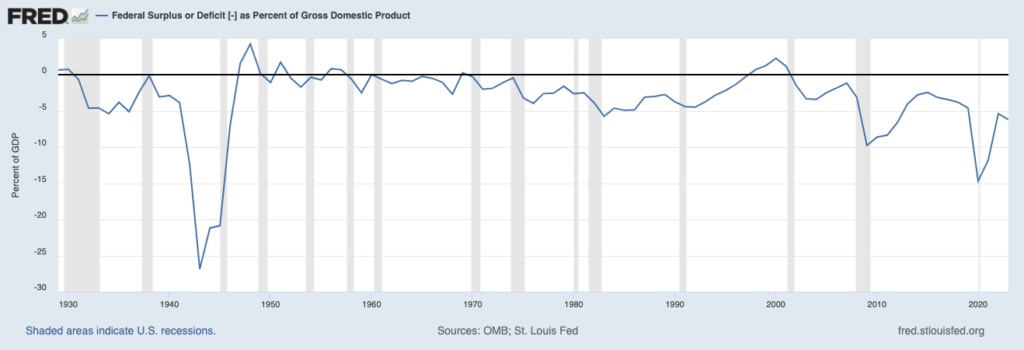

Sure, but you also have to consider that the money printing/ spending, hasn’t stopped! The U.S. is currently running the largest deficit as a percentage of GDP outside of WWII.

It is VERY difficult for the economy to roll over into recession with this going on. Indeed, in many ways, the government IS the economy right now.

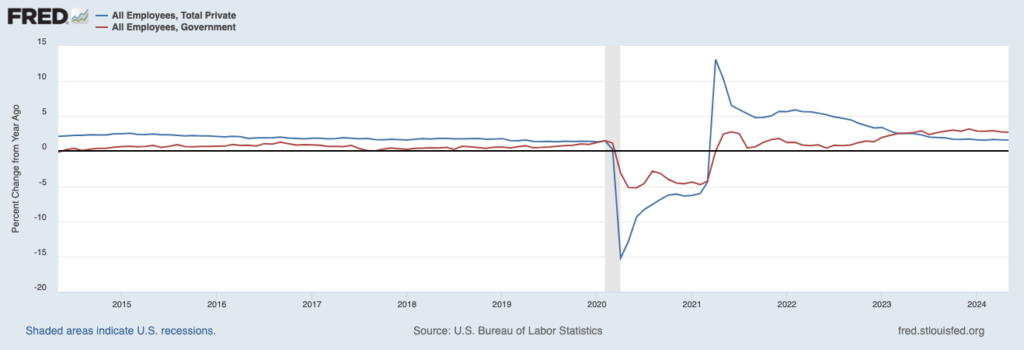

Since mid-2021, job growth in the public sector/ government (red line in the chart below) has outpaced that in the private sector (blue line in the chart below).

The government isn’t just hiring, either. It’s also putting out gargantuan amounts of money via social spending. As E.J. Antoni notes, 40% of the growth in income in 1Q24 was from government transfers (read: spending). Indeed, government transfers were the SINGLE largest contributor to personal income growth in 20 states!

So Uncle Sam isn’t just hiring… he’s also handing out money by the tens of billions of dollars!

Again, it’s VERY difficult for the economy to roll over into recession with this going on. I’m not saying this will work forever. But we need to see the private sector absolutely collapse to overcome all these government interventions in order for the economy to roll over into a REAL recession.

After all, as investors, our job is to make money, not look for any excuse to dump stocks and panic about something bad happening. And as I’ve outlined in recent articles, this means riding bull markets for as long as possible, and then side-stepping bear markets when they eventually hit.

In the very simplest of terms, you need to be invested in stocks, until an objective, verifiable tool (not your feelings or limiting beliefs) tells you it’s time to “get out.”

More By This Author:

Want to Get Rich From Stocks… Remove These Three Ideas From Your Mind

Are You Worried About A Recession?

Is The Stock Market About To Crash?