Why Cyber Security Stocks Look Poised For Continued Growth In 2018

It was 2015 when IBM’s Chairman, President and CEO Ginni Rometty said, “Data is the phenomenon of our time. It is the world’s new natural resource. It is the new basis of competitive advantage, and it is transforming every profession and industry.”

She couldn’t have been more right. The world continues its push to go digital in more areas than ever, with restaurants dropping employees for robots, self-driving cars set to take over roads and cryptocurrencies intensifying the war on cash. In doing so, every individual and institution running these and so many other networks are leaving perpetual trails of data everywhere. Some of the most impressive organizations, such as Google (GOOG), Facebook (FB) and Amazon (AMZN), are demonstrating that data really is the most valuable commodity in the market.

But Rometty’s words are even more prophetic than just predicting the increasing value of mass data. “If all of this is true– even inevitable –,” she followed her above remarks, “then cyber crime, by definition, is the greatest threat to every profession, every industry, every company in the world."

Cyber Security’s Rise

While the groundbreaking developments in data and technology are in many ways exciting and breakthrough, they are simultaneously triggering mass exposure to unprecedented levels of cyber-danger proving costly and threatening to society. From email phishing and ransomware attacks to cloud vulnerabilities and data breaches, hackers are demonstrating their prowess. And with governmental bodies wrestling with talks of potential election interferences and mass technology firms losing grip of invaluable user data, these major institutions are emerging as clear targets by hacking groups. Thus, the demand for top-notch security is greater than ever.

To refresh your memory, here are some notable examples of cyber-warfare in recent history. This past September, major credit reporting company Equifax (EFX) was attacked and information on an unimaginable 148 million consumers was hacked. Flip back a couple years and recall when around 70 million debit and credit card numbers were stolen from Target (TGT). Uber has even been a recent victim too. As such, even the most “reliable” companies are proving vulnerable to cyber-damage.

To quantify the issue in broader terms, cybercrime is expected to cost companies $6 trillion in damages by 2021, which would double its 2016 impact. Further, leading research entity on global cyber economics Cybersecurity Ventures forecasts that worldwide expenditure on cybersecurity products and services will exceed $1 trillion in the coming years, reflecting the gravity of the current landscape and dire need for asset protection.

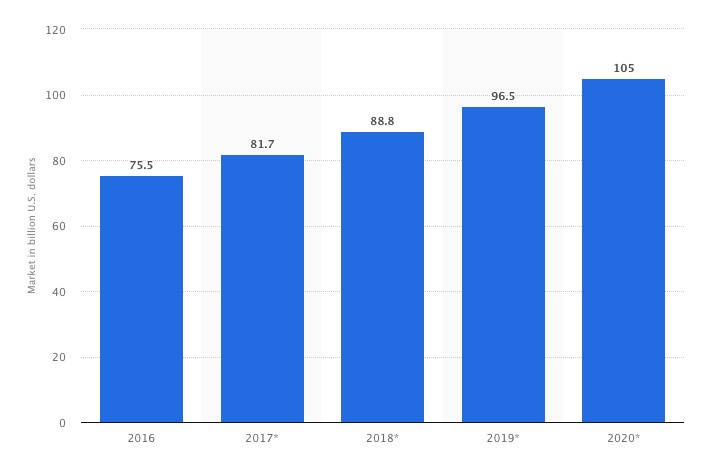

These less than ideal circumstances that the tech world finds itself in has caused the cyber and IT security industry to soar. Sized at $81.7 billion in 2107 by Statista, the global IT security sector is on pace to become a $105 billion industry by 2020. Global spending on IT security services in 2018 is also on pace to increase for yet another consecutive year, and would mark a 39% increase over the past half-decade.

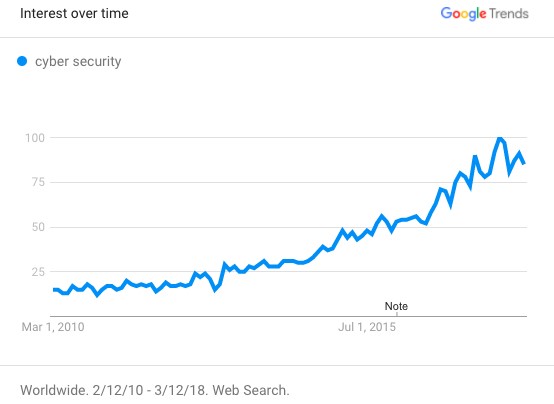

In an attempt to gauge public interest and concern on the matter, Google Trends appear to confirm that cyber security has increasingly been on people’s minds. The graph below demonstrates the term as a search trend since 2010.

"Cyber security is definitely a topic that is being taken into account now more than ever,” shared Moti Attias, CEO of international security company ProTeachTeam. “It’s subject clients seem to be very concerned about, and with reason. Most of the recent inquiries we’ve been receiving have been about cyber security. All security projects being assessed by ProTechTeam worldwide now include a reference to cyber security and all related risks and challenges. We’ve been forced to integrate the subject in assessments and consultations and start acknowledging it more over time.”

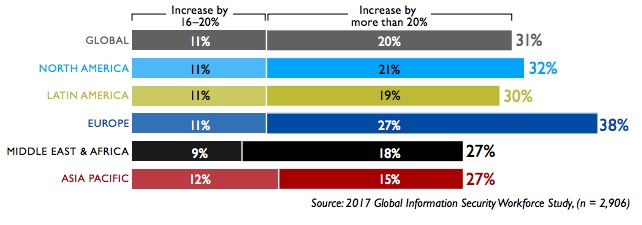

The job market for cyber security talent is spiking too. According to Glassdoor.com, average base pay for a cyber security manager is upwards of $82,000 with plenty of room to grow into six-figure earnings. Moreover, recent results from the Global Information Security Workforce Study (GISWS) indicate that a growing workforce gap is forming. According to the study, an estimated shortage of 1.8 million professionals in the space could be seen by 2022. The study also found that around a third of hiring officials intend to boost the size of their cyber security departments by at least 15%.

While the circumstances certainly less than ideal, the market can’t deny the growing needs at hand. And as long as the cyber-hacking industry stays lucrative, criminals will stay their course. So, with the demand certainly there, public cyber security and insurance equities are certainly worth consideration for your portfolio.

Companies in the space are on the rise, building everything from firewall infrastructure software and biometric security solutions to advanced analytics for developing protective intelligence.

IBM Security (IBM), with a market cap of $146 billion, has been a powerhouse in the space for years, and offers enterprises a wide range of customized solutions, including security analytics, forensics, and cyber risk assessment. Cisco (CSCO) has a market cap of over $215 billion and is another reputable player that has been around for years.

Smaller, yet immensely impressive companies like Palo Alto Networks (PANW) exude the industry’s depth. Offering clients network security through advanced firewalls, advanced endpoint protection, threat detection and protection and cloud security, the firm looks poised for further growth. Rapid7 (RPD) is an analytics-focused firm that offers leading data-driven intelligence solutions for companies looking to develop and implement powerful cyber and IT security solutions. The companies have market caps of $17.4 billion and $1.26 billion, respectively.

Additionally, two notable ETFs focusing on the cyber security sector, PureFunds ISE Cyber Security ETF (HACK) and the First Trust Nasdaq Cybersecurity ETF (CIBR) each have experienced significant growth over in recent past and are worth consideration as well.

Newer technologies, like cryptocurrencies and digital assets, that lack historical precedent with regards to best-practice security measures are hot commodities too protect in particular. “Digital cryptocurrencies such as bitcoin (BTC.X) are continually making headlines as tech investors closely follow the daily rollercoaster price swings hoping to cash in.” stated Scott Schober, Cybersecurity Expert and Advisor to BlockSafe Technologies. "For all of the layers of security that cryptocurrencies both establish and also require, cryptocurrency traders still suffer from tried and true social engineering and inherent weaknesses in all security managed by people," noted Schober.

Since its inception almost a decade ago, the emerging sector has had a checkered past on security issues, as unprepared, vulnerable exchanges and personal wallets have been lucrative targets of hackers. Therefore, a major trend in the space over the recent years has been to solidify infrastructure and allow for better confidence in use. A University of Cambridge study in 2017 focusing on the global cryptocurrency landscape found that exchanges allocate 13% of their personnel to full-time security work and 17% of their total budget on security. The study also noted that “Over 70% of exchanges secure their systems with the help of external security providers, including external code reviewers, multi-signature wallet service providers and two-factor authentication (2FA) service providers.”

Cyber Insurance’s Expansion

In a nearby corner to cyber security, cyber insurance is still in its nascent stages, largely due to the rapid acceleration of the digital and cyber related activity the world is now involving itself with. As such, risk assessment for the industry is more difficult as it lacks the years of data that sectors like health and auto have accumulated over time. Cyber insurance is therefore one of the more upcoming, developing segments of the insurance industry.

“Cyber insurance is one of the fastest growing segments of the insurance industry,” said American Israeli cybersecurity expert Ariel Evans in a Forbes interview. “Cyber insurers are beginning to understand the need to differentiate themselves and price policies based on the actual risk of the insured.”

American International Group, Inc. (AIG) has been a household name in the insurance space that could be on the rise, as well as Beazley Group, another insurance firm with a global presence and cyber-focused operation. Chubb Ltd. (CB) also looks to be a significant part of cyber security future, securing $3.9 billion net income in 2017.

An industry report published by Allied Market Research estimates that the global cyber insurance market will reach $14 billion by 2022. Such an outcome would mean a nearly 28% compound annual growth rate from an initial 2016 benchmark. Other findings in the report found that hospitals are currently among the most likely brand of organizations to have strong cyber insurance backing and that European countries have the most room to grow in this space.

As the world continues its trajectory to digitize everything and integrate tech wherever it can, highly valuable data will continuously be at risk. It is for this reason that the cyber security market appears to be here to stay. For those inexperienced in investing in the security and insurance industries, gaining a straightforward, yet comprehensive understanding of a company’s service and product line as well as assessing its competition is a wise start.

Disclaimer: The ideas expressed in this writing are my own personal opinions and should not be taken as financial advice in any regard. Individuals or institutions seeking to invest in the any of the ...

more

Good stuff. When will we see more by you?