Why Are The Chinese Stockpiling Silver? Big Price Move Coming?

It looks like something big may happen to the silver market and the Chinese are preparing for it. After China launched it’s new Yuan Gold Fix today, the prices of the precious metals surged. At one point today, silver was up 5%. Silver is now trading at the $17 level, a price not seen in over a year.

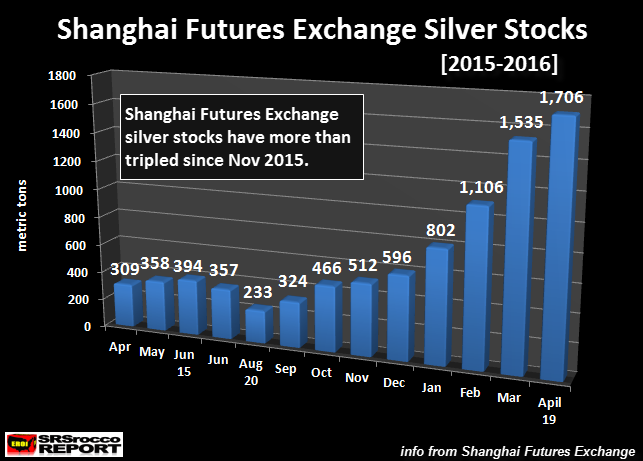

Even though gold has taken center stage today due to Chinese rolling out there new Yuan Gold fix, something quite interesting has been taking place in the silver market over the past six months. While Comex silver inventories have been declining from a peak of 184 million oz (Moz) in July 2015 to 154 Moz today, silver stocks at the Shanghai Futures Exchange have been doing the exact opposite. And in a BIG WAY:

Shanghai Futures Exchange (SHFE) silver inventories bottomed on August 20th 2015 at 233 metric tons (mt), or 7.5 Moz. However, silver inventories at the SHFE began to really pick up in 2016 as they surged to 802 mt in Jan from 596 mt in December. This continued at a more rapid pace during the next few months reaching a staggering 1,706 mt today (54.7 Moz).

Thus, silver inventories at the SHFE have more than tripled in less than six months. Why have the Shanghai Futures Exchange silver inventories jumped this much in such a short time? Do the Chinese know something we don’t?

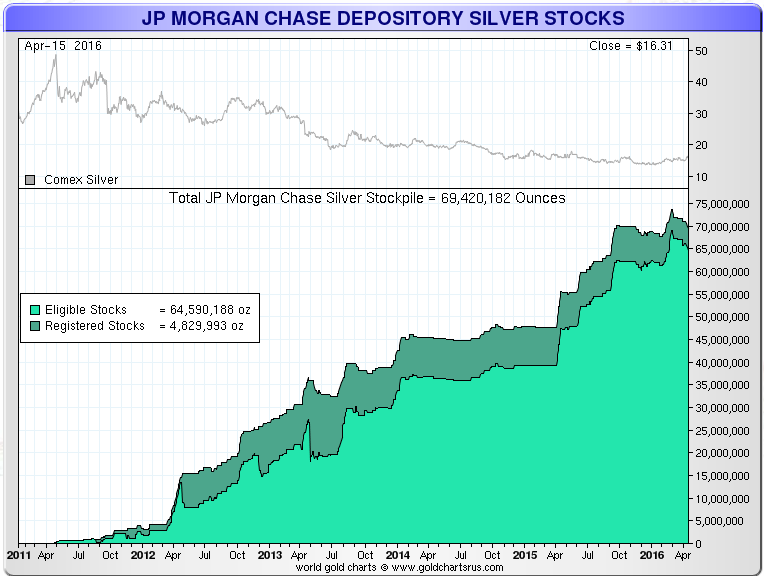

To give you an idea just how much the SHFE silver inventories have grown, let’s compare it to largest bullion bank Comex silver inventories in the world… JP Morgan (JPM). There’s been a lot of talk about the huge buildup of silver on JP Morgan’s Comex inventories. Here a chart of JP Morgan’s Comex silver inventories, courtesy of Nick Laird at Sharelynx.com:

JP Morgan started accumulating silver right at the price of silver topped at $50 in 2011. In April 2012, JP Morgan had about 4 Moz of silver in its inventories. JP Morgan’s silver inventories continued to grow as the price of silver declined to a low of $14. Today, JP Morgan holds 69.4 Moz of silver in its Comex warehouses.

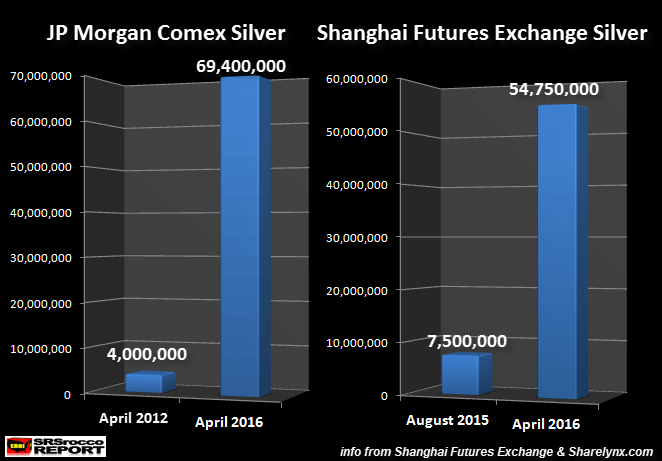

However, the Shanghai Futures Exchange silver inventories surged at a much more rapid rate. If we take a look at the chart below, you will see what I mean:

It took four years for JP Morgan to build their silver inventories from 4 Moz to 69.4 Moz today, whereas the SHFE silver stocks jumped from 7.5 Moz to 54.7 Moz in only eight months. And remember, most of the silver inventory gains at the SHFE came in the past four months.

Part of the reason for the increased silver stocks at the Shanghai Futures Exchange was probably due to the Chinese government abolishing the ban on silver concentrate imports in November 2015. According to the article, China abolishes ban on silver concentrate ore imports, unwrought bismuth exports:

China has abolished its ban on imports of silver concentrate ore and its refined concentrates, as well as exports of unwrought bismuth effective November 10, the Ministry of Commerce said in a directive posted on its website Tuesday.

MOC said the abolition is due to those products having complied with the country’s industrial policy, do not belong to high-energy consuming and high polluting sectors, as well as having comparatively high technological content.

Regardless, the Shanghai Future Exchange silver inventories have never been this high before. The highest level they reached was 1,143 metric tons back in May 2013. For whatever reason, the SHFE is accumulating a lot of silver, and quickly.

As I mentioned in my previous article, Record Breaking Silver Factors In 2015 Can Make 2016 Quite Interesting:

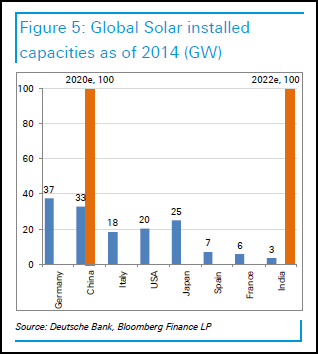

India and China plan on adding a lot of Solar Power by 2020-2022. India plans to reach 100 gigawatts by 2022 and China 100 gigawatts by 2020. That will take a lot of silver.

Either way, China is accumulating a lot of silver compared to the net exports years ago. If the new Chinese yuan gold fix is going to put a lot of pressure on the U.S. Dollar in the future, mainstream investors may need to start protecting themselves now before it may be too late to acquire silver at a reasonable price.

Disclosure: None.

Great article! I too believe something 'big' is right around the corner.