Whistling Past The Graveyard

A lot happened this week and it was almost all bearish in my opinion. The week started (Monday) and ended (Friday) with concerns about the collapse of behemoth Chinese property conglomerate Evergrande. US markets don’t seem much concerned about it but China is a key part of the global economy and problems there will almost certainly have ripple effects. I’m no expert on Evergrande or China but I think this is a bigger deal than markets are making of it.

China #Evergrande resumes slide as bondholders are left in the dark on today's deadline for a USD 83.5 million coupon. pic.twitter.com/5gR590IEBg

— jeroen blokland (@jsblokland) September 24, 2021

$FDX $GIS $NKE & $COST earnings make clear that supply chain issues are impacting businesses top line and inflationary pressures are increasing costs & squeezing margins. This is going to be an issue for 3Q earnings and the market has NOT priced it in $SPY $QQQ $IWM @chessNwine

— Top Gun Financial (@TopGunFP) September 24, 2021

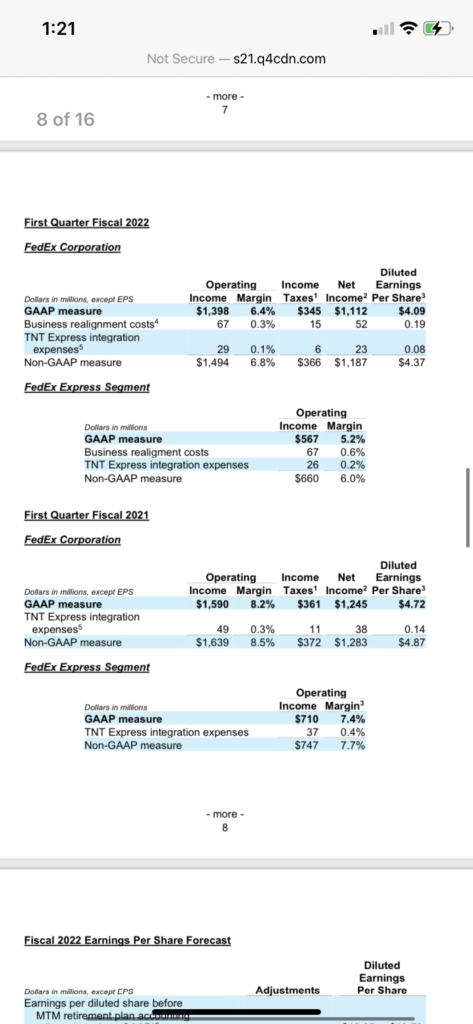

The most important piece of news on Tuesday was Federal Express (FDX) earnings. FDX was hit with supply chain issues and inflationary pressures causing its Adjusted Operating Margin to contract from 8.5% a year ago to 6.8%. Shares were annihilated Wednesday on huge volume.

On Thursday afternoon Nike (NKE) reported similar supply chain issues, specifically factory closures in Vietnam (where it produces much of its footwear and apparel) due to COVID. As a result, they guided current quarter revenue to flat to down low single digits compared to a year ago.

As I wrote in the tweet above, I think these two earnings reports in particular are canaries in the coal mine. The market reaction clearly shows that the news was unexpected and I believe these supply chain and inflation issues are not specific to FDX and NKE. My suspicion is that many more companies will be reporting similar issues during the upcoming 3Q earnings season and I see no reason why the market reaction will be any different.

Powell: The purpose of our language is to tell you we will probably taper at the next meeting.

— Nick Timiraos (@NickTimiraos) September 22, 2021

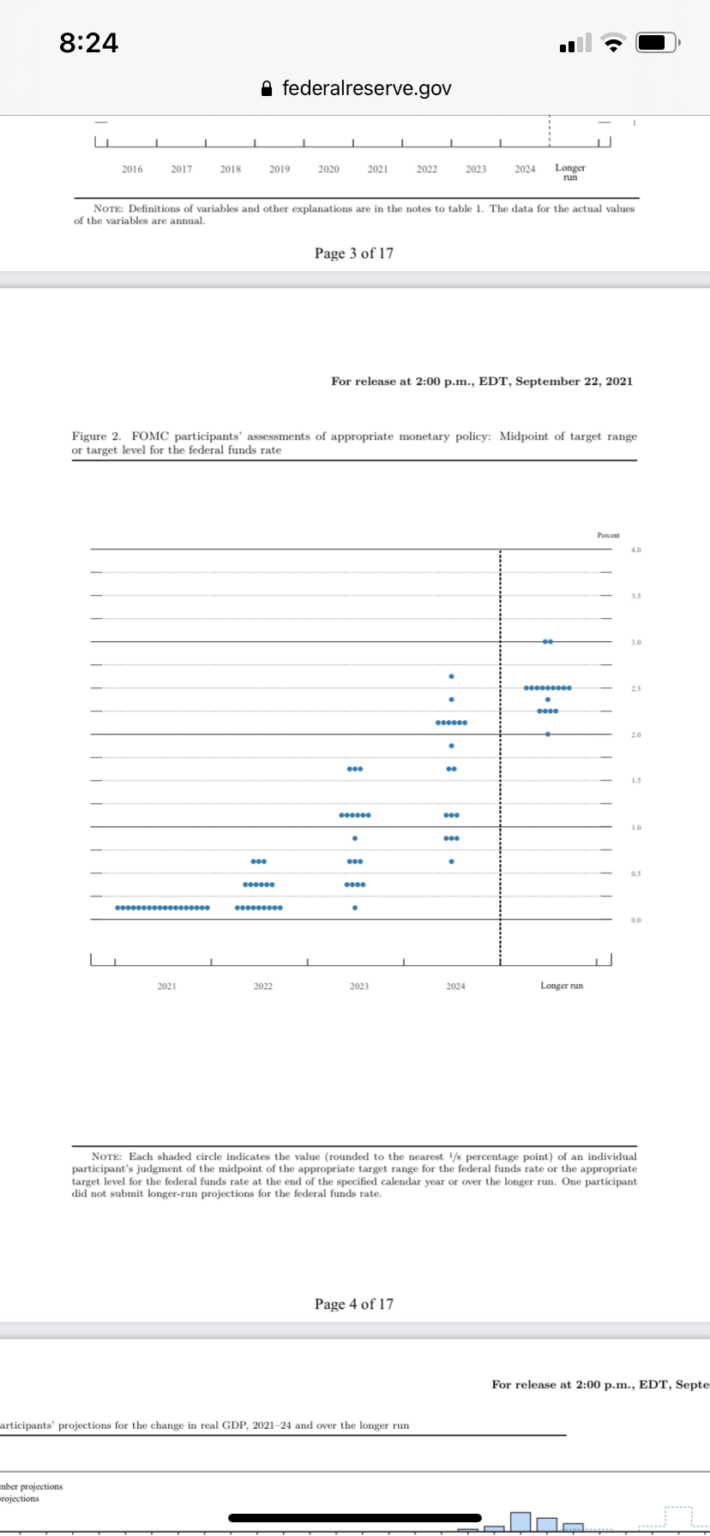

As if that wasn’t enough bad news, on Wednesday the Fed delivered a more hawkish message than I believe the market was expecting. In addition to almost guaranteeing a taper of asset purchases at their next meeting at the beginning of November, 9 of the 18 FOMC members now expect interest rates to increase next year (as you can see in the dot plot above) up from 7 in June.

In my opinion, Fed liquidity has been the main driver of the massive rally we’ve seen since the March 2020 lows. If the Fed is now tightening that should therefore be a headwind for financial assets.

To sum up: Evergrande is more likely to damage China’s economy and have spillover effects into the global economy than US markets seem to think, FDX and NKE are canaries in the coal mine for supply chain and inflationary issues that I believe are effecting many companies, and the Fed (whose easy money policies have been the main driver of asset prices since March 2020) is shifting gears and starting to tighten. In my estimation, the addition of these catalysts to a significantly overvalued market could well mean the bull market is over.