When The Snowball Reverses

“I wrote a series of articles on the Fed versus History. If you thought the Fed could keep us out of recession, you would be a bull. If you thought History would prevail, you should stay out of the market. I bet on History. Time has shown that History won that fight. History is a tough opponent. Betting against History is usually a losing proposition.” [Bull’s Eye Investing: Targeting Real Returns in a Smoke and Mirrors Market (2004) John Mauldin, pg 33, quoted in Riders on the Storm: Short Selling in Contrary Winds (2006), Doug Wakefield w/Ben Hill, pg 135]

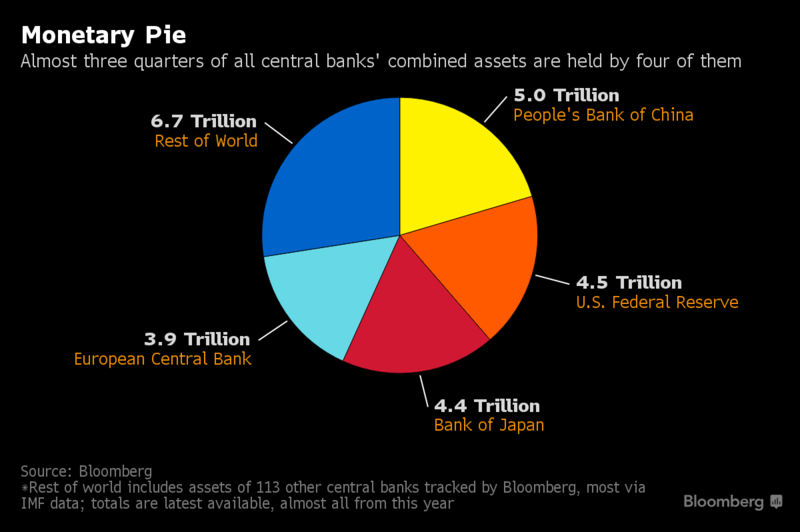

September 2008 seems so long ago now. The experiment of global QE has proven from the last 9 years that the $700 billion bailout in 2008 did not end the crisis, but kicked off a world that became addicted to ongoing bailouts.

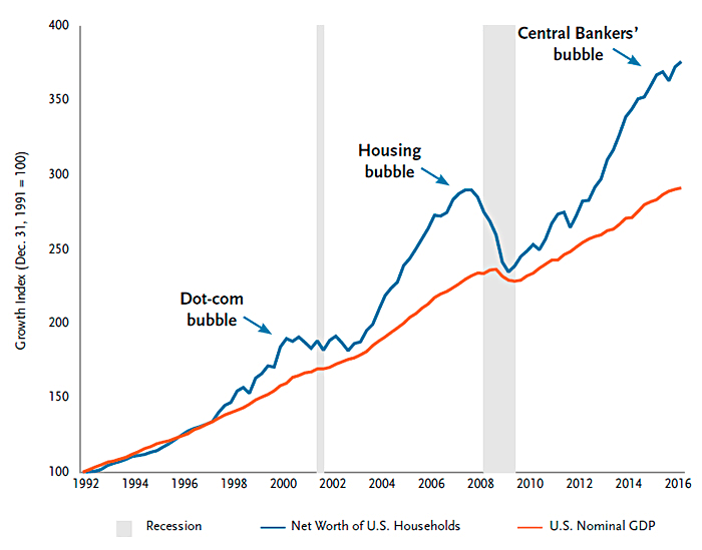

Bear markets, those declining over 20%, have disappeared since 2008. They are now in the dustbins of history. Central banks finally won; history lost. Mauldin was wrong, or was he?

Today one can read of the $2 trillion bailout of global markets YTD in 2017, yet most individuals do not seem to know, or care if they know, what has created the most complacent markets on record with prices clocking in at record highs again and again. The thought that another mammoth decline could take place, see 2000-2002 or 2007-2009, is not proper for public and private discussion or consideration.

Bush: ($700 Billion) Bailout Plan Necessary To Deal With Crisis, CNN, Sept 24 '08

Central Banks Have Purchased $2 Trillion in Assets in 2017, Zero Hedge, Sept 8 '17

A year after stocks bottomed in March 2009, and the Federal Reserve announced the kickoff of QEI in January 2009, the American public's sentiment toward the US economy and stocks was very low.

Fox News Poll: 79% Says US Economy Could Collapse, Fox News, Mar 23 '10

Yet by this July, consumer confidence in America was at a 16 year high. What about the lessons of 2008, a period now known as the Great Recession? Removed from the mind, recent experience reigns.

Consumer Confidence Near a 16 Year High, MarketWatch, July 25 '17

From watching this grand experiment in global finance, my experience and contacts show me we divide into three camps.

First, is the conventional buy and hold camp that has dominated markets for decades. Central banks’ role in financial markets is merely academic. The historical record in US stocks and bonds since US Treasury yields hit their highest levels in American history in the early ‘80s, has shown that stocks and bonds always bounce back, pushing stocks to new record highs and interest rates to lower lows. Cycles have little or no relevance in their decisions.

The second group come from the growth of retail traders using ETFs to buy the dip. With central bankers telling the public worldwide for years they are creating hundreds of billions each quarter to buy assets, this has fueled extreme confidence in shorting the VIX and buying stock ETFs. What could go wrong, the money printers have “unlimited” powers? If markets move lower, one merely waits for the next dip to buy. I even saw a recent ad by a major brokerage firm promoting to prospective investors that because of their technology, retail investors never need worry about missing a dip!

The third group comprises individuals who are students of history, science, and human behavior. Whether they make short-term trades, hold investments for longer periods, or are heavy buyers of gold and metals, they understand that since 2009 central banks' are at the root of this historic bubble. They grasp that unwinding the role of BUYER of last resort has never been done before. Because of its size and scope, the consequences must come, unlike “the script” presented to the public.

They constantly watch for market extremes underneath record price levels. Many study market history. Yet their greatest concern is how this ultimately impacts the entire society, not just the individual.

For those in the first group, there is little time to wake up from fantasyland. One must understand that our central banking “gods” cannot manipulate the perfect stock market much longer. Because of constant suppression to produce a 19-month period without even a 2.5% weekly decline in the S&P 500, when losses return and rising volatility they will return with a vengeance. While no one knows the exact day of the top, consider this example from history when looking at prices reaching an “all time high”. Clearly there are times to sell at record highs rather than buy!

On 1/2/90, the Japanese Nikkei closed at 38,915. On 6/24/15 it reached its highest level in 19 years, 20,952. Its current 2017 high is 20,481 on 9/21/17. With all the debt expanded by the Bank of Japan to buy up their own government bonds as well push their stock market higher through purchasing Japanese exchange traded funds…. the Nikkei has still never crossed 21,000 in the last 2o years. January 1990 made records never seen since. (The Bank of Japan stated that it started Quantitative Easing in March 2001, 8 years before the Federal Reserve launched Quantitative Easing I).

Retail traders need to remember that of the last 103 months, only 6% of the time we have seen corrections. Never during this time has a major US stock indice declined even 20%. Professional traders and hedge fund managers that helped their clients during the bear markets kicked off in 2000 and 2007 have watched repeatedly since 2011 as hedging strategies were pounded and following the herd to the next record high rewarded.

This is extremely dangerous. Anyone studying the speed of market corrections and flash crashes from stocks to bonds to currencies over the last few years understands how quickly liquidity providers (HFTs) can become liquidity consumers. Anyone who was hedging or shorting during the many months of the two major bear markets since 2000 can tell you it was a different mindset than trading in the most assisted bull market on record.

As we move closer and closer to the end of the 2nd longest bull market on record, consider these facts. Markets can drop swiftly, as seen during the four-day 2,000 point drop in the Dow during August 2015. There have been several records made since the December 2016 rate hike, both in insider selling AND retail buying.

The last group will not be the least bit surprised when fantasyland smashes into reality land. They have been reading, writing, and speaking out for a long time. They understand this is not simply a financial game, but one helluva mental game. It is world history.

However, we are all human, and none of us wants to consider all the change coming from the bursting of the central banker’s bubble…but it is coming. No amount of bubble blowing can stop the inevitable bubble bursting.

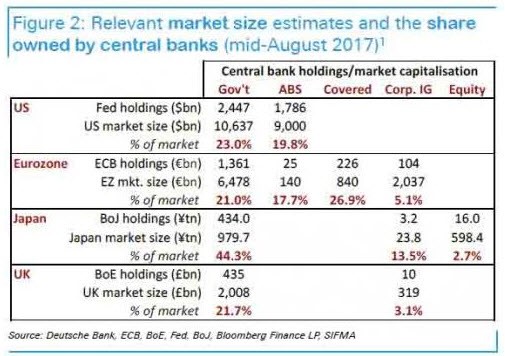

This snowball is becoming exceedingly tired of being pushed up the hill. The amount of bonds (extra snow) that the ECB and BoJ continue to buy to push the snowball up the hill are limited. While they can tout “whatever it takes”, the reality of a rapidly shrinking supply of bonds for them to buy in an attempt to suppress interest rates is staring them and us in the face.

Big Central Banks Assets Jump Fastest in 5 Years to $21 trillion, Bloomberg, October 16 ‘16

Both ECB And BOJ Are Just Months Away From Running Out Of Bonds To Buy, Zero Hedge, May 18, 2017

When Will The ECB Run Out Of German Bunds To Buy: Here Is The Math, Zero Hedge, July 25 ‘17

The snowball becomes heavier with every “we are in control” press release from our financial gods. Yet the experience in US stock indices since December 2016 has planted a false idea in the major of investors:

“The Federal Reserve has raised rates three times since December after US Treasuries hit their lowest yields in American history last summer. They begin unwinding their balance sheet in October and the Dow is still making new highs almost every day. They have everything under control.”

Time To Plan for The End of a Bubble?

Best Minds Inc has a new website and blog. Check out www.bestmindsinc.com for free blog and paid ...

more