When Smart Money Sees A Credit Crisis Coming

Image Source: Unsplash

The high yield bond market just flashed a warning signal most traders will miss until it's too late.

On October 16th, someone placed a 100,000 contract bet on HYG puts expiring November 21st. They paid the ask. No negotiating. No waiting for a better price. They wanted in immediately.

The same day, gold traders made an even bolder move. They rolled existing calls into higher strikes and bought aggressive verticals targeting $415 within two weeks.

These weren't separate bets. They were coordinated positioning for a credit crisis. The kind of trades that appear days or weeks before markets crack.

I break down prints like these Monday at 2:00 PM ET in Ghost Prints. We'll analyze this week's most significant options flow and decode what smart money is positioning for next.

Now let me show you exactly what these trades reveal about the next market move.

Credit Markets Are Cracking

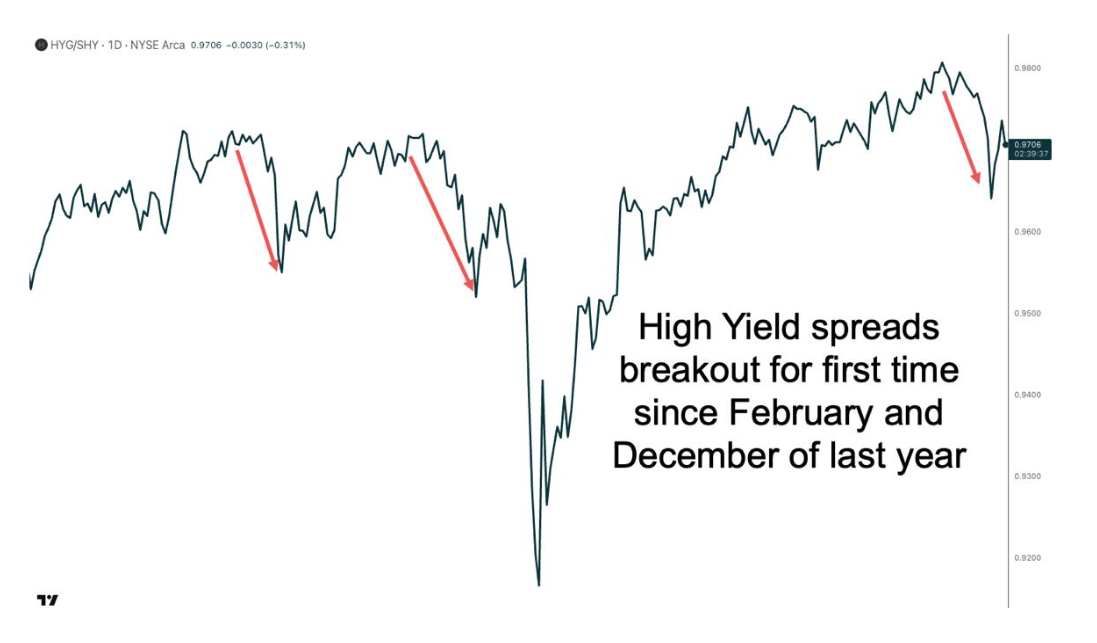

(Click on image to enlarge)

High yield spreads just broke out for the first time since February and December of last year. The HYG/SHY ratio measures junk bonds against short-term Treasuries. The breakout signals deteriorating confidence in corporate credit.

(Click on image to enlarge)

The technical picture confirms what options traders already know. After climbing steadily from April's low of $75.31 to recent highs above $81, the breakout projects a 423% Fibonacci extension back to April's level.

Charts show clean patterns. Options flow shows panic.

The Prints That Matter

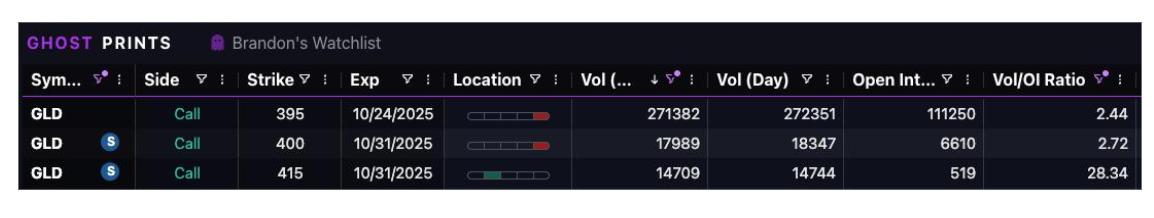

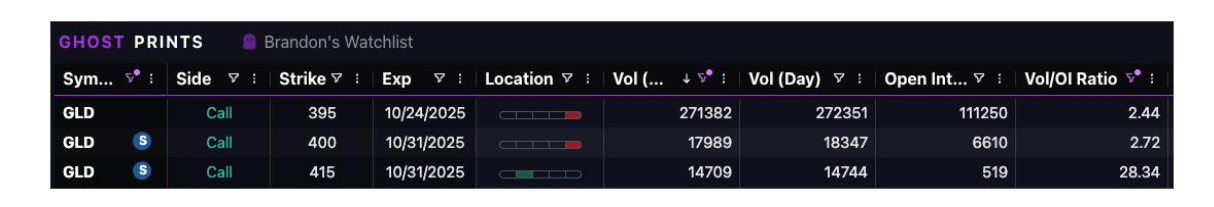

(Click on image to enlarge)

The October 16th trade came with a put sizzle of 1.2. That means put volume ran 20% above normal levels. More telling: 68% of all put volume hit the ask while 61% of calls were dumped at the bid.

Professional traders were aggressively buying downside protection and simultaneously exiting bullish positions.

This wasn't an isolated print. The October 16th trade escalated a similar position from the day before. Someone built an 11,250 contract position in November 21st $71 puts across two consecutive days.

They're not hedging a small position. They're preparing for a substantial move lower in junk bonds within five weeks.

The timing matters. Trade wars continue. Government shutdown threats loom. Credit spreads are widening. When professionals pay up for downside protection in high yield bonds, they're positioning for stress in the corporate debt market.

Gold Tells The Same Story

(Click on image to enlarge)

The same day those HYG puts printed, gold traders made their move.

(Click on image to enlarge)

They rolled 106,206 October 24th $380 calls into 263,353 contracts split between $395 and $400 strikes. Taking value out of the position. Adding leverage. Betting on gold above $405 by this week's expiration.

Then came the aggressive vertical. Someone bought 13,352 October 31st $400 calls and sold the same number of $415 calls. They're positioning for gold to trade north of $415 within two weeks.

Gold rallied from $300 to $394 during a period of geopolitical uncertainty. The options flow suggests professionals expect that rally to accelerate hard.

Gold rallies when credit markets freeze. These two trades together tell you everything.

Reading The Coordinated Bet

Credit protection and gold calls appearing simultaneously is not coincidence.

When institutional money pays premium prices for HYG puts while simultaneously loading up on gold calls, they're positioning for a risk-off environment. This is the playbook for capital preservation before volatility spikes.

The Ghost Prints system captured both trades in real-time. The HYG puts showed elevated put volume with aggressive bid-ask behavior. The gold trades displayed unusual size with immediate execution.

These are the signatures of informed positioning, not retail speculation.

The Volume/Open Interest ratio of 2.44 on the October 24th GLD calls showed new money entering positions. The put sizzle of 1.2 on HYG indicated elevated bearish activity relative to normal volume patterns.

Professional traders were building coordinated positions across multiple markets.

What Happens Next

Most traders wait for headlines to confirm what options flow already revealed.

By the time CNBC discusses credit market stress, the moves are over. The premium has evaporated. The protection costs twice as much.

The alternative is tracking unusual options activity before the crowd catches on. When you see large traders paying ask prices for credit protection while simultaneously betting on gold strength, you're watching capital preservation in real-time.

Gold sits at $394. Someone is betting it hits $415 in two weeks. High yield bonds are breaking down. Someone is betting they fall further within five weeks.

What do they see that retail charts don't show?

Where The Real Edge Lives

Trades like these don't appear by accident.

They come from tracking institutional order flow in real-time. The Ghost Prints system flags unusual activity as it occurs. Volume patterns. Bid-ask behavior. Open interest changes. The data points that reveal professional positioning.

The HYG and GLD prints from October 16th showed coordinated institutional activity across asset classes. That coordination doesn't happen randomly. It signals preparation for a specific scenario.

Understanding options flow gives you the same view professional traders have. You see the bets being placed before the reasons become obvious. You position alongside institutional money instead of chasing moves after they happen.

More By This Author:

Volatility Soars But The Market Ignores

The "Dumb Money" Just Beat Wall Street Again

9 Tech Stocks That Can't Pay Their Bills

Neither TheoTrade nor any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, registered ...

more