When In Fear, Gold Is Near? Miners May Regret Hasty Decisions

While the PMs were the belle of the ball when the Russia-Ukraine conflict erupted, I warned that investors are often the most bearish at the bottom and the most bullish at the top. With the S&P Goldman Sachs Commodity Index (S&P GSCI) following in the footsteps of the ARK Innovation ETF, commodities' fervor has cooled materially in recent days.

For context, the S&P GSCI contains 24 commodities from all sectors: six energy products, five industrial metals, eight agricultural products, three livestock products, and two precious metals. However, energy accounts for roughly 54% of the index's movement.

More importantly, though, while the index declined by another 3.22% on Mar. 16 and helped diminish gold's sentiment, the S&P GSCI still remains materially disconnected from its 20-month moving average. Furthermore, the more than 150-point peak-to-trough decline has done little to reduce the overbought conditions showcased on its monthly RSI (~74).

As a result, there is plenty of room for further downside, and the PMs should suffer if the mean reversion continues.

Please see below:

(Click on image to enlarge)

To that point, with investors known for their herd mentality, I noted on Mar. 15 that speculators’ love affair with gold was bearish, not bullish. I wrote:

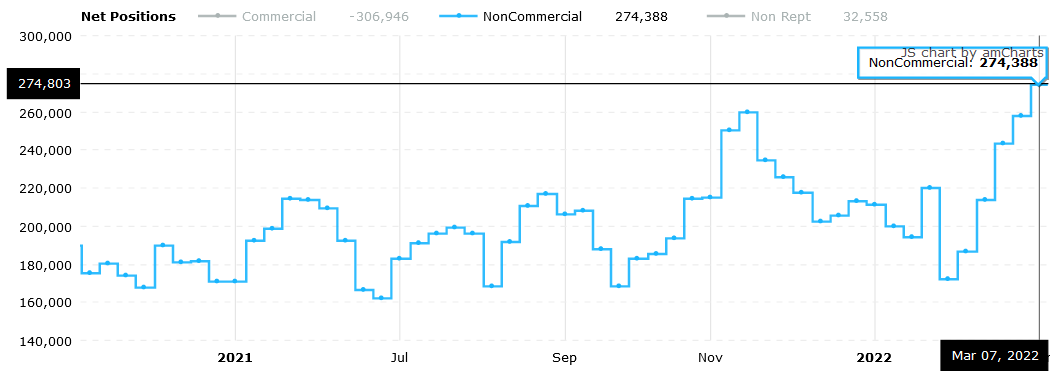

It’s clear that human nature never changes. If you analyze the chart below, you can see that non-commercial (speculative) futures traders were all-in on gold at the end of last week (the latest data available).

(Click on image to enlarge)

Source: COT report

Moreover, with speculative long positions increasing materially in recent weeks and the crowd often the most bullish at the top, it’s another contrarian indicator that supports lower gold prices over the medium term.

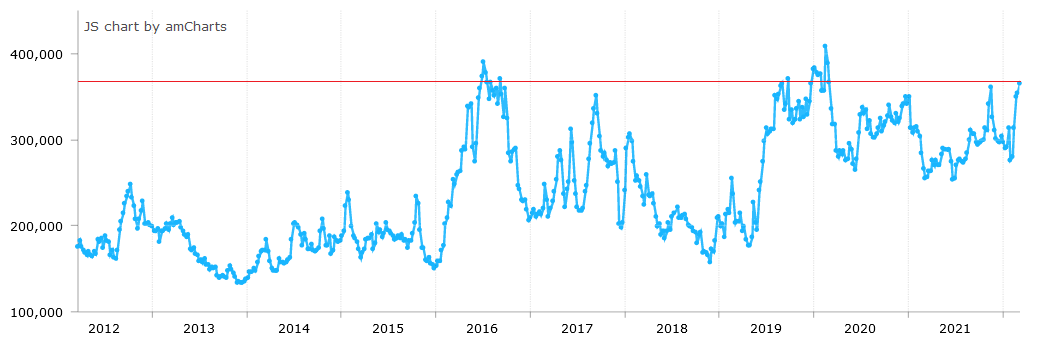

Please see below:

(Click on image to enlarge)

Source: COT report

The Sentiment Unwind

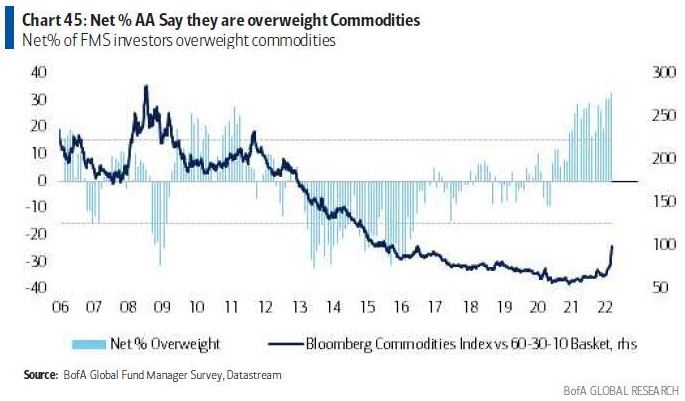

Likewise, with Bank of America releasing its latest Global Fund Managers Survey on Mar. 15, the net percentage of institutional investors overweight commodities is the highest in more than 16 years.

Please see below:

(Click on image to enlarge)

To explain, the dark blue line above tracks a variation of the Bloomberg Commodities Index, while the light blue bars above track the net percentage of respondents that are overweight on commodities. If you analyze the right side of the chart, you can see that allocations shot to new heights in the latest survey.

Moreover, with large dispersions often followed by large reversions, what’s popular today may not be so popular next week or next month. With price often a major driver of sentiment, the recent decline in the S&P GSCI could spark a positioning shift. If this occurs, the outcome is bearish for the PMs.

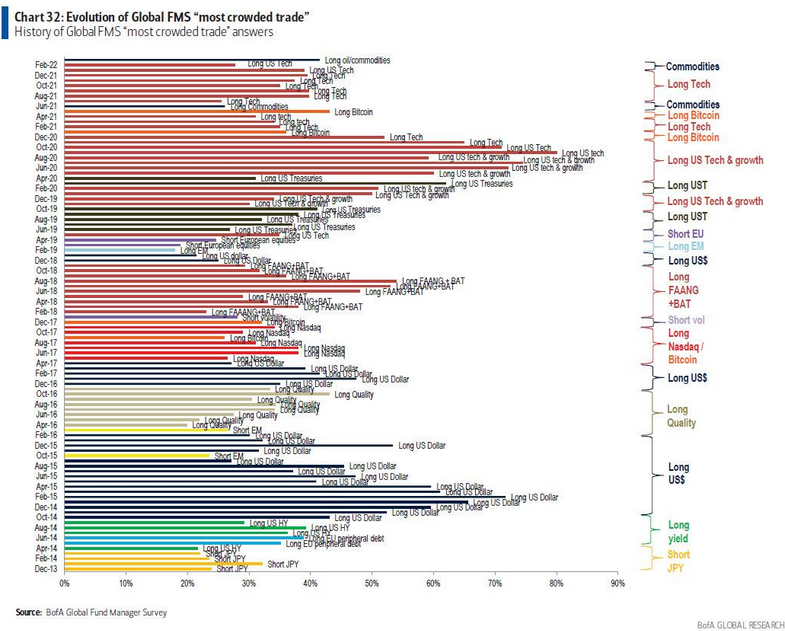

As further evidence, the Bank of America noted that long commodities are the most crowded trade on Wall Street.

Please see below:

(Click on image to enlarge)

To explain, the various horizontal bars above track the most popular positions of institutional investors each month. If you analyze the dark blue bar at the top, you can see that long commodities have gained immense popularity.

However, please note the length of the horizontal red bars from Jun 20 to Oct 20. Notice anything interesting? Well, with long tech captivating investors during that period, they chased ever-higher prices. However, if you analyze the second bar from the top, you can see that long tech positioning is roughly half of what it was then. As a result, it indicates how quickly sentiment can shift.

For context, I wrote about the similarities between commodities and high-growth tech on Mar. 8:

The unabated optimism rivals what we saw with SPACs, IPOs, and the ARK Innovation ETF in 2020. Yet, this time is different, and $2,500 gold is on the horizon?

Please see below:

(Click on image to enlarge)

When its RSI mirrored the behavior and the ARK Innovation ETF outperformed its 20-month MA by more than 115% in 2020, an epic collapse eventually unfolded. As of the Mar. 7 close, the ETF had suffered a 64% peak-to-trough decline.

To that point, with sentiment as a powerful force, investors’ emotions often cloud their judgment. When this occurs, fundamentals are powerless to stop the momentum. As a result, that’s why financial markets often overshoot on the upside and the downside.

Moreover, with institutional investors’ heightened anxiety about the Russia-Ukraine conflict and the potential for a global recession impacting their decision-making, gold provides them comfort as a natural safe haven.

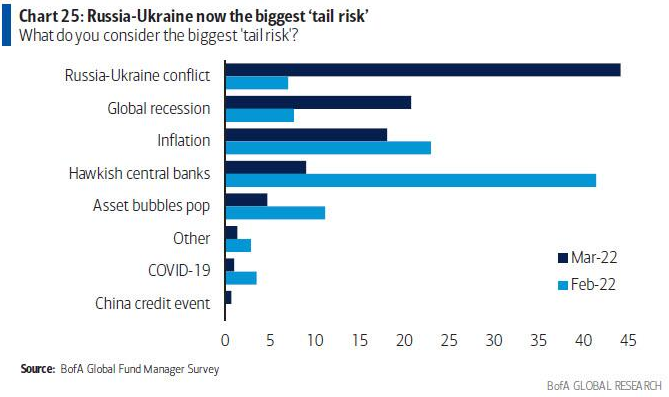

For example, if you analyze the chart below, you can see that fear over both developments rose to the top spots in March. However, with “hawkish central banks” going from big deal to no deal in a span of the month, it signals how quickly sentiment can shift.

Please see below:

(Click on image to enlarge)

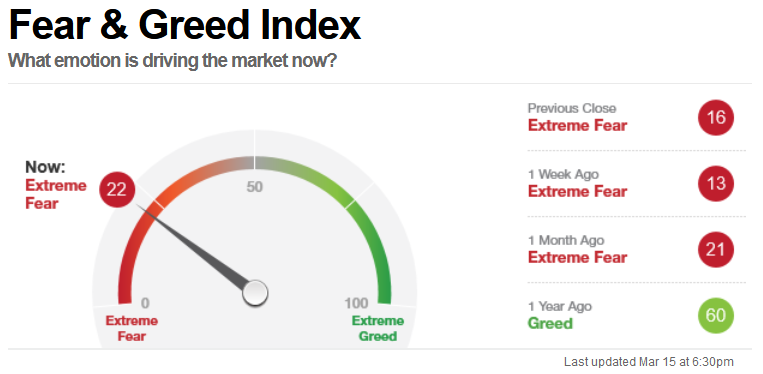

Furthermore, with fear helping to underwrite the PMs’ recent ascent, the S&P 500’s relief rally on Mar. 15 did little to quell investors’ trepidation. As evidence, CNN’s Fear & Greed Index is still firmly in the red.

Please see below:

Source: CNN

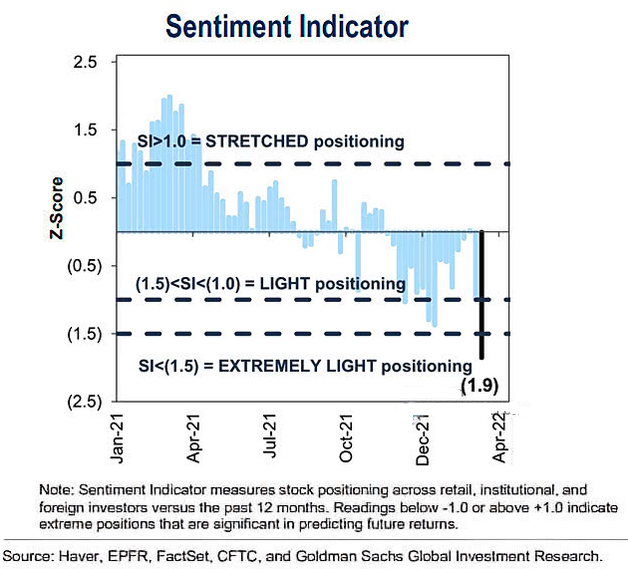

On top of that, Goldman Sachs’ sentiment indicator hit 1.9 standard deviations below the average on Mar. 14.

Please see below:

PMs to Fill the Void

To explain, Goldman Sachs considers z-scores of -1 or +1 to indicate “extreme” positioning. If you analyze the right side of the chart, you can see that the latest reading (the dark blue bar) is sharply negative. As a result, with skittish investors often flocking to gold during periods of uncertainty, a normalization of sentiment will likely hurt the PMs.

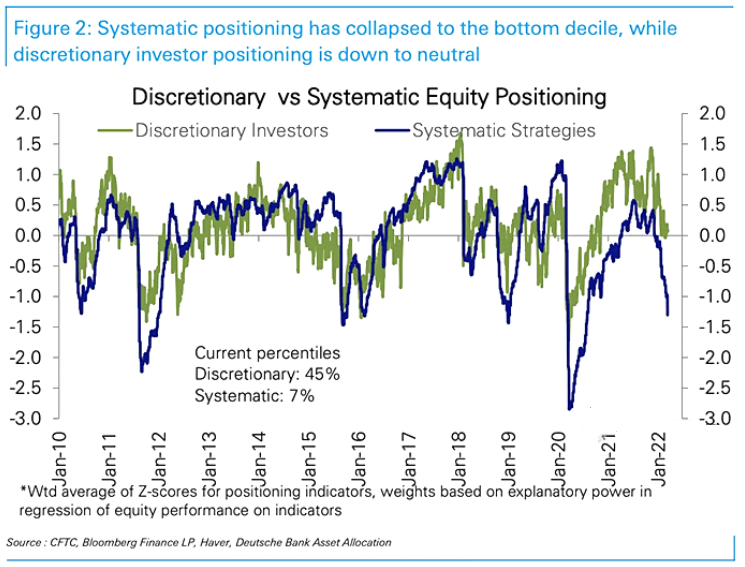

Expanding on that point, data from Deutsche Bank shows that systematic equity positioning is in the 7th percentile. For context, this metric tracks the positioning of algorithmic and quantitative investors. Moreover, if they’re not buying stocks or bonds, the PMs are strong candidates to fill the void.

Please see below:

To explain, the green and blue lines above track discretionary and systematic investors’ equity positioning. If you analyze the right side of the chart, you can see that the latter has declined significantly. Moreover, with a reading in the 7th percentile implying that 93% of the time, systematic investors have more equity exposure, the void opened the door for more commodities investments. As a result, the PMs benefited from ‘the most crowded trade on Wall Street.’

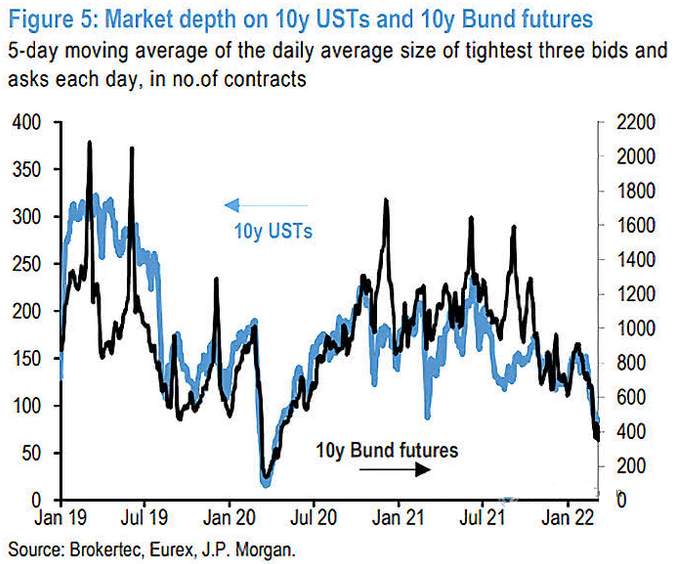

Finally, the U.S. 10-Year Treasury yield rallied again on Mar. 15 and closed at another 2022 high of 2.15%. Moreover, with liquidity in the futures market continuing to deteriorate, more yield spikes could be on the horizon.

Please see below:

To explain, the black and blue lines above track the market depth for 10-Year Treasury and Bund (German bonds) futures. If you analyze the right side of the chart, you can see that the five-day moving average of the tightest bid-ask settlements continues to decline. As a result, a shallow market has resulted in more contracts being settled with wider bid-ask spreads.

In turn, this creates liquidity risk, as buyers may not be there when large sellers want to unwind 10-Year Treasury futures positions. Due to that, yields often spike when sellers outweigh buyers. As such, the more the blue line declines, the more it increases the chance of a taper-tantrum-like event.

The bottom line? While the Russia-Ukraine conflict allowed the PMs to ignore bearish domestic fundamentals, sentiment is starting to shift, and while the PMs retreat from their 2022 highs, the USD Index has barely budged. As a result, while the Russia-Ukraine drama helped elicit a bid for the greenback, its strong fundamentals are in place despite the conflict. Moreover, with U.S. Treasury yields seeking higher ground alongside the USD Index, it’s an extremely bearish sign for the PMs.

In conclusion, the PMs were mixed on Mar. 15, as mining stocks sidestepped the negativity. However, with their fundamental outlooks worsening and the Fed poised to raise interest rates today, larger drawdowns should occur over the next few months. Moreover, if Russia and Ukraine reach a resolution, the sentiment unwind could occur at a rapid pace.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more