What’s Driving Bitcoin? Factor, Analysis, Profiles

What makes bitcoin tick? There are many theories, ranging from a digital-age store of value to the world’s greatest Ponzi scheme. Narratives are interesting and perhaps useful, but can we quantify bitcoin’s risk betas with specificity? Let’s give it a try in a series of factor-analysis tests.

Image Source: Pixabay

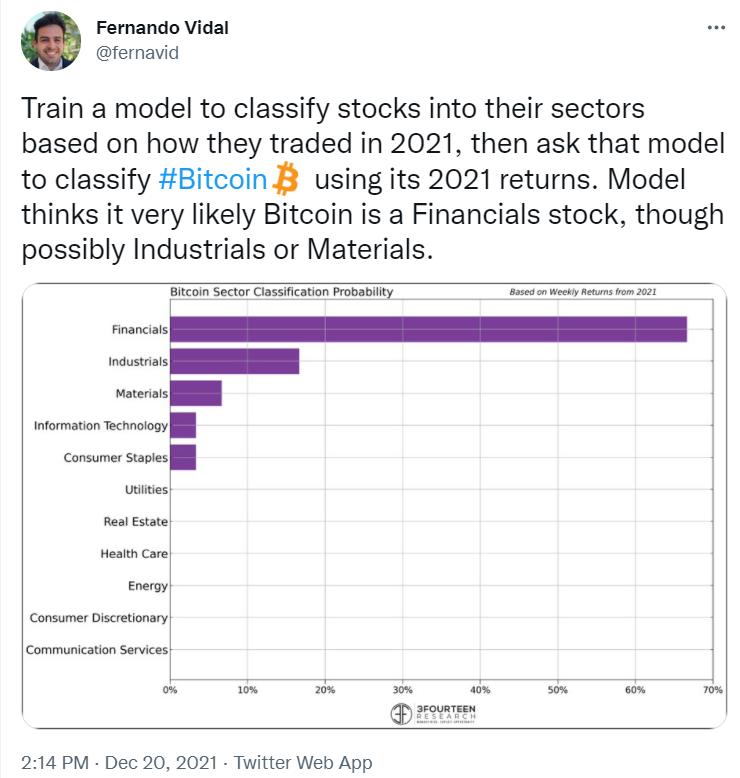

The idea of regressing bitcoin’s price against a set of risk factors comes from a tweet by Fernando Vidal at 3Fourteen Research. Using a classification methodology focused on equity sectors, the modeling shows that financial stocks are the leading suspect to “explain” bitcoin price changes.

Let’s dig into this a bit deeper by running a series of factor regressions using several sets of economic and markets indicators. As a starting point, we’ll use a set of ETFs as proxies for the primary market betas:

- Global stocks (VT)

- US Bonds (BND)

- Global real estate (REET)

- Commodities (GCC)

- Forex (UUP)

- Cash (SHV)

There are several caveats, starting with limited data. Bitcoin is a relatively young asset class and so this analysis uses a data set that extends only to 2014. In any case, the main result is that trying to “explain” bitcoin price volatility through this lens is a poor fit, indicated by the low multiple R-squared: a thin 0.0355. In other words, these six factors explain less than 4% of bitcoin (BTC) returns, this metric suggests.

Not encouraging, but what does resonate is that US bonds (BND), followed by global stocks (VT), post the biggest explanatory betas. Note, too, the large negative beta for cash (SHV), which implies that whatever explains BTC, safe-haven liquidity — at least in the traditional sense (i.e., Treasury bills) — isn’t a likely candidate. Meanwhile, commodities (GCC), forex (UUP) and property (REET) are relatively trivial factors.

All this suggests that trying to deconstruct bitcoin through a standard markets lens from a global top-down perspective is a dead-end. But we’ve only just started to explore our bag of tricks.

Disclosures: None.