What Our Bond/Stock Model Says About Allocating Assets

Image Source: Pixabay

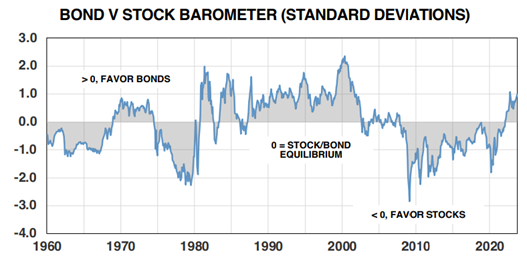

Our bond/stock asset-allocation model is indicating that bonds are the asset class offering the most value at the current market juncture, as interest rates have risen over the past few weeks. Our model takes into account current levels and forecasts of short-term and long-term government and corporate fixed-income yields, inflation, stock prices, GDP, and corporate earnings, among other factors,

The output is expressed in terms of standard deviations to the mean, or sigma. The mean reading from the model, going back to 1960, is a modest premium for stocks, of 0.15 sigma, with a standard deviation of 1.0. The current valuation level is a 0.98 sigma premium for stocks, inside the normal range but up from the 0.50% sigma premium at the beginning of the year.

Stock valuations have risen not only because stock prices are higher for the year, but because interest rates have been climbing as well. Indeed, the benchmark US Treasury 10-year bond yield is now near 20-year highs. Other valuation measures show reasonable multiples for stocks.

The current forward P/E ratio for the S&P 500 is 16, which is within the normal range of 10-21 and down from 22 a year ago. The current S&P 500 dividend yield of 1.5%, while below the historical average of 2.9%, is up from an ultralow 1.2% as recently as 2021.

Looking ahead, we expect the results from our stock-bond valuation model to improve, as interest rates start to decline next year and EPS growth picks up. Based on the current valuation levels, as well as those interest rate and earnings forecasts, we have called for a recovery in stock prices in 2023 from bear-market lows and are maintaining our year-end S&P 500 target of 4,600.

Our current recommended asset allocation for moderate accounts is 67% growth assets, including 65% equities and 2% alternatives; and 33% fixed income, with a focus on opportunistic segments of the bond market.

More By This Author:

Looking To Improve Your Results? Here Are 50 Laws For Better Investing

Rockwell’s Heitkoetter Talks Options Strategies, “Wheel Options,” Volatility, & Value Stocks

Jobs, Salary Data Spring Stock Market Bear Trap. Next: Q3 Earnings For SPX Firms

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.