What Isn't The Fed "Breaking?"

Image Source: Unsplash

We’re in a tricky period, with high selling pressure and many questions about the Fed’s rate policy. Insider buying remains low on a dollar-for-dollar buying/selling basis and on a Form 4 filing basis. That said, monetary inflation remains strong while the dollar is at a 34-year high against the Yen. Central banks continue to pour into gold and silver while investment funds keep Bitcoin and other hedges elevated. Investors should be skeptical today, however, about the Producer Price Index reading. The report showed a 3.6% drop in gasoline prices, ignoring seasonality. The truth is that gasoline prices increased by about 6% for the month. Tack on blatant manipulation in natural gas prices via public policy, and you have a nation still facing inflationary challenges.

Yesterday’s report for the Consumer Price Index was bad.

So bad… that Jim Cramer, of all people, is saying that other people misread the situation…

He’s learning!!!

For the record, we’ve been consistent on policy for two years here in these pages.

When the Fed went to 0.25%, I said they’d need to be at 4.5% by the end of 2022.

At the time, markets projected just 2.25%.

When we hit 4.5%, I said that we needed to go to 6%. We’ve needed a cleansing to bring us a “Morning in America” moment.

We didn’t. Now we’re paying the price. This fight is political, and everyone is losing.

We also said in November (when it was written) - in Luckbox Magazine that there wouldn’t be a rate cut until July 2024 and that housing rates would be over 7% for the entire year.

Now, we’re saying no rate cut until after the election while the market attempts to price in a pre-election cut in September.

Yeah… right…

Not when you look at the PPI numbers today, ignoring that gasoline prices are going up, not down. And any natural gas glut will decrease and eventually force prices to rise.

Meanwhile, look at the CPI from Wednesday.

This is not a good report. All of the things that easily topped the core CPI number… were REAL things that people need to be productive members of society.

-

Car Insurance Inflation: 22.2%

-

Transportation Inflation: 10.7%

-

Car Repair Inflation: 8.2% 4

-

Hospital Services Inflation: 7.5%

-

Homeowner Inflation: 5.9%

-

Rent Inflation: 5.7%

-

Electricity Inflation: 5.0%

-

Food Away From Home Inflation: 4.2%

Insurance prices keep rising because… well… a lot of other people aren’t carrying car insurance. I think I pay more for insurance against an uninsured driver now than for myself… Isn’t that America?

As I noted… the things that matter… keep going up, up, up in price.

But is it only because of consumer behavior?

No… there’s something else that’s driving these prices higher.

If It Stops Moving, Subsidize It

It’s not just monetary policy and the Fed.

Look at fiscal policy as another problem.

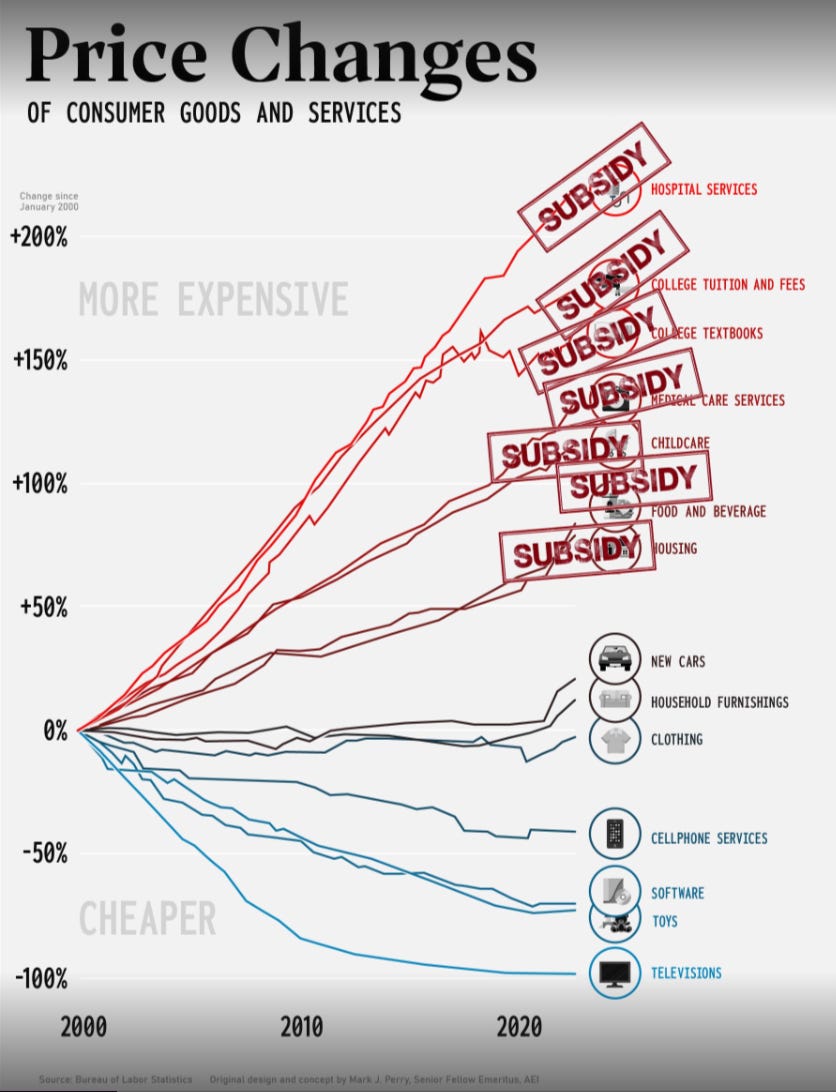

Government subsidies juice price inflation.

If there’s a subsidy… on food, energy, housing, education, and medical care… the price has increased over the long term.

Have a look at this chart.

If there’s a government check behind it…

You can bet that companies will charge a premium.

Why wouldn’t they?

AEJ

So, while they’re telling you that inflation is coming down… it’s really the rate of inflation…

And when they tell you that “the rate of inflation is coming down…” it’s only on the stuff that doesn’t matter: televisions, cell phones, clothing, and software.

But anything they touch with a subsidy - it’s just been going up for decades.

Food… healthcare… energy… housing… education… It’s all right in the data.

That’s why healthcare and insurance giant Cigna (CI) has outpaced the S&P 500 by a staggering margin since the government takeover of healthcare (which isn’t socialism… it’s economic fascism.)

I’d tell you that these people are all stupid… but there’s no way someone has worked on Capitol Hill since the 1970s and not realized this.

And if anyone with a Ph.D. who works in the Fed doesn’t realize this… they should be coloring in the corner instead.

That doesn’t mean that prices won’t dip from time to time.

Take a look at the housing market as an example…

Ebb and Flow On Housing

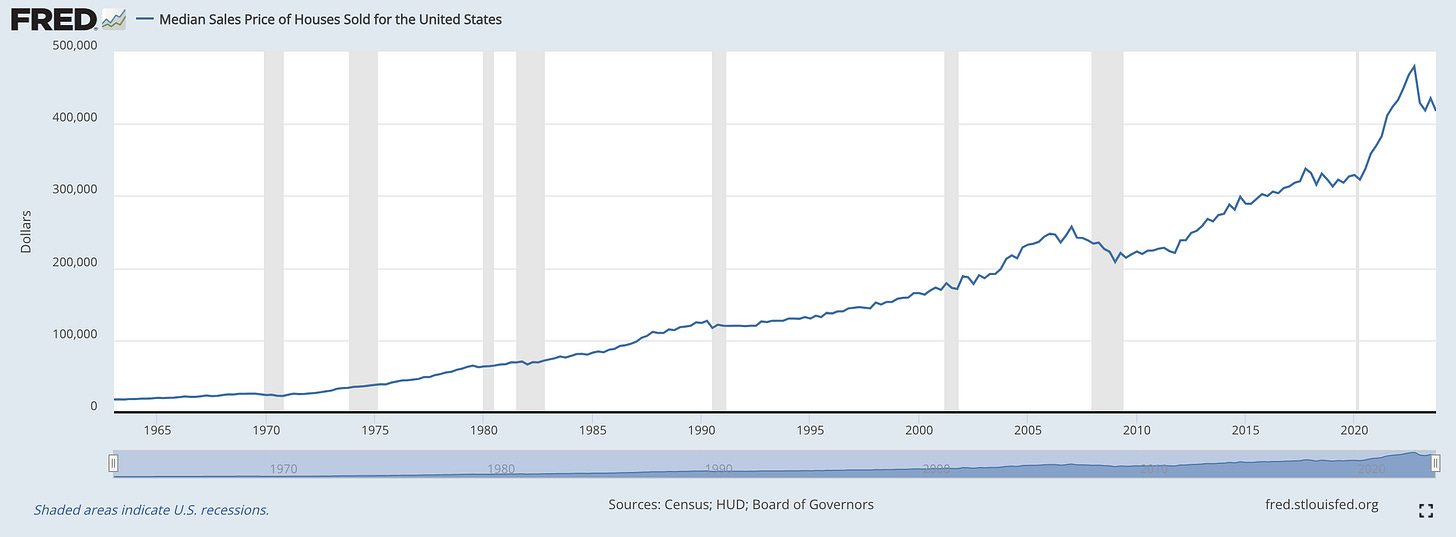

One thing isn’t surging, though: Median new housing prices.

In the film The Big Short, a group of traders accidentally receive a phone call tipping them that a big player aims to short the housing market. “Who shorts housing?” one of them asks.

A moment later, he checks the performance of Mortgage-Backed Securities, a derivative instrument that insures against massive default among a large portfolio of mortgages.

It was likely 2007 in that scene, and mortgage security prices were falling while yields were rising. The concern was that subprime markets were imploding.

That - by definition - is an “Oh shit” moment for a trader or investor.

When something slips UNDER their radar for some time. Many analysts and media members are starting to have a similar moment.

If I told you that the decline in new home prices has been worse than the onset of the 2008 financial crisis… you probably wouldn’t believe me. But…

It is.

New home prices are down 20% in the last 16 months.

It took 43 months to drop to that level in 2008.

There are two things.

First, this is rather perplexing given that new home builder stocks are absolutely on fire - and have been so since the bottom of Howell’s liquidity cycle in October 2022.

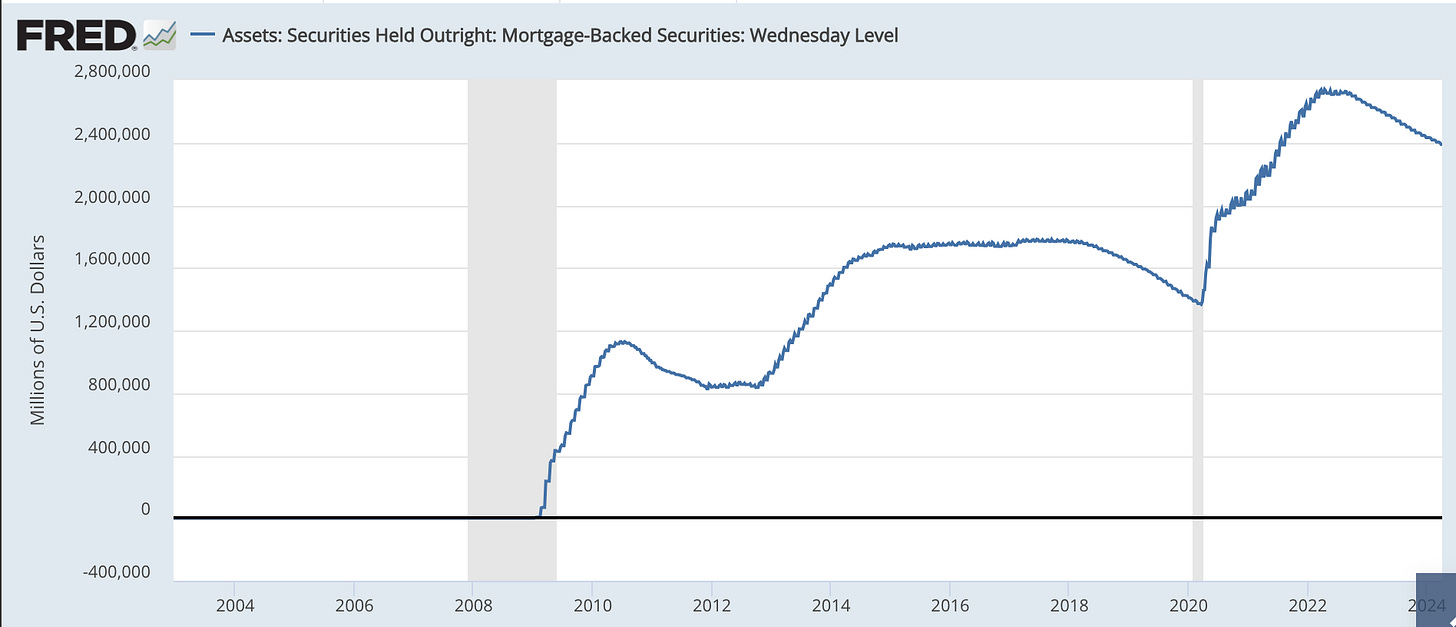

Two: The Federal Reserve buys a lot of mortgage-backed securities to help underpin the housing market… and the Fed’s rate decisions impact mortgages

The Federal Reserve was cautious about its MBS strategy when its holdings peaked in late 2022. Since then, housing stocks have been on an absolute run, with the S&P 500 Homebuilder’s Index more than doubling.

All of that is happening - while the Fed allows its MBS holdings to run off (expire) and raised interest rates… aggressively. We just hit 7% on the 30-year FHA loan yesterday, and a 700 FICO is facing a 7.81% rate on a 30-year fixed. That’s ugly.

The relationship between monetary policy and housing prices is quite apparent.

When did MBS holdings peak post-COVID?

The Fed held over $2.7 trillion in MBS from May to mid-September 2022.

When did median home prices peak post-COVID? October 2022.

When did MBS holdings peak before COVID-19?

December 2017… as rate tightening would hurt the bond market at the end of 2018 and cause more panic the following year…

When did mean home prices peak Pre-COVID: December 2017…

It’s been incredible to watch home prices plummet around me since January. And the more I watch Miami home prices, the more convinced that Florida’s in deep trouble.

More Pain Ahead, Then Upswing

So, how far will the Fed let this go?

For now, 20% on new home prices in 16 months isn’t good.

But there is reason to believe that the housing market isn’t set to implode.

First, supply remains a challenge. There still needs to be more new supply.

In addition, lending practices have tightened credit access - especially in this environment.

But - consider the current problem facing this market.

Real estate site Zillow writes: “The income needed to comfortably afford a home has been up 80% since 2020, while median income has risen 23% in that time.”

Affordability is still facing a crisis.

And places like Florida—where interest rates are elevated, insurance premiums are climbing, and HOA reserve rules are shifting to require MORE escrowed capital for improvements—are now a Buyer’s market.

And when there’s a “Buyer’s” market on an illiquid asset class, there is always MORE downside than upside for a period. Currently, the housing sector is the collateral damage of rate policy and the Fed’s fight against inflation.

If you’re waiting to buy a home… there’s probably a negative cycle poised to continue.

Rates will likely remain elevated for some time, so we must pay close attention to the Fed’s balance sheet.

We’ll wait to see if and when the Fed puts its foot back on the gas and starts buying MBS again. That would be the fourth time in the last 12 years that central bank intervention on MBS has driven home prices up… kicking mortgage rates down.

It's funny, but when it comes to the Equity markets… the Fed’s Treasury bond purchases have been big drivers of risk-off activity and higher prices.

The same goes for housing. The Fed drives the home market and has done so since the end of the 2008 crisis.

That’s the world post-2008 when the Fed intervened in the housing sector.

But critics will blame capitalism, the same as it ever was.

As always, play our strategy - focus on strong balance sheets in companies that make real things. Assets matter, and as inflation increases across those various sectors, the balance sheets will absorb those price increases - helping offset the weakening U.S. dollar's purchasing power. We’ll show you how.

In addition, traders will want to tune in tomorrow for a key lesson on momentum…

That includes our latest watch list and insights on how to trade THIS very market.

More By This Author:

Reuters, Musk, And EmotionsRussia, Risk Off, And Republic Rules

Feeling Bearish For Once

Disclosure: None.