What Hubbert Practitioners, Art Berman, And The EIA Agree On With Shale Oil

Oil Is Oil

A big problem with energy thinking today is the notion that "oil is oil" and it doesn't matter where it came from. Wrong! A major criticism you see of Hubbert is when they point to all the "oil" we've found (shale oil, tar sand, kindling wood) and throw it in the URR pot (Ultimate Recoverable Resource) and generate a production curve. This is not Hubbert's method at all, and when you see them doing this, you can ignore the whole analysis. It totally misses the vastly different set of recovery physics between conventional crude and shale, or anything else. Each set of physics demands its own Hubbert tabulation. His method can be done, for example, with the coal production of Australia, or any resource that has and will have fairly consistent recovery geophysics.

The shale oil of the US is ultra critical to oil prices and the world economy. A little considered fact with oil is that world conventional production has been declining since 2005 except for just two players:

Ken Deffeyes, using Hubbert knowledge he learned from him personally, wrote his book Beyond Oil: The View From Hubbert's Peak in 2005 where he said the peak is:

postulated as 24 November 2005 (`Thanksgiving' Day), after this date world oil will go into decline, slowly at first then more rapidly

This was for world conventional oil. Considering that the two players left out of the graph above are climbing almost entirely with shale (US) and bypassed oil (Russia) what you have shown is the world's conventional oil production. Deffeyes missed the peak by maybe a few days.

Isn't it ironic that these two big players, whose oil peaked over 30 years ago at the height of the cold war, are now both displaying a production resurgence that is changing perception of peak oil today. I discuss what's up with Russia here , which may have a lot to do with the cold war. But what about the amazing shale revolution of the US? It is very critical to the global picture, so it would behoove us to use the best projection tool there is to see about the future of shale. This method requires a few years of actual production data to make its projection. Now that we've had a few years of shale oil production, has anyone bothered to tabulate a true Hubbert curve for our shale oil ?

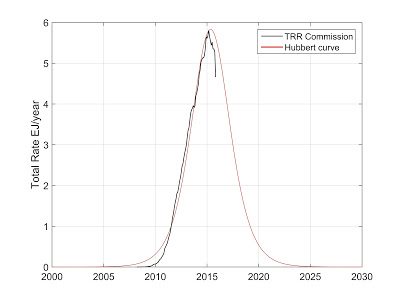

Yes. Tad Patzek has done a Hubbert curve on the two big shale oil plays of the US and published them earlier this year - "Is US Shale Oil Production Peaking?"

Who Is Tad Patzek?

Tad Patzek is Professor of Petroleum and Chemical Engineering at the Earth Sciences Division and Director of the Upstream Petroleum Engineering Center in KAUST, Saudi Arabia. You can read his blog here.

He and Art Berman, a "good friend", collaborate to make Hubbert curves for both gas and oil in the shale fields. Berman supplies the data and Patzek does the rest. According to Wikipedia,

"The focus of his research is mathematical modeling of earth systems with an emphasis on multiphase fluid flow physics and rock mechanics [spending] years as a researcher at Shell Development under M. King Hubbert"

A fellow grasshopper of Hubbert, like Deffeyes, he generates curves per the methods used in his highly cited study "A Global Coal Production Forecast With Multi-cycle Hubbert Analysis". If anyone on earth is qualified to make a Hubbert curve for Shale, it would be Patzek. Here is the Bakken:

And here is the Eagle Ford:

This is all very unsettling when you consider that the only thing propping us up from a return to Hubbert's curve for conventional, where we were driven to over $100 a barrel in 2012, is the current US shale oil boom we are enjoying. That's over 4 mb/d, and the two plays pictured above account for over 3 mb/d of that. Are we soon to lose our only prop saving us from peak net energy? This would have severe consequences on the price of oil out 5 years and beyond..

Patzek isn't the only one using Hubbert's method on US shale. David Archibald has done some curves that closely agree with the above in "The Imminent Peak In US Oil Production" posted over two years ago at Peak Oil Barrel, where the site's subtitle reads "The Reported Death Of Peak Oil Has Been Greatly Exaggerated".

The over-production problem I've discussed in other articles for the large conventional fields of Russia and Saudi Arabia may apply also to our shale oil when you consider that the shale drilling boom was fueled by free money and a massive debt frenzy. Instead of price wars or cold wars running the oil fields, we've had the bankers running our fields. The mechanics of shale over-production are different, but whatever they are, there has probably been a lot of it. A Bloomberg article "Refracing Is The New Fracking" points to one possible over-production mechanism, new fracking blasts before a well's first fracking production is over:

It’s easy for things to go wrong. If poorly executed, the maneuver could take oil from the producing zones of other wells, or worse yet, ruin a reservoir. Then there’s the concern that some industry analysts have that a refrack only accelerates the flow without increasing the actual total output over the life of the well. EOG is among the drillers that remain reluctant to start using the procedure.

Patzek views refracking as a poor substitute for making a good well to begin with:

As to the refracking the jury is out. Very poor wells may see some increase of production. Very long wells cannot be reentered towards the toe. Other wells may see the new fractures linking back to the old ones with no incremental benefit. I think that the technology of controlled refracking will improve, but I doubt if it will change the picture dramatically. The key is to make a good well first time around and improve how this well is hydrofracture. There is a lot of work done everywhere on this subject, including yours truly.

Arthur Berman is a consultant to several oil companies and provides guidance to capital formation and investment conferences. He is an energy contributor at Forbes and is interviewed often on CNN, CNBC, and other major media outlets. Does Berman buy this popular notion that we have many decades worth of shale oil to rely on? Well, he recently wrote an article titled, "Why Today's Shale Era Is The Retirement Party For Oil Production" wherein he states:

... looking at the Eagle Ford shale ... even the EIA shows Eagle Ford oil production peaking in 2016... Where do we get this decades of production? ... Eagle Ford isn’t going to stop in 2016; it will go on for many, many years, but at greatly reduced rates of production every year ... They look at the US tight oil plays and they see a couple of years, maybe five years before things start to fall off.

Rex Weyler, a director of Greenpeace said of shale:

In spite of huge shale and tar reserve discoveries, peak discoveries remain well behind us, in the 1960s. My father, a petroleum geologist his entire life (and still, in Houston, Kazakstan…), knew about shale and tar deposits when I was a teenager in the 1960s. He called them “the dregs.” These deposits are not really news within the oil industry. And they are the dregs because of high cost, low EROI and rapid depletion.

It is only prices around $100 that brings dreg oil out. Fracking was invented in 1947. It is less a technology revolution than a price revolution. Berman doesn't think the popular $60 figure for their profit point is right - more like $85-$95. He looks at free cash flow as a big measure of this. If you look at cash flow from operations on these companies, it's typically good if oil stays above $60. With free cash flow including a lot of future building cap-ex, Berman seems to be stretching present costs to cover typical future ambitions. He claims in the above article that, "these plays cannot survive on anything other than sustained $100, $90, $95 oil prices and that is the bottom line."

The profit points may be debatable, but the awestruck view of shale as new vistas of added oil supply seems like a pipe dream of either bad analysis or head-in-the-shale ignorance. Berman agrees:

... once your conventional production peaks, then you are going to be increasingly driven to more expensive, lower quality kinds of sources and that is exactly what we are seeing ... Sure, we will find something more than what we have. Will we find the equal of what we found so far? Highly unlikely ... I mean, these shale basins are not news ... The big companies have had teams of geologists and geophysicists and engineers studying them for decades ... so when the prices got high enough and the technology arrived ... companies knew exactly where to go.

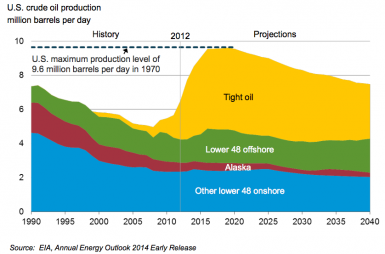

If you look at the EIA total shale oil projection, you can see this "sweet spot first" effect evident in their production profile:

Here we see pretty much the same peak time frame for shale (yellow) as the Hubbert curves for the Eagle Ford and Bakken plays, the two sweetest of the sweet spots, with the super-fast ramp-ups in production. The giant, high quality Permian Basin is also contributing to this profile, but with a slower climb and a slower projected decline. The sharp climb pictured closely reflects what Eagle Ford/Bakken has done while the EIA sees the Permian and the sum of all the lesser plays coming on line hereafter plateauing a top and making for a much slower decline than just the two big play Hubbert curves. But they still see about the same overall top that the two big, explosive plays may produce by Hubbert linearization.

You have all these independent means of analysis in Tad Patzek, Art Berman, and the EIA in close agreement. Patzek is using Hubbert's math method (with Berman's data) while Berman does meticulous well-by-well reserve data accounting. And they both agree on a shale oil production peak in 3 years or less. The EIA also is projecting this with a 2020 peak. If that's all true, in just 3 years, conventional will be declining along with shale oil. With these declines, the only meaningful prop keeping us above Hubbert's curve for conventional oil will then be buckling, and we will once more be in a losing battle with rising demand, as we were briefly before the shale sweet spots ignited in 2012. You will probably want to be long oil once this condition sets in, barring a really bad global economy.

Shale Oil outside the US

The EIA says the US has 78 of world's 419 billion barrels of unproved technically recoverable reserves of shale oil. There is shale outside the US, but as explained in this study, "The Shale Oil Boom: A US Phenomenon" it is unlikely that the US shale explosion will be replicated elsewhere. The reason - logistics:

- The shale boom has depended on an exponential growth of wells drilled. Unlike conventional, shale oil requires punching holes in rock like crazy like a machine gun. No other country has anything like the drilling rigs of the US, where 60% of all the rigs in the world are. They simply don't have the tools or crews to make it happen. The study concluded that this is unlikely to change in this decade because of the time needed to build and man the right rigs and equipment.

- Also a problem is that the thousands of new wells a year will be impossible in the more populated areas like Europe due to environmental and other concerns.

- And nowhere but the US do you have the small independent oil companies that are needed to take on the fast moving, high risk business profile of shale. And in most other countries with shale, the property is state owned with issues unlike the private and freely sold property rights of the US.

- Also in other countries, they don't have the pipeline infrastructure or water supply needed by the water intensive shale business.

The study concluded:

For all these reasons. it is difficult to believe that a US style shale revolution may occur in any other part of the world in the foreseeable future.

The other shale plays in the world will be played - eventually. As oil stays high enough, these countries will deal with all the above logistic roadblocks, and this oil will find its way onto the market. If the "dreg" US shale card soon goes into a decline, there are other cards to play in global net energy supply. But how quickly can those cards be played? It will likely be in small, erratic doses.

This is why it is so critical to build the natural gas bridge away from oil, as I and others have been writing about for 10 years now. Fracked natural gas has much different dynamics and will peak much later than oil, (around 2040 by Hubbert and other means) and is a much superior transportation fuel than refined oil. The Pickens Plan is needed more urgently now than ever.