What A Difference A Year Makes

Image Source: Pixabay

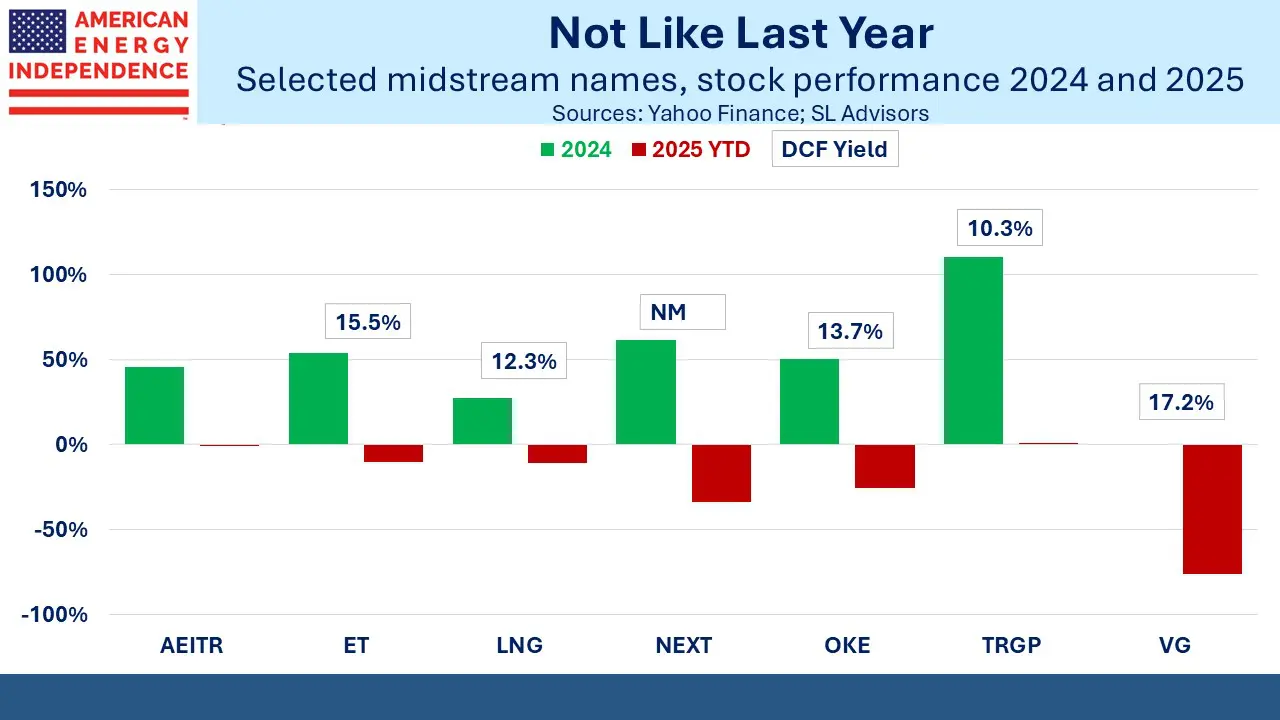

2025 has been frustrating for those who must explain short-term performance in midstream energy stocks – which is to say this blogger, along with many financial advisors whose clients are invested in the sector.

It hasn’t been an especially newsworthy year. In 2024, the realization that natural gas would benefit from the growth of data centers was an important driver of stock performance. The other source of demand, LNG exports, continued to benefit from growing liquefaction capacity.

(Click on image to enlarge)

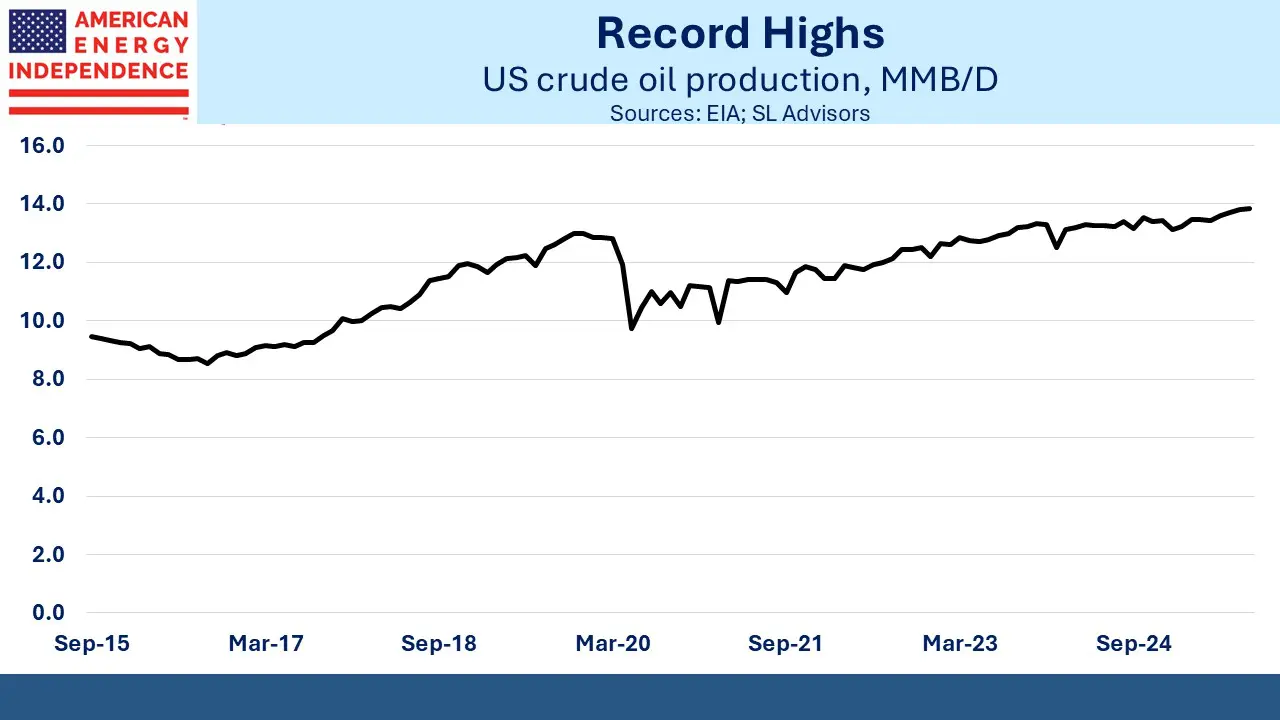

2025 hasn’t offered much in the way of dramatic new developments, simply a steady stream of confirmations that the bullish thesis from 2024 remains intact. US oil production reached a record 13.8 Million Barrels per Day (MMB/D) in September, up 5% year-on-year.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

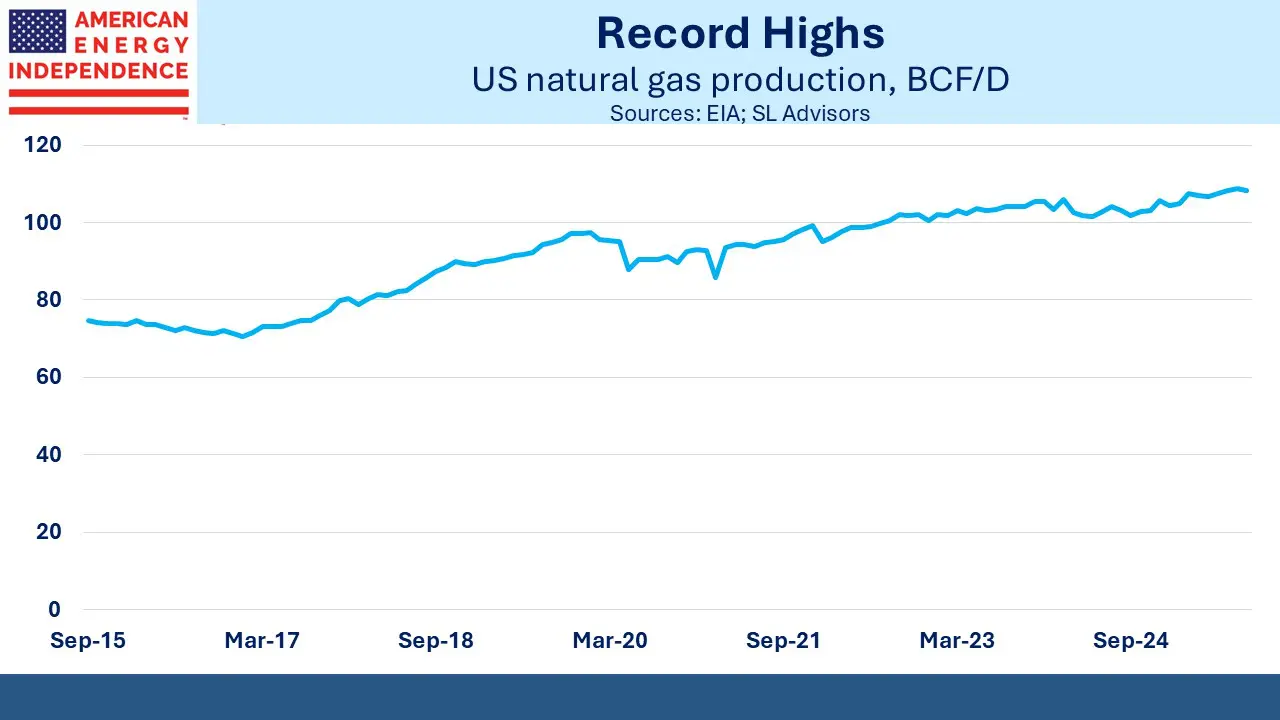

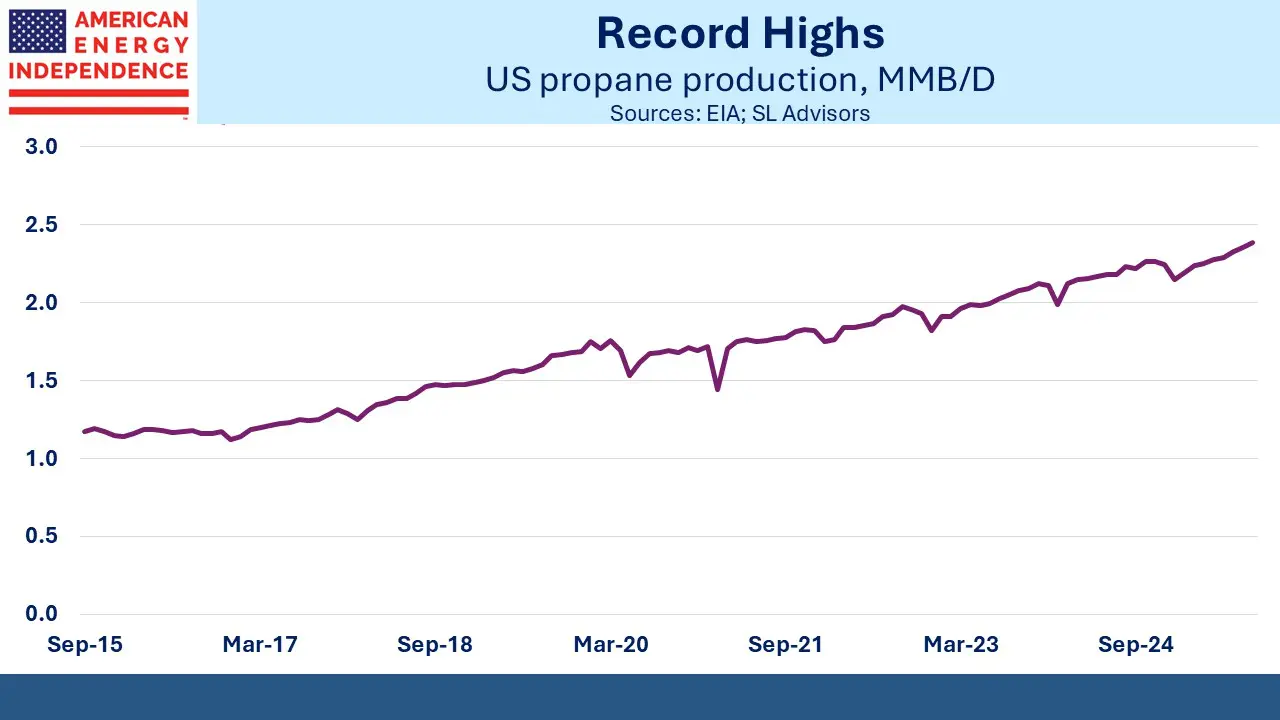

Dry gas production (natural gas) exceeded 108 Billion Cubic Feet per Day (BCF/D) in September, up 6% year-over-year. LNG exports were over 15 BCF/D in September, up +24%. Propane production, used in backyard barbecues, by farmers for drying crops, and for exports, reached 2.4 MMB/D in September, up +7%.

US power generation reached 368 Terrawatt hours in September, up +2.4%. Natural gas remains by far the dominant source of electricity generation. Grid operator, PJM Interconnection held a capacity auction last week that set a new record high.

In other words, natural gas and natural gas liquids such as propane are a growth story.

A year ago, many analysts expected continued growth in hydrocarbon production, although there were concerns that soft oil prices might depress output of crude. Electricity consumption has probably run modestly ahead of expectations. The big grid operators have been warning of a jump from the 0.2% annual growth that prevailed for the past decade. Data center demand is starting to impact, which is partly why electricity prices are up around 7%.

This has been a good year for businesses that handle natural gas and related hydrocarbons. Cash flows are growing. Dividend hikes are the norm. Leverage has been falling. And the co-location of data centers with the power plants that support them (also known as Behind The Meter or BTM) has been creating growth opportunities for the biggest natural gas pipeline companies.

What midstream doesn’t have is an exciting AI story. It’s true that sending natural gas to data centers is a modern-day equivalent of selling pickaxes to gold miners. But it’s not a new story.

A looming oil glut has added to the negative sentiment towards energy, with forecasts that crude may drop below $50 per barrel next year. US E&P companies continue to defy expectations by continuing to innovate and lower their production costs. The $7 drop in prices over the past year hasn’t curbed output.

Nonetheless, for many investors the oil price is probably their first thought when they consider the outlook for the energy sector. It continues to persuade many generalists to look elsewhere for opportunities.

The absence of an exciting new story has weighed on midstream stocks this year, even though operating performance has been generally good. Investors are afraid of still-weaker oil prices with 2026 supply forecast to be 2-3 MMB/D in excess of demand. They’re afraid of a surplus of LNG exports as more liquefaction capacity comes online. They’re afraid that tariffs will be imposed on US exports of propane and other Natural Gas Liquids (NGLs).

These are all manageable and probably inconsequential risks for the midstream companies that handle, move, and store hydrocarbons.

(Click on image to enlarge)

Cheniere (LNG) has continued to add liquefaction capacity. Fears of an LNG glut are unlikely to be realized, in our view. Regassification capacity is growing to keep up with the increased availability of LNG shipments.

Similarly, over the past year NextDecade (NEXT) has begun construction of their Rio Grande facility, has signed numerous long-term shipping agreements, and has been on track to expand at its existing site.

Venture Global (VG) has fallen far below its IPO price because of an adverse arbitration ruling. We think the current valuation more than discounts the worst plausible outcome on the remaining cases.

Foreign buyers of US propane or ethane have generally not imposed tariffs, in part because they have few other sources. This concern has hurt the likes of Energy Transfer (ET), Oneok (OKE), and Targa Resources (TRGP). Propane trade with China has been disrupted, but flows have been redirected elsewhere in Asia and to Europe. China quickly dropped tariffs on ethane because their petrochemical industry relies heavily on it.

Energy Transfer is also among those well positioned to benefit from data center gas demand, and the company has paused their LNG export terminal in Lake Charles, LA. Its 15.5% Distributable Cash Flow (DCF) yield almost defies belief.

Even allowing for the discounted valuation common for MLPs, Energy Transfer looks like a cheap stock. It could also benefit from the January seasonal effect that typically impacts partnerships more than c-corps, reflecting their bigger retail ownership.

Several big midstream companies have seen poor stock performance while the fundamentals of their business have remained strong and their valuations have improved. Some investors are already starting to take advantage of that.

Recently, we had the good fortune to enjoy lunch with long-time investor Eric Schulze and his delightful wife Jessica, who were visiting Naples from Colorado. Whatever the weather in America, it’s usually sunny and warm in south Florida, as was the company that day.

We have two have funds that seek to profit from the current energy environment:

More By This Author:

The Midstream Earnings/Valuation ParadoxTen Reasons To Consider Buying Midstream Now

MLP Yields Look Better Than Cash

Disclosure: The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their ...

more

Bullish