Weekly Forex Forecast - Sunday, Feb. 9

Image Source: Pixabay

Fundamental Analysis & Market Sentiment

I previously wrote on Sunday, Feb. 2 that the best trade opportunities for the week were likely to be the following:

- Long of gold in US dollar terms (also known as XAU/USD). The price rose by 2.13% over the week.

- Long of corn futures (CORN ETF can also be used) following a daily close of the next ZC future at or above the 498 level. This did not set up.

- Long of coffee futures (COFF ETF can also be used). The price rose by 5.55% over the week.

The weekly gain of 7.68% equals 2.56% per asset. Meanwhile, last week saw several data releases affecting the Forex market. Notable releases include the following:

- US Average Hourly Earnings – this was notably higher than expected, showing a 0.5% month-on-month increase while a value of 0.3% was widely forecasted. This reinforced the now widespread belief that the Federal Reserve will make only one more rate cut of 0.25% during 2025.

- US Non-Farm Employment Change – this was a little lower than expected, with 143,000 net new jobs when 169,000 was forecasted.

- Bank of England Policy Meeting – this came in as expected, the Bank cut its interest rate from 4.75% to 4.50%, but Governor Bailey’s dovish talk on the expectation of further cuts throughout 2025 helped sink the pound by the end of the week.

- US JOLTS Job Openings – this was a little lower than expected.

- US ISM Services PMI – this was a little lower than expected.

- US ISM Manufacturing PMI – this just a little higher than expected.

- US Unemployment Rate – this was lower than expected, at 4.0% while 4.1% was widely forecast.

- US Unemployment Claims – this was just a fraction higher than expected.

- Canadian Unemployment Rate – this was much better than expected, at 6.6% while 6.8% was forecasted.

- New Zealand Unemployment Rate – this came in as expected, as the rate rose to 5.1%.

Last week’s key takeaways were as follows:

- There was a general, continuing decline in inflation and the continuation of rate cuts in G7 nations (this time, it was the UK), with the notable exception of the US, which saw average hourly earnings increase unexpectedly beyond the forecasted amount. The Fed is now expected to make only one more rate cut in 2025 of 0.25%.

- The Japanese yen has continued to strengthen firmly, as Japanese wage inflation beat expectations and the Bank of Japan looked more likely to begin hiking rates.

- US President Trump secured climbdowns from Canada and Mexico after threatening new 25% tariffs on their imports (excepting Canadian energy, which would be taxed at 10%). Both nations agreed to make concessions to the US in return for a month-long freeze on the new tariffs while negotiations continue. The Canadian dollar and Mexican peso both made very strong recoveries following the temporary agreements.

- China responded to the new 10% US tariff with a retaliatory tariff of its own on US imports, which President Trump dismissed as “fine.”

Interestingly, these two developments should be helping to increase in the relative value of the US dollar, which is still in a valid long-term bullish trend. However, the US Dollar Index decreased in value last week, and technically, its price action seems to be ranging between support and resistance.

A few commodities have been performing strongly and breaking to new record highs, while a few others have also been advancing in value.

The Week Ahead: Feb. 10-14, 2025

The coming week has a lighter schedule of releases, so we are very likely to see a lower level of activity and volatility in the Forex market. The coming week’s important data points, in order of likely importance, are as follows:

- US CPI (inflation)

- Fed Chair Powell testifies before US Congress

- US Retail Sales

- US PPI

- UK GDP

- Swiss CPI (inflation)

- New Zealand Inflation Expectations

- US Unemployment Claims

It should be noted that Tuesday is a public holiday in Japan.

Monthly Forecast for February 2025

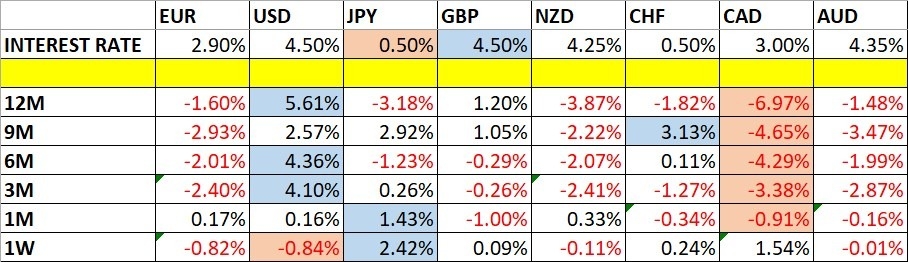

(Click on image to enlarge)

For February 2025, I forecasted that the EUR/USD currency pair could decline in value. The performance so far is shown below:

Weekly Forecast for Sunday, Feb. 9, 2025

Last week, I made no weekly forecast. This week, I forecast that the following currency crosses will rise in value over the coming week:

- AUD/JPY

- CHF/JPY

- EUR/CAD

- EUR/JPY

- NZD/JPY

The Japanese yen was the strongest major currency last week, while the US dollar was the weakest, putting the USD/JPY currency pair in focus. Volatility increased last week, as 52% of the most important Forex currency pairs and crosses changed in value by more than 1%. Volatility is likely to remain relatively high over the coming week.

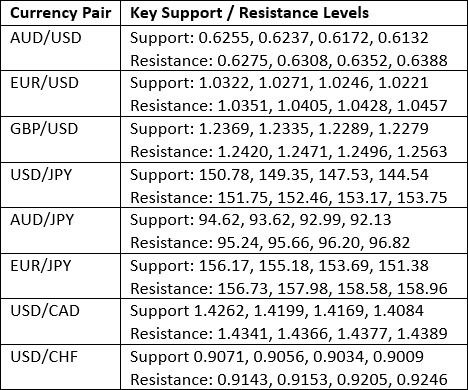

Key Support/Resistance Levels for Popular Pairs

Technical Analysis - US Dollar Index

Last week, the US Dollar Index moved lower against the long-term bullish trend after making a bearish reversal near the resistance level at 110.00. However, the price also rejected the nearest support level at the 106.85 mark.

It seems clear that the dominant price action is a ranging one, between the levels of 106.85 and 110.00. The dollar is likely to continue rise over the coming week. The price has room to rise to at least the next resistance level at the 110.00 mark.

(Click on image to enlarge)

USD/JPY

The USD/JPY currency pair is in a strong short- to medium-term bearish trend, but it has no dominant long-term trend. The bearish momentum is strong, has persisted for a while, and is backed by the fundamental change in the Bank of Japan’s monetary policy, which seems to have fully turned the corner and gotten established on a more restrictive path as Japanese wage growth begins to take off.

There is also a feeling that the Japanese yen is benefiting from flows as a safe haven, with few risky currencies advancing over the past week. So, although these sound like good reasons to be short, it should be remembered that the US dollar is in a long-term bullish trend, so if you want to be long of the yen, it might be better to find another currency to use for the short side; maybe the euro.

(Click on image to enlarge)

USD/CAD

The USD/CAD currency pair printed a huge bearish outside candlestick, which closed very near its low. It has been years since this currency pair made such a large directional price movement in only one week.

The story here is, of course, about the threatened 25% US tariff on Canadian imports (10% on energies), with its threatened imposition seeing the Canadian dollar sell off strongly and pushing the price of this currency pair up to a new four-year high price, before the temporary climb down and agreement which then triggered massive buying of the Loonie, leaving the price firmly lower on the week.

I had not expected such a fast concession by Canada, so I had thought that the rise would continue for a few days – I was wrong about that. It is tempting to go short here, with another factor being the bid in crude oil, which is also giving a tailwind to the Canadian dollar, but I think the price will probably consolidate over the next week, as the bearish move has already more or less run out of momentum.

(Click on image to enlarge)

XAU/USD

Gold advanced last week to reach a new all-time high last Friday above $2,886 per ounce. However, later in the day on Friday, the price gave back much of its earlier gain to close below Wednesday’s record high closing price, which should be a signal of some caution to bulls.

This trend may see a relatively slow rise, but we can see how steadily and strongly gold gained over the past year, so this looks likely to be a solid trend. I am far from sure that gold will reach $3,000 per ounce over the coming week, but this target is certainly in sight now.

The traditional safe haven assets of the Japanese yen and gold seem to be doing well in the current market environment, although I should note that gold often acts as a surrogate for risk appetite.

As we saw a slight bearish element creep in at the end of last week, I’d like to see a new record high daily closing price before entering any new long trade – primarily above the $2,867.25 mark.

(Click on image to enlarge)

Coffee Futures

The price chart below shows that coffee futures have been breaking out to long-term high prices over a period of more than six months, with last week’s price increase being a relatively strong one. This is suggestive of a climax, which would make going long dangerous, and this is reinforced by the fact that Friday’s close was not the highest daily close.

Taking long trades when major commodities break out to new six-month highs has historically been a very profitable trading strategy, which is the main reason that I want to look for a long trade here.

Due to the bearish factor that came in here on Friday, I want to see a closing price above the 403.95 level before entering a new long trade. It is not just the lower daily close which is worrying to bulls, but the fact that the three-candle pattern includes a bearish pin bar and a sharp V-shape.

Unfortunately, coffee futures are quite expensive and usually just too large for retail traders, but there is an ETF called COFF which can be used to participate in increases in the price of coffee. However, note that this ETF does not always cleanly mirror the price action of coffee futures, so if you are using the fund, be careful.

(Click on image to enlarge)

Corn Futures

Corn futures have been breaking to new highs recently, although the price action over recent days, which is shown in the price chart below, is looking very much as if a bearish top has been formed.

I think corn is a buy -- only if it makes a new daily high closing price, and this does not look likely to happen. Although we clearly have a medium- or maybe long-term bullish trend in corn, this bullish move is relatively new and may have already have run out of steam, which is why I am cautious.

Many analysts see this move as mostly seasonal in nature, and they do not seem to think the price is going to make a new high any time soon. I will be prepared to enter a new long trade only if I see corn futures make a new six-month high closing price at the end of any day over the coming week, specifically above the 498 mark.

(Click on image to enlarge)

Bottom Line

I see the best trading opportunities this week as the following:

- Long of gold in US dollar terms (also known as the XAU/USD cross) following a daily close of spot gold above $2,867.25.

- Long of corn futures (CORN ETF can also be used) following a daily close of the next ZC future at or above the 498 level.

- Long of coffee futures (COFF ETF can also be used) following a daily close of the next C future at or above the 403.95 mark.

More By This Author:

BTC/USD Forex Signal: Consolidating Below $100,000Forex Today: Gold, Coffee, Corn Hit New Highs Again

Forex Today: Gold, Coffee Rise To Record Highs

Risk Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more