Weekly Forex Forecast - Sunday, Feb. 11

Image Source: Pexels

Last week saw chances of a US rate hike at the next Fed meeting continuing to decline, boosting the US dollar. However, the major US stock indices also advanced once again to reach new record highs.

Fundamental Analysis & Market Sentiment

I wrote in my previous piece on Sunday, Feb. 4 that the best trade opportunities for the week were likely to be:

- Long of the Nasdaq 100 Index following a daily close above 17686. This gave a win of 1.03%.

- Long of the S&P 500 Index. This gave a win of 1.45%.

- Long of cocoa futures. This gave a win of 11.20%.

- Long of the USD/JPY and/or EUR/JPY currency pairs following a bullish bounce at key support. This set up in the EUR/JPY pair with the bounce off 159.00, giving a very profitable trade.

- Short of the AUD/USD pair following a bearish rejection at key resistance. This did not set up.

The overall result was a gain of at least 13.68%, which comes to an excellent gain of 4.56% per asset.

Last week saw slightly higher directional volatility in the Forex market, as 15% of the significant currency pairs fluctuated by more than 1%. There was important action in US stock markets. Last week once again saw new, all-time high prices reached by the benchmark S&P 500 Index, the Nasdaq 100 Index, and the Dow Jones 30 Index.

This rise in stock markets occurred despite the CME’s FedWatch tool showing strongly lowering expectations of a March rate cut by the Federal Reserve. Markets now see only a 16% chance of a rate cut in March, down from 38% one week ago. However, there is a strong expectation of a rate cut at the next meeting in May.

Last week's agenda was relatively light, dominated by Fed Chair Jerome Powell’s interview and the Reserve Bank of Australia’s policy meeting, both of which came early in the week. Powell said that a March rate cut was "unlikely," which helped lower expectations of a possible cut next month, boosting the US dollar. The Reserve Bank of Australia left its rate unchanged as widely expected, but made a hawkish tilt in its statement by casting doubt on rate cuts, which boosted the Australian dollar somewhat.

The Forex market was dominated by a strong New Zealand dollar, while the Swiss franc was the weakest major currency. The US dollar has been showing weak, short-term, bullish momentum, and it has now established a new, long-term, bullish trend by the indicator I like to use, but it looks very fragile – much will likely depend upon key US CPI (inflation) data, which will be released this Tuesday.

There were several other important economic data releases last week, including the following:

- US ISM Services PMI – this came in above expectations, pointing to continuing strength in the US economy.

- Governor of Bank of Canada Speaks – he pushed back on near-term rate cuts, pointing to fewer rate cuts in 2024 than were expected.

- New Zealand Unemployment Rate – employment growth in New Zealand was notably stronger than expected, helping to strengthen the New Zealand dollar.

- US Unemployment Claims – this came in almost exactly as expected.

- Canadian Unemployment Rate – employment growth in Canada was notably stronger than expected, keeping the Canadian dollar relatively firm.

The Week Ahead: Feb. 12-16, 2024

The most important item over the coming week will almost certainly be the US CPI (inflation) data release. Next week has a relatively heavy data schedule. Other major economic data releases this week will be, in likely order of importance, as follows:

- US PPI

- US Retail Sales

- US Preliminary UoM Consumer Sentiment

- UK CPI (inflation)

- Swiss CPI (inflation)

- UK GDP

- US Unemployment Claims

- US Empire State Manufacturing Index

- UK Retail Sales

- New Zealand Inflation Expectations

- UK Claimant Count Change (Unemployment Claims)

- Australian Unemployment Rate

- The Governor of the Bank of England will be giving two minor speeches

Monday will be a public holiday in Japan. In China, the whole week will be a public holiday.

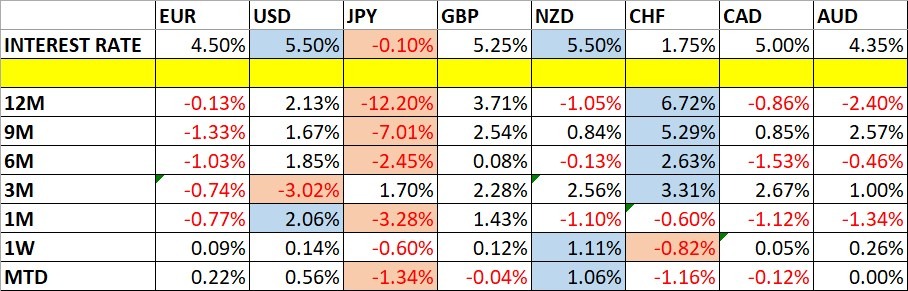

Monthly Forecast for February 2024

(Click on image to enlarge)

For the month of February, I made no monthly forecast, as there was no obvious, long-term trend in the US dollar that could be relied upon.

Weekly Forecast for Sunday, Feb. 11, 2024

Last week, I made no weekly forecast, as there were no strong counter-trend price movements in any currency crosses, which is the basis of my weekly trading strategy. I once again will give no forecast this week for similar reasons.

Directional volatility in the Forex market remained mostly the same last week. Volatility is likely to increase over the coming week, as such a low level of volatility is unusual to see for more than a few weeks. There is also quite a heavy, high-impact economic data release schedule this week.

Last week saw relative strength in the Swiss franc, and relative weakness was seen in the euro.

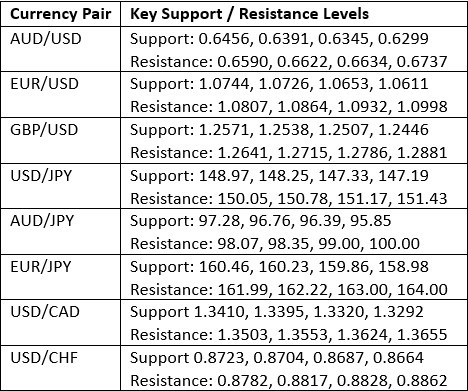

Key Support/Resistance Levels for Popular Pairs

(Click on image to enlarge)

Technical Analysis - US Dollar Index

The US Dollar Index printed a candlestick which closed above its open last week, but it is arguably a small, bearish pin bar. However, the weekly close was up on the price of three months ago and six months ago, presenting a new, bullish, long-term trend.

Despite this new, bullish trend in the greenback, I think the direction still looks uncertain. Much will likely depend on this Tuesday's release of US CPI (inflation) data. If inflation is dropping faster than expected, it will probably trigger a selloff. If inflation proves persistently high, the dollar will probably begin to rise with real momentum as expectations for a first rate cut in May would lower.

(Click on image to enlarge)

Nasdaq 100 Index

The Nasdaq 100 Index rose firmly last week to reach a new record high price. Its closing price was right on the high of the week. These are bullish signs, supported by the fact that the S&P 500 and Dow Jones 30 Indices also made record highs last week.

Although the Federal Reserve seems to be in no hurry to cut rates, with expectations of cuts decreasing, this is not slowing the advance of US stock markets. I am happy to be long of the Nasdaq 100 Index, which has a much better historical record than the S&P 500 Index.

(Click on image to enlarge)

S&P 500 Index

The S&P 500 Index once again rose firmly last week to reach and close at a new record high. The price similarly closed right on the high of the week. These are also bullish signs.

This bullishness in US stock markets is a bit counter-intuitive, as it comes at the same time that short-term US treasury yields and the US dollar are rising in value, while expectations of a rate cut by the Federal Reserve in March are continuing to fall even lower.

These factors typically weaken US stock markets. It may be that the US economy is just looking so much more impressive than its competitors right now that an inflow of foreign investment is coming into the US stock market.

I see the S&P 500 Index as a buy. The technical picture is bullish. A first break to a fresh, all-time high has historically generated an advance of a median of 13% over the next year, so I believe traders and investors should be seriously considering going long here.

(Click on image to enlarge)

Bitcoin

After consolidating for several weeks, Bitcoin has made a firm, bullish breakout, but has not yet exceeded the recent high made a few weeks ago when Bitcoin ETFs were securing regulatory approval. The recent price is very near the high of the past week’s range, which is a bullish sign.

However, despite these bullish signs, I would like to see Bitcoin make a daily close above $50,000 before entering a long-term investment here. I am concerned about the recent high just above $49,000 and the big, round number at $50,000 acting as resistance.

(Click on image to enlarge)

GBP/USD

I had expected that the level at $1.2641 might act as resistance in the GBP/USD currency pair last week, as this price has acted previously as both support and resistance. Note how these “role reversal” levels can work well.

The H1 price chart below shows how the price rejected the resistance level during last Wednesday’s London/New York session overlap with a doji, marked by the downward arrow, signalling the timing of this bearish rejection. This can be a great time of the day to trade a major Forex currency pair like this one. This trade was profitable, giving a maximum reward-to-risk ratio of more than 2 to 1 based on the entry candlestick.

(Click on image to enlarge)

EUR/JPY

I had expected that the level of JPY158.98 might similarly act as support. The H1 price chart below shows how this level was rejected repeatedly during last Tuesday’s New York session, marked by the upward arrow, signalling the timing of this bullish rejection.

It took several hours, but then the start of the Tokyo session finally saw the decisive rejection by a pin bar – it is common to see decisive rejections at the start or close of major and relevant geographical sessions in the Forex market.

This trade has been extremely profitable, giving a maximum reward-to-risk ratio of more than 10 to 1 based on the size of the entry candlestick. Note that the yen has been showing some relative weakness, so this currency pair and others may be good vehicles to take advantage of that. If the US CPI is higher than expected, the USD/JPY currency pair will be likely to rise, so that could be attractive in the long run.

(Click on image to enlarge)

Cocoa Futures

Cocoa futures have been in a strong, bullish trend for over a year, and the price advanced extremely strongly last week to reach a new, multi-year high price, rising by more than 11% over the week. The price chart below applies linear regression analysis to the past 73 weeks, and it shows graphically what a great opportunity this has been on the long side over the long-term.

Despite this very bullish picture, there are some muted notes of caution to keep in mind:

- The price is way above the linear regression channel.

- Volatility is extremely high, and cocoa has been getting a lot of media attention.

These factors suggest a sharp dip may be coming soon, making it a bit dangerous to enter a long trade blindly here.

Trading commodities long on breakouts to new six-month highs has been a very profitable strategy over recent years, so I see this as a buy. However, it is worth waiting for a daily close above the recent high to be sure the extremely high volatility is not a sign of this trend ending, as it often can be.

(Click on image to enlarge)

Bottom Line

I see the best trading opportunities this week as:

- Long of the Nasdaq 100 Index.

- Long of the S&P 500 Index.

- Long of Bitcoin following a daily close above $50,000.

- Long of cocoa futures following a daily close above 5800.

More By This Author:

WTI Crude Oil Weekly Forecast: Prices Edged Higher Going into Last WeekendEUR/USD Weekly Forecast: Choppy Results As Angst And Trading Questions Grow

XAU/USD Gold Price Analysis: Gold Recovers Despite Strong Dollar

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more