Weekly Forex Forecast - Sunday, April 21

Image Source: Unsplash

Hawkish remarks from Fed Chair Powell and ongoing tension in the Middle East saw the US dollar continue to gain while stocks and most commodities sold off firmly, excepting precious metals.

Fundamental Analysis & Market Sentiment

I previously wrote on Sunday, April 14, 2024 that the best trade opportunities for the week were likely to be:

- Long of the Nasdaq 100 Index following a daily close above 18400. This did not set up.

- Long of gold following a daily close above $2373. This set up last Monday and gave a winning trade of 0.36%.

- Long of silver following a daily close above $28.45. This set up last Monday and gave a losing trade of 0.66%.

- Long of the USD/JPY currency pair. This gave a winning trade of 1.03%.

- Long of gasoline futures following a daily close above 2.8516. This did not set up.

- Long of cocoa futures, but with only half a normal position size. This gave a winning trade of 4.27%.

The overall result was a net win of 5.00%, resulting in a gain of 0.83% per asset.

Last week saw unchanged volatility in the Forex market, which has been relatively low since 2024 started. Last week’s key event was Fed Chair Jerome Powell making clear that there has not yet been enough progress on inflation to justify imminent rate cuts.

This is not a new message at all, but it did produce more of a hawkish tilt to general market sentiment. This risk-off sentiment was given a boost by the first direct attack by Iran on Israel and the Israeli retaliation which followed some days later.

Bearishness in stock markets was very notable this week. We may be entering a new environment for stock markets, with major US indices finally giving exit signals to trend traders after a lengthy bull run, as prices fell to levels well off recent highs.

Other important data was a slew of CPI releases, which showed:

- Lower-than-expected Canadian inflation at 2.9%.

- Higher-than-expected UK inflation.

- New Zealand inflation as expected at 3.2%.

Apart from these factors, it was a relatively quiet week, although we did see the froth come off the market with several assets retreating from recent highs. There were only a few other important economic data releases last week:

- US Retail Sales – this came in higher than expected.

- US Empire State Manufacturing Index – this came in lower than expected.

- UK Retail Sales – this came in considerably worse than expected.

- US Unemployment Claims – this came in as expected.

- Chinese Industrial Production – this came in considerably worse than expected.

- UK Claimant Count Change (Unemployment Claims) – this came in lower than expected.

- Australian Unemployment Rate – this increased by less than expected to 3.8%.

The Week Ahead: April 21-25, 2024

The most important items over the coming week will be the release of US Core PCE Price Index and Advance GDP data, as well as the Bank of Japan’s monthly policy meeting. Apart from these, there are a few other important releases due:

- US, UK, German, French Flash Manufacturing & Services PMI

- US Revised UoM Consumer Sentiment

- Australia CPI

- US Unemployment Claims

- US Pending Home Sales

Monthly Forecast for April 2024

(Click on image to enlarge)

At the start of April, the long-term trend in the US dollar was unclear, so I did not make any monthly Forex forecast.

Weekly Forecast for Sunday, April 21, 2024

Last week, I made no weekly forecast, as there were no strong counter-trend price movements in any currency crosses, which is the basis of my weekly trading strategy. I once again give no forecast this week for similar reasons.

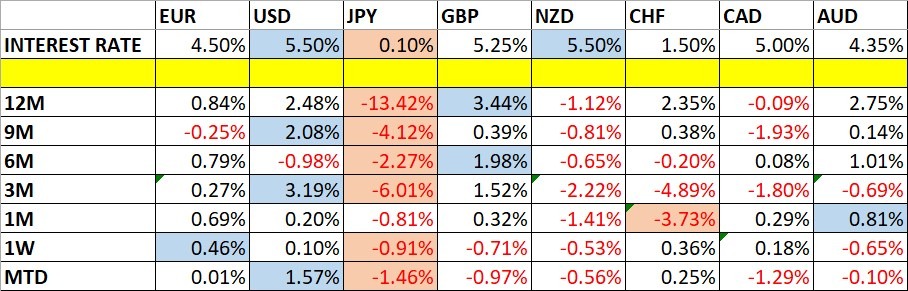

Directional volatility in the Forex market was unchanged last week, as 26% of the most important currency pairs fluctuated by more than 1%. Last week, relative strength was observed in the euro, and relative weakness was observed in the Japanese yen.

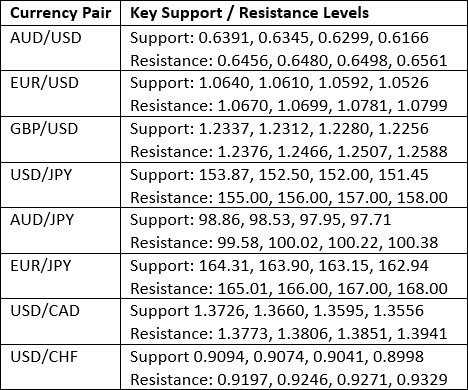

Key Support/Resistance Levels for Popular Pairs

Technical Analysis - US Dollar Index

The US Dollar Index printed a small candlestick last week, which looks like a bearish pin bar, at a new five-month high price. Most of the week’s price action was above the new support level at 104.68.

However, the weekly close presented a mixed long-term trend, as it was higher than three months ago, but lower than six months ago, although the price is very close to a long-term bullish trend.

The concern for bulls must be the small and weak candlestick last week, which suggests that the recent bullish move is running out of steam. However, market sentiment and the policy of the US Federal Reserve seem to be supporting the greenback, so it may be wise to look for trades which are long of the US dollar over the coming week.

(Click on image to enlarge)

Gold

Gold rose strongly last week, marking its highest weekly close and ending with a weekly candlestick that looks like a bullish inside bar. The high price of last week was not far from the record high made during the week before. The weekly close was not very far from the high, either. These are all bullish signs.

It is important to remember that gold has historically been positively correlated with the stock market and other risky assets, and it does not tend to act as a hedge against them as is commonly supposed. Nevertheless, gold held up well last week despite the uptick in the US dollar and the strong selloff in stock markets, suggesting that gold and other precious metals may be fulfilling such a hedging role right now.

I see gold as a buy, but it might be safest to wait for a daily close above $2400 before entering a new long trade.

(Click on image to enlarge)

Silver

Silver rose quite firmly last week, making its highest weekly close in 10 years and ending with a weekly candlestick that looks like a bullish inside bar. The weekly close was not very far from the high, either. These are also bullish signs.

It is important to remember that silver, similar to gold, has historically been positively correlated with the stock market and other risky assets. Nevertheless, silver held up well last week.

I see silver as a buy, but it might be safest to wait for a daily close above $29 before entering a new long trade.

Silver is a little weaker than gold, so it might be wise if you are going to buy both precious metals to buy more gold than silver. If you will only trade one long, gold is likely to be a better bet.

(Click on image to enlarge)

USD/CAD

I had expected that the USD/CAD currency pair would have potential support at $1.3726.

The H1 price chart below shows how this resistance level was rejected right at the start of last Monday’s London/New York session overlap by a bullish doji, marked by the upward arrow, signaling the timing of this bullish rejection. Note that this can be an excellent time of day to enter a trade in a currency pair which involves the US dollar, such as this one.

This trade has been extremely profitable, with a maximum reward-to-risk ratio greater than 3 to 1 based on the size of the entry candlestick.

(Click on image to enlarge)

AUD/JPY

I had expected similarly that the AUD/JPY currency cross would have potential support at the JPY97.95 level.

The H1 price chart below shows how this support level was rejected during Friday’s Tokyo session by a an engulfing candlestick, marked by the upward arrow, signaling the timing of this bullish rejection. Note that this can be an excellent time of day to enter a trade in a currency cross which involves the Japanese yen, such as this one.

This trade has been profitable so far.

(Click on image to enlarge)

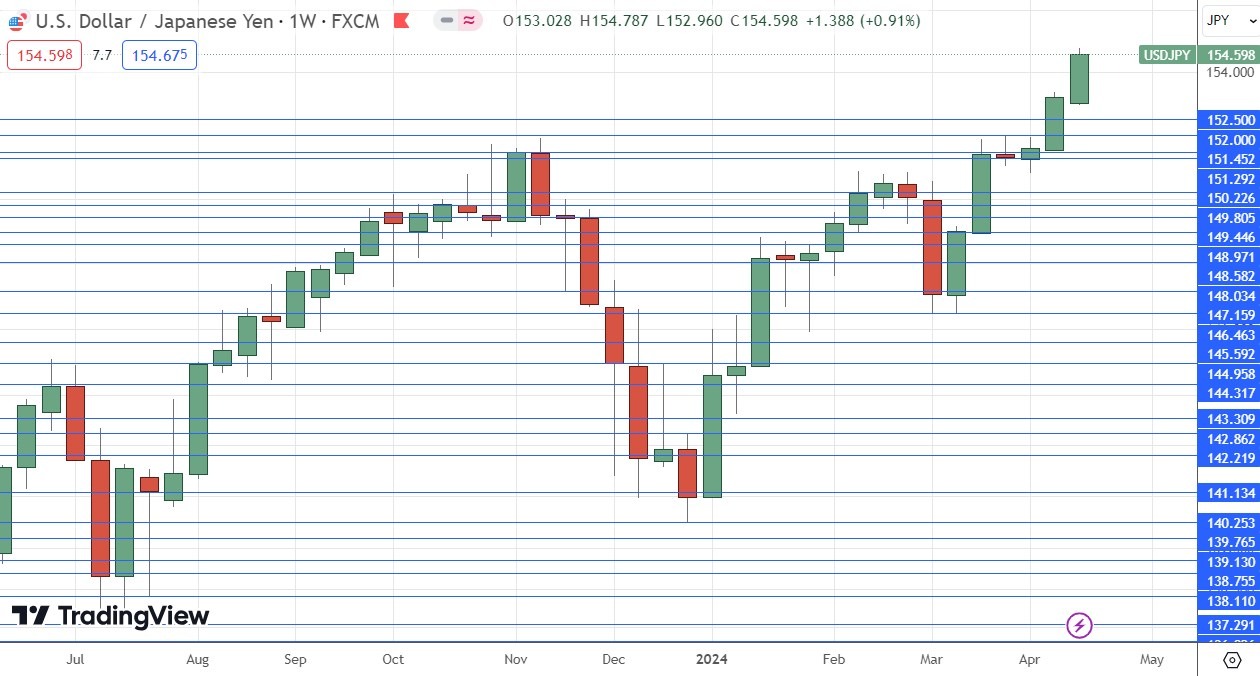

USD/JPY

The USD/JPY currency pair continued to rise firmly for another week following its recent strong bullish breakout beyond the former key resistance level at JPY152, which had been seen as a price that the Bank of Japan would defend. The price closed at a new 34-year high and near the high of the week’s range. These are both very bullish signs.

The Japanese yen is weak, as the Bank of Japan and the Japanese financial establishment do not seem to be very serious about halting the yen’s slide. On the other side of this pair, the US dollar is the strongest major currency, as the risk-off environment sends a money flow into the greenback, supported by the growing feeling that US interest rates will have to remain higher for longer.

I see the USD/JPY currency pair as a buy, but we may see profit taking or general resistance at the JPY155 mark, which is not far from the closing price.

(Click on image to enlarge)

Cocoa Futures

Cocoa futures made yet another bullish move last week and rose to reach a new multi-year high. The price ended the week extremely close to the high of its weekly price range. These are very bullish signs.

You can apply a linear regression analysis to the start of the increased bullish momentum 16 weeks ago. Since then, the price of cocoa futures has almost tripled. Cocoa is now considerably more expensive pound for pound than copper.

This amazing trend will eventually end, but there is no point in calling a top. However, using a trailing stop in this kind of trade is extremely important. The stop should be based upon volatility, which has become extremely high.

Weekly price movements of about 10% are now quite normal here, so position sizing should be small, especially on new trades, as the price is overbought on any technical indication – the price chart below shows that the close is very near the top of the standard deviation channel which has contained the price over recent weeks.

I see cocoa as a buy, but only with a half-sized position.

(Click on image to enlarge)

Bottom Line

I see the best trading opportunities this week as follows:

- Long of gold.

- Long of silver.

- Long of the USD/JPY currency pair.

- Long of cocoa futures, but with only half a normal position size.

More By This Author:

AUD/USD Forex Signal: Resistance at $0.6456 HoldingGBP/USD Forex Signal: High UK CPI Makes Consolidation Less Bearish

AUD/USD Forex Signal: Risk-On Flow

Risk Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more