Weak Bounce For Nasdaq; S&P Breakout

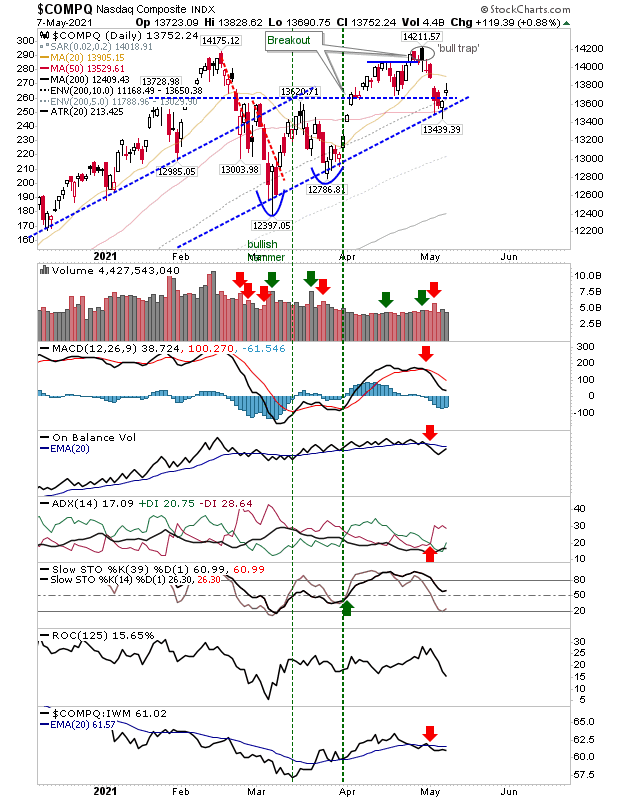

I wanted to see more from the Nasdaq support test but Friday's doji came in with a neutral 'spinning top' -not the ideal candlestick you want to see off a successful support test. Technicals are mostly negative with a relative underperformance to the Russell 2000.

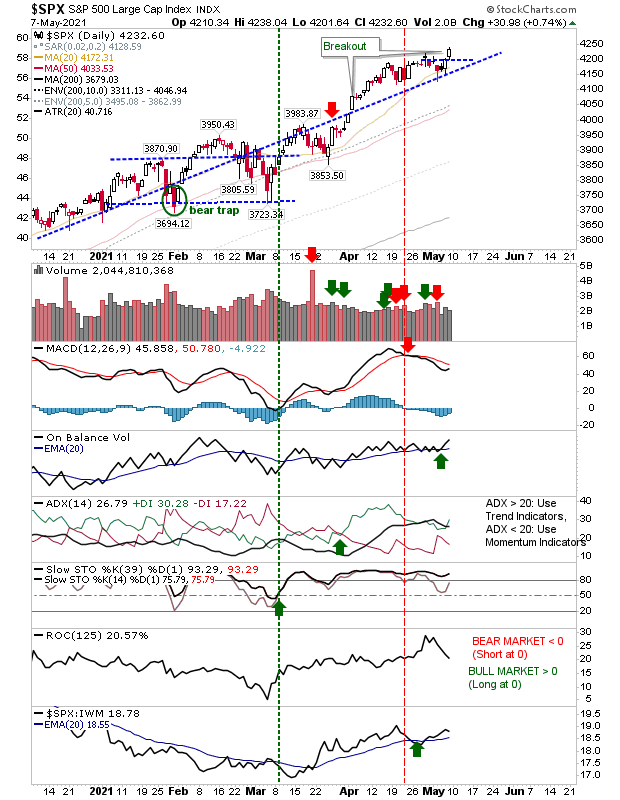

The S&P managed to break to a new closing high; helped by bullish technicals - except for the MACD. However, the relative gain against the Russell 2000 will keep this index in the news, even if it's more important to have leadership in the Russell 2000.

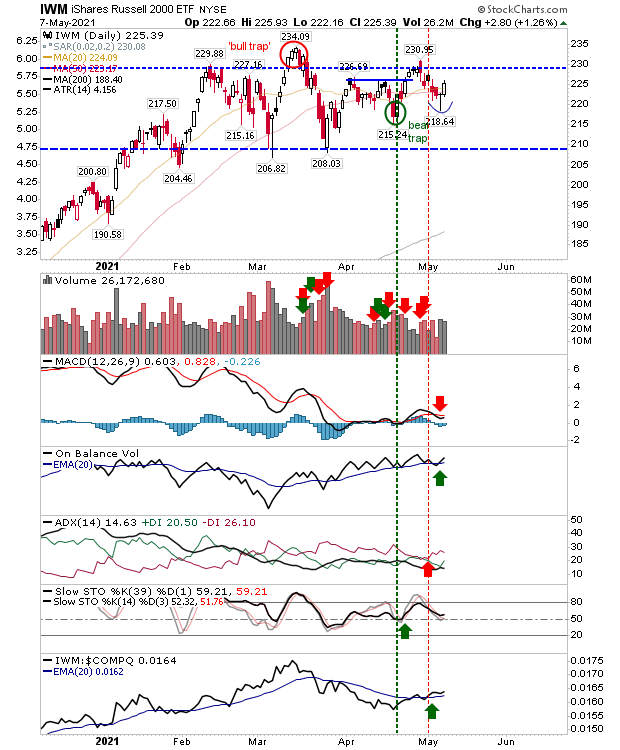

The Russell 2000 built on Thursday's dragonfly' doji with an upside gain. There was some good volume but given this whole scenario played out within a larger consolidation it come across as mostly noise. While the index is underperforming the S&P is outperforming the Nasdaq.

One thing to watch is the 20-week average, which the Russell 2000 has been tracking but is now finding itself squeezed against.

For tomorrow, and the rest of the week, we will want to see further advances for the breakout in the S&P, and for the Russell 2000 to join in with new highs.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more