Wednesday, April 15, 2020 10:34 AM EDT

Loading number of views...

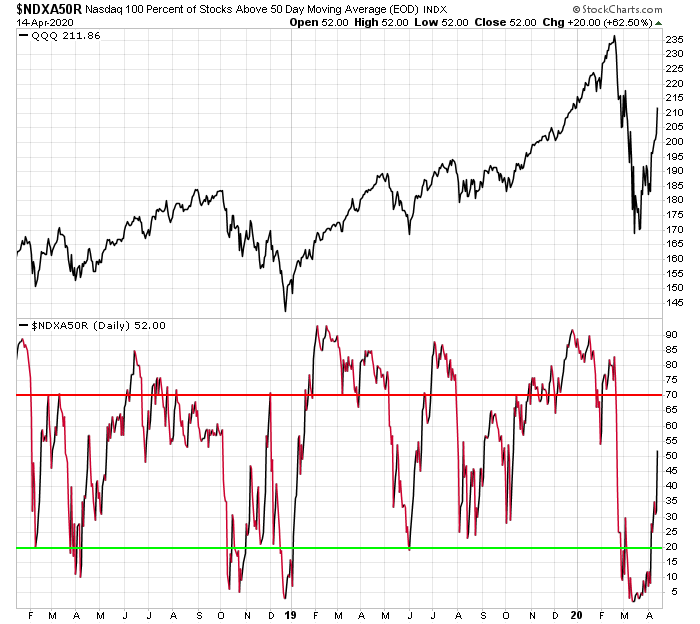

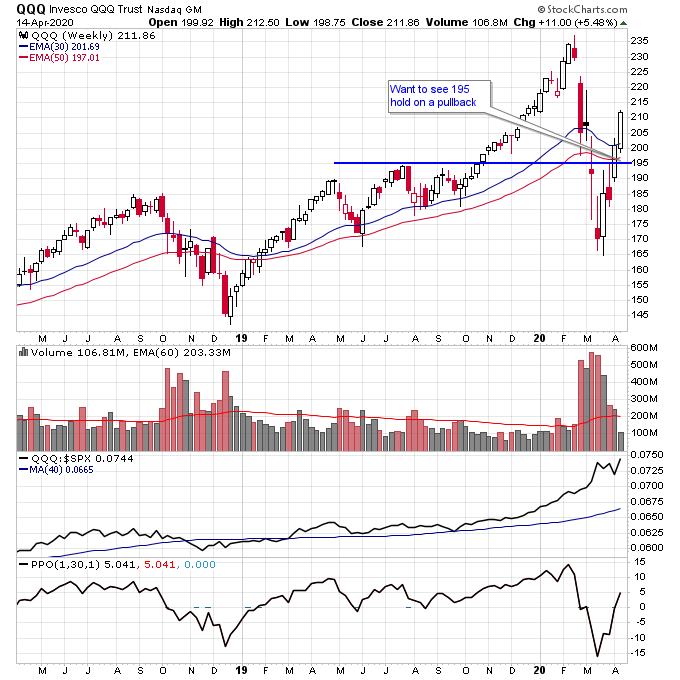

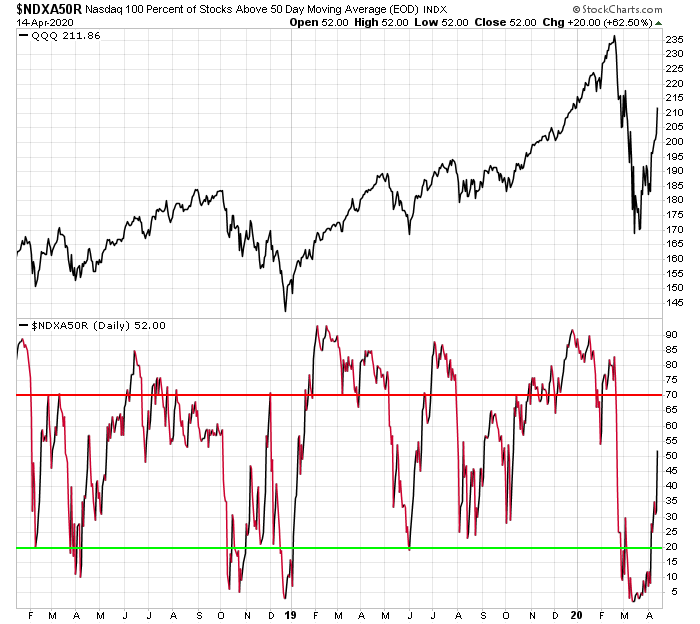

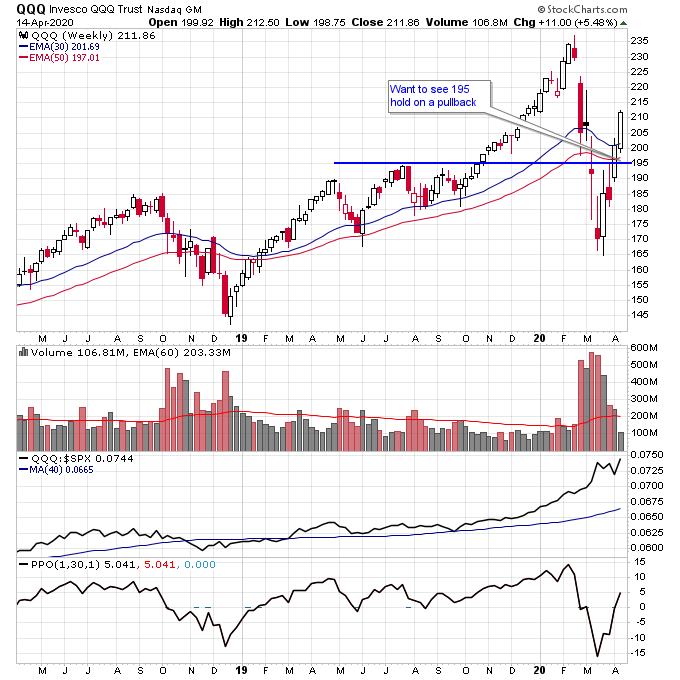

The Nasdaq 100 ETF QQQ has now broken back above the 30-week moving average after an impressive thrust off the bear market lows in mid-March. The percentage of stocks above the 50-day moving average has surged to over 50 percent in the Nasdaq 100 which is something I discussed back in March as the market worked off its oversold condition.

I will be watching this index closely for how it reacts to the next pullback. If it can hold above 195 which is a resistance zone from 2019 that is bullish for the stock market. Or even more bullish would be if it holds the 30-week moving average on a pullback. If it fails at 195 then the bear case would be in play and the rally off the March lows could possibly have been a bear market rally.

Along with QQQ I’ll be watching to see how SPY acts as it approaches the 30-week moving average. As I’ve discussed in previous videos the best place to enter short positions is above the 30-week moving average in a bear market, but it’s also important to be open-minded and flexible in case the bear market is over and the market merely consolidates on the next pullback.

Disclaimer: The views and opinions expressed are for educational and informational purposes only, and should not be considered as investment advice. The author of this website is not a licensed ...

more

Disclaimer: The views and opinions expressed are for educational and informational purposes only, and should not be considered as investment advice. The author of this website is not a licensed stockbroker or financial advisor. Nothing contained herein should be construed as a recommendation to buy, hold or sell any securities or financial products.Always seek the advice of a financial advisor and do your own independent research prior to making any trade or investment decisions.

We do not guarantee the accuracy or completeness of any information on this website. Such information is provided “as is” without warranty or condition of any kind, either express or implied. Past performance may not be indicative of future results. Information could include inaccuracies or typographical errors.

We are not liable or responsible for any damages incurred whatsoever from actions taken from information provided above, including financial losses. Since all readers who access any information on this website are doing so voluntarily, and of their own accord, any outcome of such access is understood to be their sole responsibility. In no event shall we be liable to any person for any decision made or action taken in reliance upon the information provided herein.

less

How did you like this article? Let us know so we can better customize your reading experience.