Watch Out For This Silver Lining - A Failure Will Result In A Stock Market Crash

After a deeply oversold condition in S&P 500, there is a silver lining scenario for the looming stock market crash according to these 4 key criteria. A Failure scenario for stock market capitulation is covered in the video, as well. Pay attention to how to spot the tell-tale signs in anticipation of a rally and at what levels would that likely to fail.

Video Length: 00:19:05

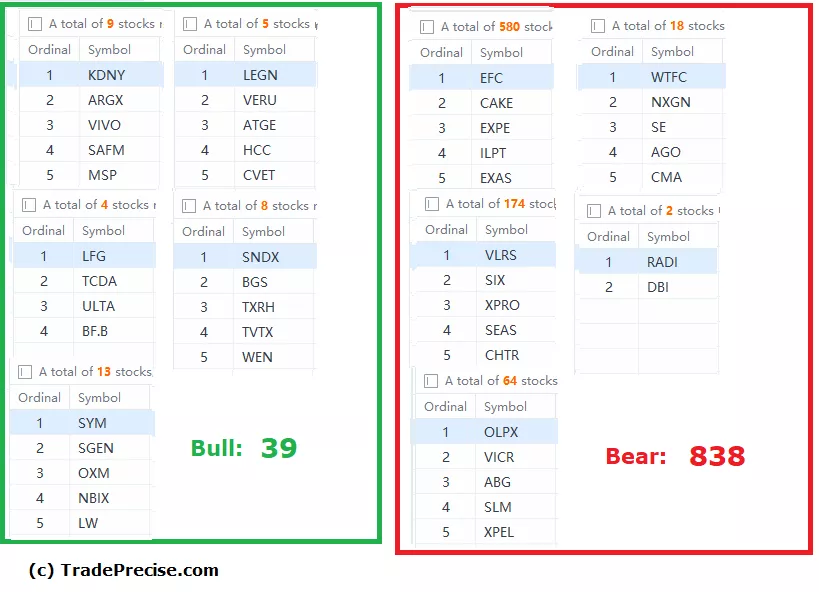

The bullish setup vs. bearish setup is 39 vs 838 from the screenshot of my stock screener below. The spike up of the bearish setup in conjunction with limited bullish setup suggest extreme bearish sentiment in the market, which could be adopted as a contrarian view upon confirmation by the price action.

It is essential to pay attention if the potential rally shows up and the subsequent characteristics of the rally, as the failure scenario as explained in the video could be fatal.

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.