Was There Really Excess Oil Production?

If this comes to fruition then we may be looking at significantly higher prices ahead…

“Davidson” submits:

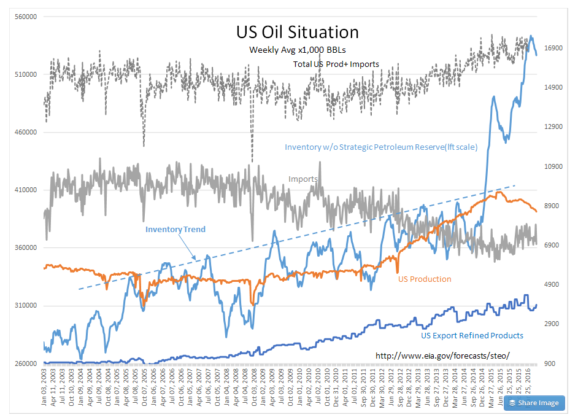

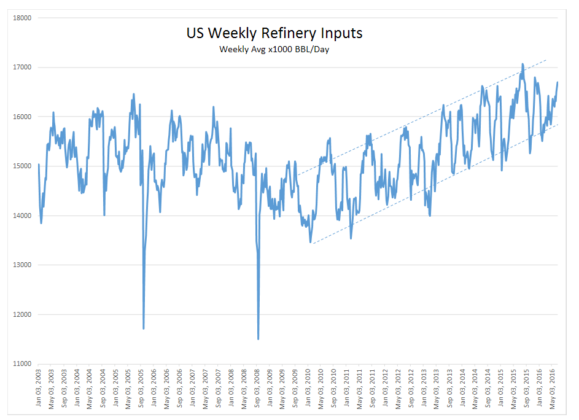

Two charts tell the story of the past several years. US oil (OIL) (USO) production has fallen to 8.622mil BBL/Day(roughly 1mm BBL/Day lower than June 2015 peak of 9.61mil BBL/Day)with falling prices. Yet, US imported to build inventories by raising imports. A driver of inventories appears to be the need to supply refinery inputs which saw substantial upgrades, some of which are coming on line in 2016.

I believe many read rising inventories as due to overproduction when this was a planned preparation for expanded refinery output.

Now that oil prices are rising, few are talking about inventories which remain at record levels. Refinery Inputs looks like they are about mid-trend this past week at 16.7mil BBL/Day. Seeing this rise over 17mil BBL/Day appears likely the next 6mos.

My observation is that the market fears of the past 2yrs were connected to oil price changes due to changes in the US$ currency relationships. The US oil situation appears not to have deviated from the trends the past 10yrs but for US oil production which declined as prices fell.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other ...

moreComments

No Thumbs up yet!

No Thumbs up yet!