Waiting For The Inflation Canary To Sing… Or Not

The Federal Reserve reports that it expects faster economic growth and higher inflation – two factors that historically have triggered tighter monetary policy. But the Fed is playing a different game this time and announced on Wednesday that it will keep interest rates near zero. Depending on your macro outlook, this is either hopelessly naïve or a clear-eyed view of looking through what some anticipate will be reflationary noise for the next several months.

In time, perhaps as early as the second half of the year, the inflation numbers will determine if Fed Chair Powell and company are prescient or reckless. Here’s a short list for monitoring the incoming data.

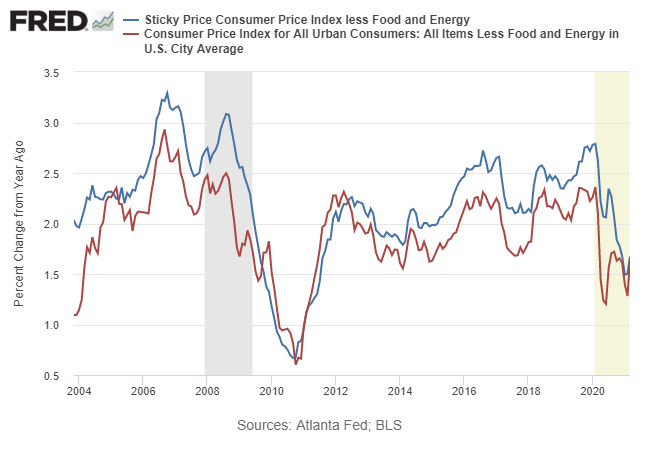

Core Inflation

The first order of business is keeping an eye on core inflation measures. Consumer price data is among the earliest hard-data series published each month and so this is an obvious place to focus. Why core? Because it offers a more reliable measure of the trend. The short-term headline inflation metrics can and do deviate sharply, up and down, from core readings, but history strongly suggests that focusing on core numbers helps minimize noise and boost signal. On that front, two data sets deserve close attention: annual changes to the core Consumer Price Index and the Sticky Price Consumer Price Index less Food and Energy – two efforts to capture a robust measure of the inflationary trend. In both cases at the moment, this pair continues to reflect modest inflation pressure that’s running below an annual 2% pace through March — well below the Fed’s 2% target. Inflation is expected to pick up in the months ahead, but the question is whether we’ll see more than a temporary bounce due to base effects brewing? If these core readings move close to 3% and stay there (or run higher), the case will significantly strengthen for worrying that the Fed has let the inflation cat out of the bag.

Treasury Market Expectations

A key question for monitoring inflation risk: Is the Treasury market pricing in temporary reflation or a sustained, substantial increase in inflation? So far, the case for reflation is persuasive on this front. Although the market’s implied inflation forecast (based on nominal less inflation-indexed yields) has rebounded sharply since last year, to date the revival has more or less returned expectations to pre-pandemic levels – roughly the 2.5% range and seems to be holding in this range. If expectations shoot substantially higher – above 3% — that would be a sign that the market is concerned that inflation is becoming a significant risk factor. Meantime, the jury’s out. Note, too, that the 10-year forecast is below the 5-year estimate, which implies that the market is projecting that inflation will moderate after a period of running hotter. If the 10-year forecast runs above the 5-year estimate, that would signal expectations are pricing in a more sustained run of higher inflation.

Commodities Prices

The commodities markets are also sensitive to inflation expectations and at the moment this signal is reflecting a reflationary run. But the comparison with last year’s temporary bout of deflation makes recent comparisons misleading. The S&P GSCI Commodity Index is up sharply from year-ago levels, but to date the gain is more about bouncing off of pandemic lows. If commodities continue to rise, however, this would be one more clue for thinking that inflation’s rise is more than temporary. With that in mind, S&P GSCI Commodity Index approaching the 3000 level (vs. 2425 currently) would signal that the commodities market is expecting higher inflation will be persistent.

Wages

A key input for inflation is higher wages. One measure in this corner has recently shot higher, providing inflationistas with support for arguing that regime shift is brewing. But wage inflation has cooled recently, based on the annual pace for average hourly earnings for private-sector employees. The current 4.2% year-over-year gain is relatively high compared with previous years (before the latest surge). But after the latest spike, wage inflation appears to be reversing. The path in the months ahead for this indicator will be a key factor in shaping the outlook for inflation in the second half of the year and into 2022.

Disclosures: None.