Wading Through The Market During Earnings Season

While Friday’s relief rally proved a welcome sight for many investors/traders, it may also bring about future selling pressure. With a VIX still above 20, signaling 1.2% daily SPX moves, the market is anything but calm and ripe for continued, large daily moves. A more common saying amongst the trading crowd is that “there is no predictability in the midst of greater volatility.” Right now, with the VIX above 20, investors/traders need to be prepared for anything and assess risk daily.

"I don't see evidence of what you'd like to see in a bottom," said Willie Delwiche, investment strategist at Baird. “Markets tend to bottom after more signs of capitulation and widespread panic, which we haven't seen thus far.”

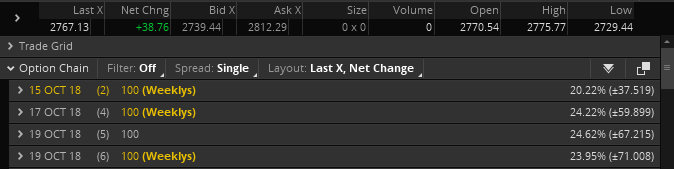

At present, this is what we identify as a trader’s market given the time of year and recent market moves. If you think last week’s $48 weekly expected move for the S&P 500 was large, this week’s is that much more grand.

As I've stated in many weekly research reports and articles, the market has remained incredibly efficient since the springtime. We’ve only managed to breach the weekly expected move on the S&P 500 three times in the last 25 weeks, until this past week of course where we breached it in a big way.

In the screenshot above of the S&P 500 options chain, we discover that this coming week’s expected move is an even bigger one than last week at $71. This is what you get with a VIX above 20 and a market that has breached the prior week’s expected move in a rather major way. Risks are abundant, high and in need of being assessed by traders and investors alike. Overexposure to the market is not your friend at the moment and likely not until the current market move is completed. Actively trading smaller positions in such an environment can prove to off-set portfolio drawdowns in the interim and assuming the volatility continues in the near term.

For those of you who have been reading my weekly articles on TalkMarkets, you already know why the market has expressed a pullback from its upward trajectory and all-time highs. Fears of interest rates rising, the Federal Open Market Committee raising rates too quickly and the fears of a Fed-induced economic slowdown have all been blamed for the pullback in equities. Beneath these headlines are details and those details include richly valued tech stocks whereby their large debt obligations come into question during a rising rate environment and an ongoing trade war that curtails profit margins on certain goods and industries. The sad thing about the aforementioned headlines and details is that… well, they are all self-inflicted. We’re literally doing this to ourselves. It’s our Fed that is tightening, which also has an adverse affect on the USD. It’s our White House Administration that is instituting trade spats and implementing tariffs. Having said that, an optimistic way of looking at the current challenges from these issues is that what has been self-inflicted can be self-remedied. We’ll have to wait and see how this all plays out.

Q3 2018 Earning Season

Thus far, 28 S&P 500 companies have reported Q3 2018 results. Of the 28 companies in the S&P 500 that have reported earnings to date, 85.7% have reported earnings above analyst expectations. This is above the long-term average of 64% and above the average over the past four quarters of 77 percent. In short, we are off to a strong reporting season and with some of the big banks having already reported this past Friday. We’re paying even greater attention to what the big banks have to say in their quarterly reports as fears of higher interest rates may impact loan growth. So let’s look at one of the banks that have already reported before moving on to previewing some of the economic data reports for the coming week.

J.P. Morgan Chase (JPM) reported that higher interest rates helped boost results, with revenue rising 5% from a year ago to $27.82 billion, above the FactSet consensus of $27.44 billion, and with net interest income climbing 7% to $14.1 billion to top expectations of $14.0 billion. Higher rates hurt the bank's home lending business, however, which was the only segment that saw revenue decline, as part of the bank's consumer and community banking unit that saw revenue rise 10% to $13.3 billion. Home lending revenue fell 16% to $1.3 billion, weighed down by lower net servicing revenue, and by loan spread and production margin compression. Among other positives, credit card sales volume was up 12% and merchant processing volume grew 14 percent. Further, Commercial Banking average core balances jumped 4% and Asset Management average loan balances rose 12 percent.

While the overall report from JPM was solid, the share price didn’t respond as well as its peers on Friday. JPMorgan Chase & Co. Chief Financial Officer Marianne Lake attempted to explain the disconnect between bank earnings and their stock price movement on the company’s earnings call, noting the “macro uncertainty noise” and overhang that has battered the markets in the last few days.

“JPMorgan is expecting the global economy to start to converge with the U.S. going forward, she said. Meanwhile, the U.S. is lining up for a December rate hike and more hikes in 2019, which means the continuation of a steeper yield curve—”and that should all be constructive for bank stocks,” she said.”

What we found reassuring, as it pertains to the economy is that total loan growth is indeed growing for JPM. Additionally, credit quality improved for the firm. Provision for credit losses was $948 million, down 35% year over year. As of September 30, 2018, non-performing assets were $5.0 billion, down 18% from September 30, 2017. Now let’s take a look at what Wells Fargo offered in its quarterly performance.

What we’re seeing so far from the big banks is that loan growth is still healthy, even if home mortgages are proving a mixed bag, with interest rates on the rise. We’ll have to see what Bank of America (BAC) has to offer come Monday before the opening of trading on Wall Street to draw any further conclusions about the lending market. For now and given the pessimism that has built up surrounding interest rates and the impact on the economy the existing results and commentary from JPM and WFC are not as pessimistic as the market action last week. With that said, the following graphic identifies some of the key corporate earnings reports due out this week.

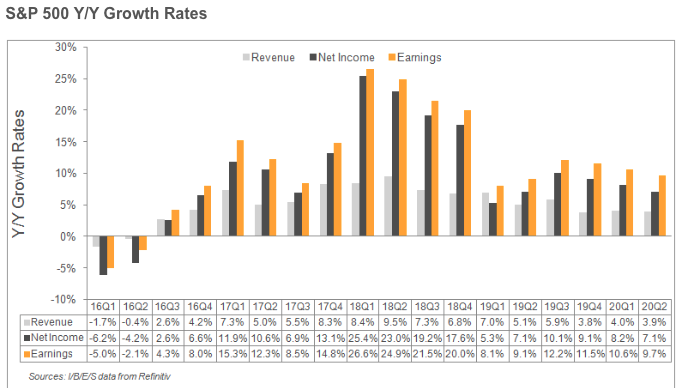

With 28 S&P 500 companies having reported and the vast majority having beaten earnings estimates, let’s now look at what FactSet and Thomson Reuters are expecting from the Q3 reporting season.

- FactSet has lowered their forecast from 19.3% Q3 earnings growth to 19.1 percent. If 19.1% is the actual growth rate for the quarter, it will mark the third highest earnings growth since Q1 2011 (19.5%).

- The blended, year-over-year sales growth rate for the third quarter is 7.3%

- The forward 12-month P/E ratio for the S&P 500 is 15.7. This P/E ratio is below the 5-year average (16.3), but above the 10-year average (14.5).

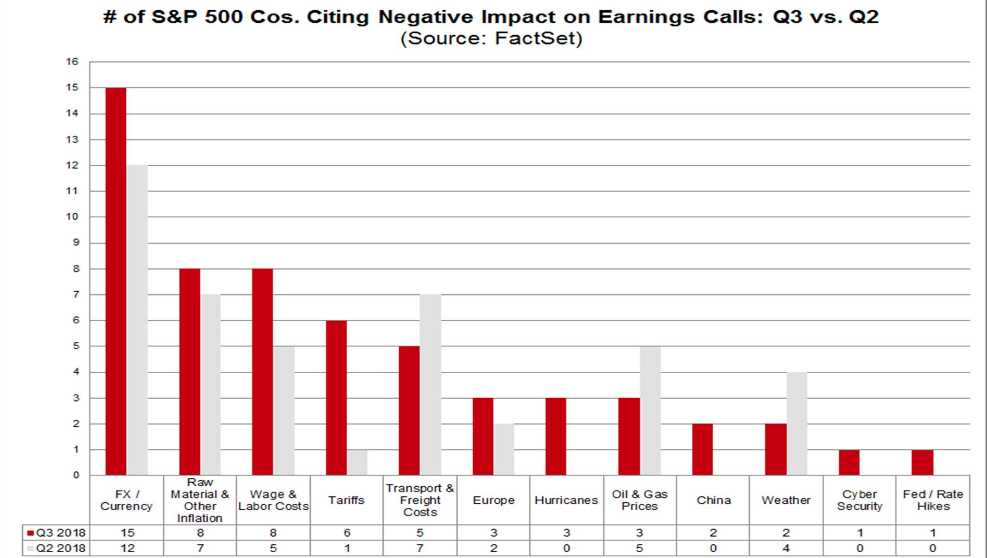

FactSet performed a rather relevant study on the companies that have already reported. FactSet searched for specific terms related to a number of factors (i.e. “currency,” “China,” etc.) in the conference call transcripts of the 24 S&P 500 companies that had conducted third-quarter earnings conference calls through October 11 to see how many companies discussed these factors. FactSet then looked to see if the company cited a negative impact, expressed a negative sentiment (i.e. “volatility,” “uncertainty,” “pressure,” “headwind,” etc.), or discussed clear underperformance in relation to the factor for either the quarter just reported or in guidance for future quarters. FactSet also compared the number of companies citing these factors in the third quarter to the number of companies that cited these same factors in the second quarter through approximately the same point in time (through July 12). The results are shown in the below bar chart:

What we can see from the chart is that rate hikes had only been mentioned once. The biggest threat or purveyor of negative sentiment amongst the companies that have reported has been FX/currency.

“Specifically, we expect revenue growth in the high-single digits, albeit at the lower end of that range as operational upside will likely be somewhat offset by FX headwinds.” -NIKE (Sep. 25)”

In addition to forecasting 19.1% earnings growth, FactSet is forecasting blended net profit margin for the S&P 500 for Q3 2018 of 11.6 percent. If 11.6% is the actual net profit margin for the quarter, it will mark a tie with the first quarter (Q1 2018) for the second highest net profit margin for the S&P 500 since FactSet began tracking this data in Q3 2008. It appears the lower tax rate is more than offsetting the impact of rising costs. As we’re reading these growth forecasts from FactSet, don’t overlook that forward 12-month PE mentioned earlier. One more time, the forward 12-month PE is now only 15.7% and below the 5-year average.

Thomson Reuters has maintained their Q3 earnings forecast week-2-week.

- Third quarter earnings are expected to increase 21.5% from Q3 2017. Excluding the energy sector, the earnings growth estimate declines to 18.5%.

- Third quarter revenue is expected to increase 7.3% from Q3 2017. Excluding the energy sector, the revenue growth estimate declines to 6.3%.

- 4% of companies have reported Q3 2018 revenue above analyst expectations. This is above the long-term average of 60% and below the average over the past four quarters of 73%.

- The estimated earnings growth rate for the S&P 500 for 18Q4 is 20.0%.

The Consumer & Small Business Sentiment

The U.S. economy is consumer driven or consumer-centric. As the consumer goes, the economy goes. Nearly 2/3rds of GDP is consumer related. With this in mind and the data already at hand, let’s take a look at the most recent consumer sentiment readings.

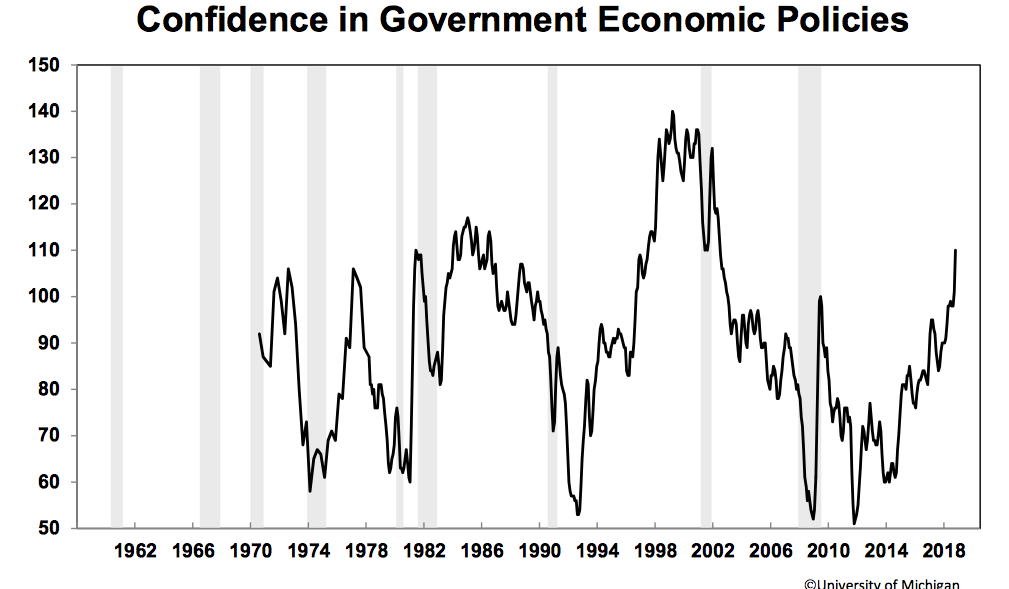

Forecasts for the University of Michigan Consumer Sentiment predicted the preliminary October release to increase to 100.5 from last month’s 100.1. The latest release, however, missed forecasts, falling to 99.0. While this is below previous levels, it is important to note that it is not a large drop in sentiment and the overall reading is still quite high relative to recent years. Moreover, the 99-level is still above the average so far in 2018 of 98.5.

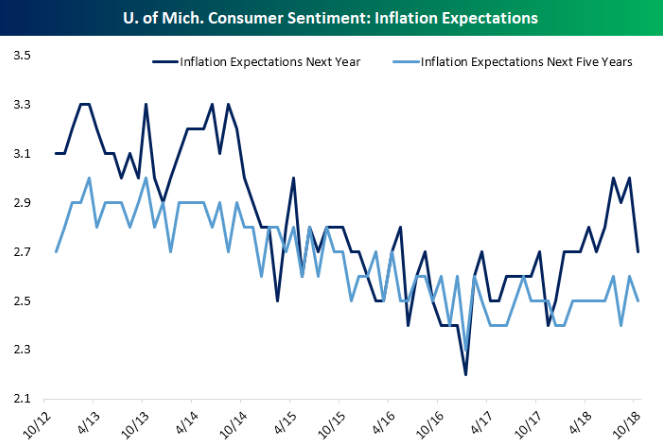

The release cited part of the reason for declining sentiment was rising inflation expectations for the next year. The chart below from Bespoke Investment Group shows the inflation expectations for consumers that are interviewed in this survey.

The combination of inflation awareness and improved credit quality at financial institutions somewhat signals an improved consumer and household debt performance. Households are managing their debt/income ratio much more favorably than leading up to the Great Financial Crisis. The uniqueness of the current economic expansion is that consumers are much more financially savvy and much more aware of the inflationary impact. While consumers are noticeably forecasting more inflation come 2019, they are also noticeably positive on the economy as a whole.

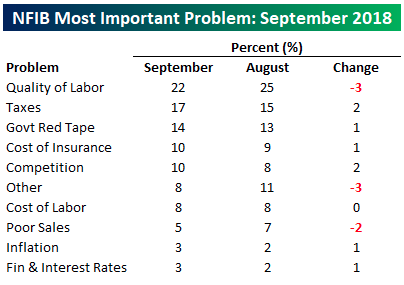

For all the talk about an economic slowdown and inflation last week, not much if any of the data supported the rhetoric. Producer Price and Consumer Price Index readings were both benign with respect to inflation and with CPI undershooting expectations. Small business sentiment, as measured by the NFIB was still extremely optimistic. Small business sentiment for the month of September saw a modest decline (108.8 down to 107.9) and came in below consensus forecasts 108.3, but the overall level is still extremely optimistic. The table below summarizes the issues that small businesses currently cite as their biggest problems. Topping the list once again this month is Quality of Labor. But look at where Inflation is positioned…

Investor Takeaways

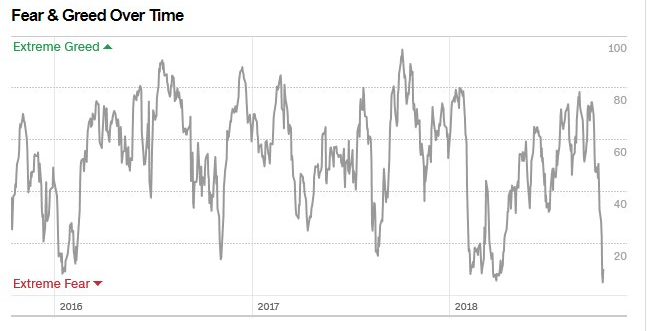

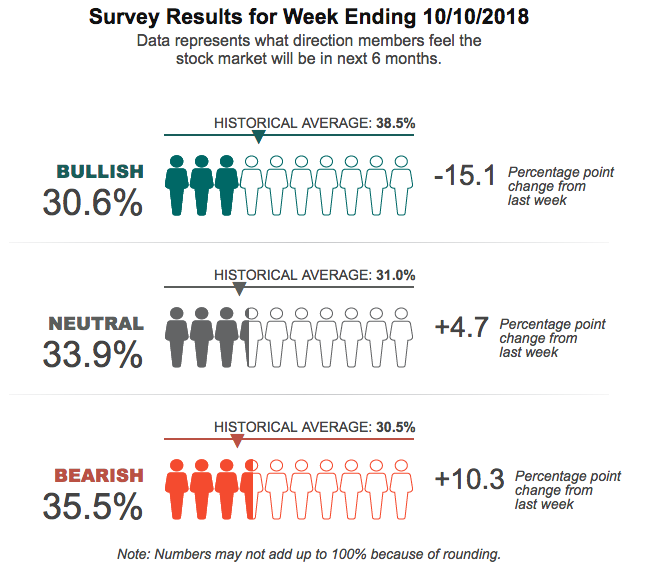

We’re not off to a good start in the 4th Quarter and the reporting of Q3 2018 earnings thus far. Investor sentiment has fallen dramatically in just the first couple of weeks of October as measured by the CNN Fear & Greed Index and the AAII Survey. (Shown below in their named order)

Bearishness has taken a hold of investor sentiment and fear has gripped traders. Nonetheless, discipline is key and as such investors should take this time to assess their portfolio holdings for risk and actively manage their positions, including cash, in the week to come.

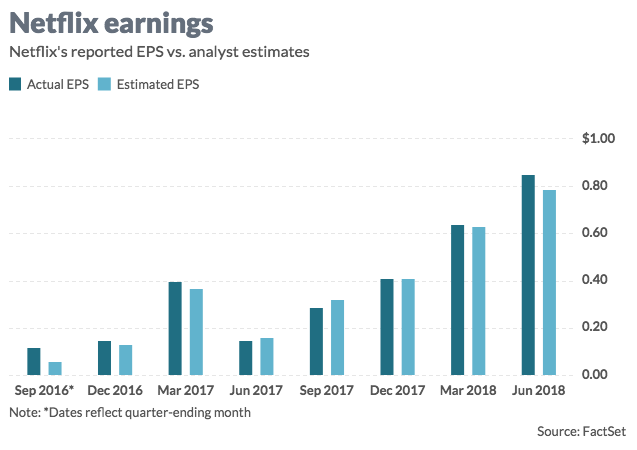

The week ahead is an important week as earnings season kicks into high gear with the financials continuing to lead the reporting season and a big tech (FANG) name in Netflix (NFLX) also gearing up to report quarterly results. All eyes will be on subscriber growth as investors decide whether the streaming giant’s miss in Q2 was really just a blip/forecasting error or an indication of a more prolonged slowdown.

Pretty rosy scenario. Market up today, big. Trump really holds the key. He is fooling Wall Street by saying he might raise tariffs on China. Probably until after the election. He wants to raise tariffs on China, and currency wars will result. Earnings are great for these companies, meanwhile 20 percent vacancy in NYC stores. All the money goes to the mortgage and rent. If New Yorkers are struggling what about the rest of the USA? It is a mixed bag, and not as stable as it seems on the surface. New York faces a high rent blight: http://www.vacantnewyork.com/

It's a good thing government data doesn't just focus on NYC then now isn't it.

True, but it is becoming a national concern. rew-online.com/ripple-effect-big-box-blight/

It's a good thing housing is barely 1/4 of of U.S. output.

The introduction lists the fears that are causing the actions that are causing the pull-back. The basis and motivation for fear is not being able to deal with the situation at hand. And the reason for being unable to deal with the situation is having made too many choices based on greed instead of wisdom and insight. Think carefully and you will see that I am correct.

ok