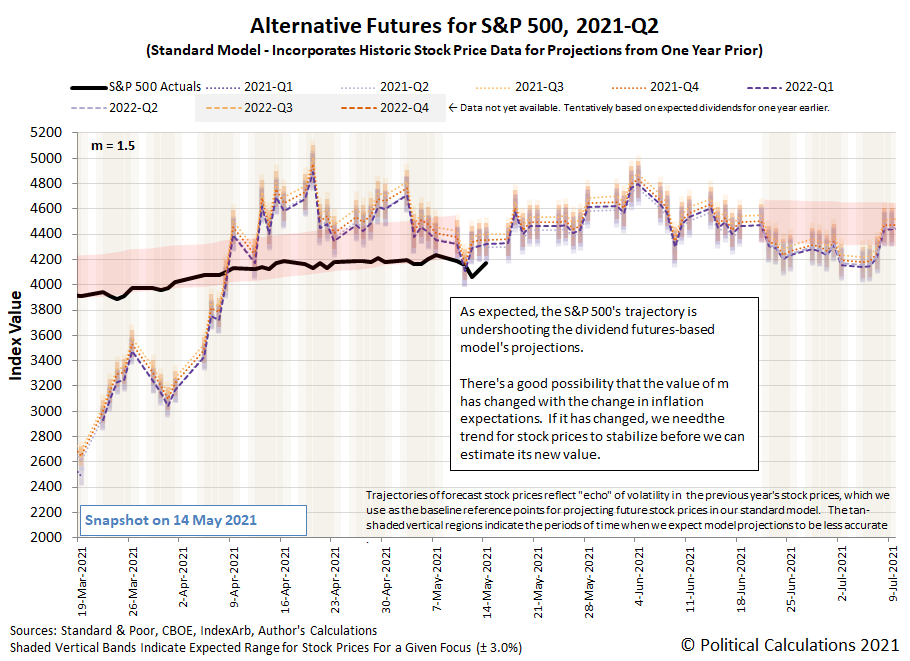

Volatility Increases For S&P 500 As Inflation Expectations Go Into Flux

The S&P 500 (Index: SPX) may be entering a new regime for inflation expectations.

In the dividend futures-based model we use to project the future for the index, we see those kinds of changes play out through a changing value for the model's amplification factor, m. Our estimate of its value was last reset on 22 September 2020, when we observed its value was approximately 1.5. Over the last month as expectations of future inflation have increased, we suspect it has increased in value as well, which shows up in the alternative futures chart with the trajectory of the S&P 500 running first to the low side, and now below, its forecast range.

(Click on image to enlarge)

That's not unexpected, since we anticipated the actual trajectory of the S&P 500 would undershoot the model's projections. Before we can estimate its new value to adjust the model's projections, however, we'll need the market's recent volatility to stabilize. Until then, we'll be in a wait-and-watch mode.

Disclaimer: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

moreComments

No Thumbs up yet!

No Thumbs up yet!