Visualizing S&P 500 Returns After Interest Rate Cuts

(Click on image to enlarge)

Today, weaker-than-expected economic data and easing inflation has strengthened the case for U.S. interest rate cuts for the first time since 2020.

Although S&P 500 firms were largely protected from rising rates due to locking in lower rates in 2020 and 2021, many loans are up for renewal in 2025. While S&P 500 returns have typically been positive after rate-cutting cycles, these dynamics may present a unique scenario for corporate America. Sectors that benefited from securing low rates, such as manufacturing, may be most exposed to refinancing risks.

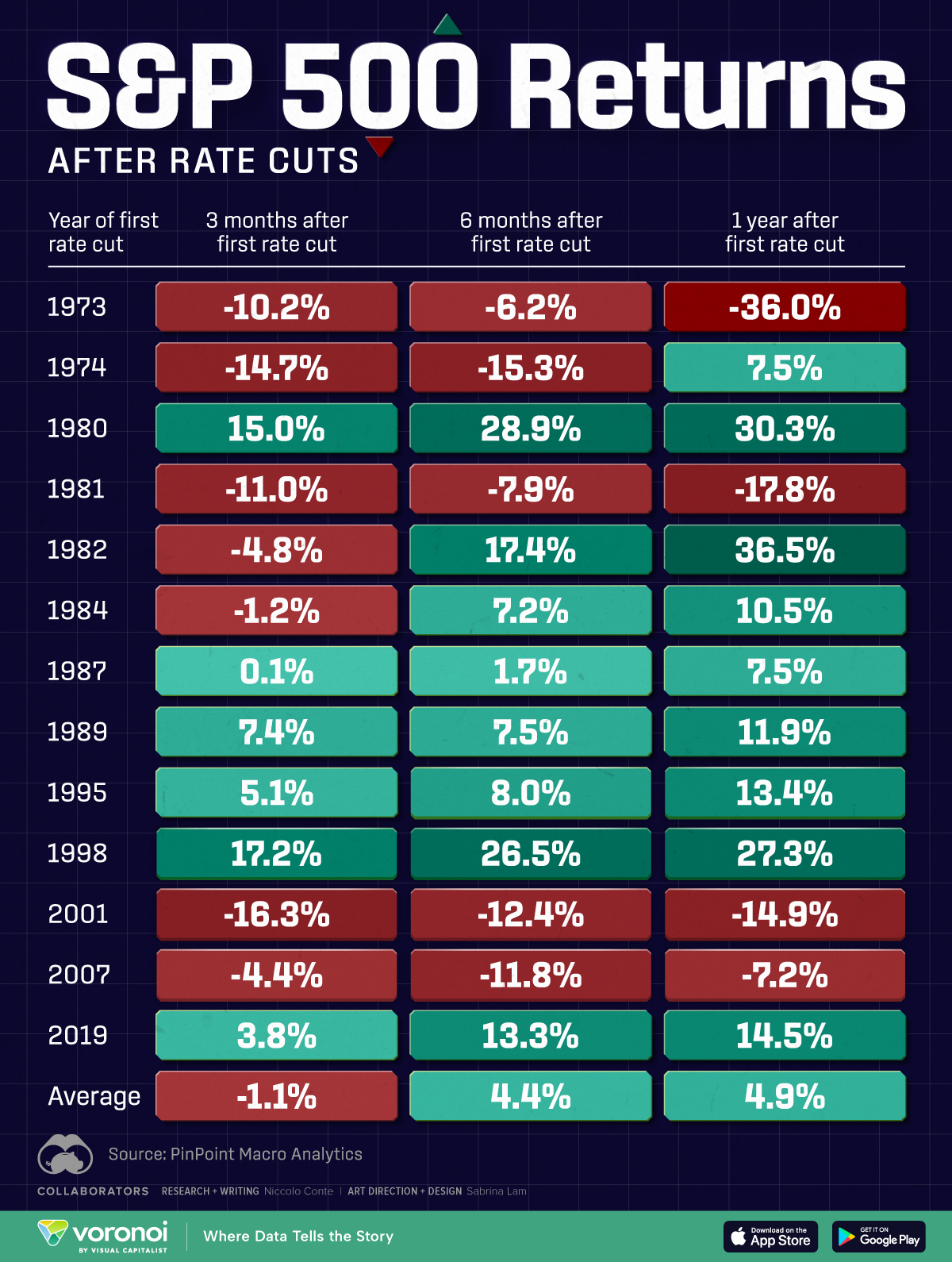

This graphic shows S&P 500 performance after interest rate cuts since 1973, based on data from PinPoint Macro Analytics.

How Does the Stock Market React to Interest Rate Cuts?

Below, we show how the S&P 500 has performed after the first rate cut over the last five decades:

Below, we show how the S&P 500 has performed after the first rate cut over the last five decades:

| Year of first rate cut | Three months after first rate cut | Six months after first rate cut | One year after first rate cut |

|---|---|---|---|

| 1973 | -10.2% | -6.2% | -36.0% |

| 1974 | -14.7% | -15.3% | +7.5% |

| 1980 | +15.0% | +28.9% | +30.3% |

| 1981 | -11.0% | -7.9% | -17.8% |

| 1982 | -4.8% | +17.4% | +36.5% |

| 1984 | -1.2% | +7.2% | +10.5% |

| 1987 | +0.1% | +1.7% | +7.5% |

| 1989 | +7.4% | +7.5% | +11.9% |

| 1995 | +5.1% | +8.0% | +13.4% |

| 1998 | +17.2% | +26.5% | +27.3% |

| 2001 | -16.3% | -12.4% | -14.9% |

| 2007 | -4.4% | -11.8% | -7.2% |

| 2019 | +3.8% | +13.3% | +14.5% |

| Average | -1.1% | +4.4% | +4.9% |

Historically, the S&P 500 returns 4.9% on average one year after the first interest rate cut, seeing positive returns nearly 70% of the time.

In the three months following a rate cut, the market often dips, but typically rebounds by the six-month mark. This aligns with conventional wisdom that lower interest rates stimulate economic activity by reducing borrowing costs for businesses and consumers, which tends to benefit the stock market.

However, S&P 500 performance following rate cut cycles can vary significantly. For instance, U.S. equities saw double-digit declines after the first rate cuts in 1973, 1981, and 2001. On the other hand, the S&P 500 surged 36.5% one year after the 1982 rate cut cycle. In the most recent rate cut cycle, the S&P 500 jumped by 14.5% in the following year.

In this way, interest rate cuts don’t show the whole picture. Instead, positive earnings growth may offer a more reliable indicator of S&P 500 performance in the following year. When earnings growth is positive, the market averages 14% returns one year after. In contrast, when earnings decline during periods of falling interest rates, the S&P 500 increased by 7%, on average.

More By This Author:

Here Are The 10 Worst US States To Retire In

Silver: The Unsung Hero Of The New Economy

Ranked: The 10 Worst Countries for Women

Disclosure: None