Very Ugly, Tailing 10Y Auction Sees Slide In Foreign Demand, Plunge In Bid To Cover

Image Source: Pixabay

After yesterday's dismal 3Y auction, markets were on edge ahead of today's $42 billion reopening of the 10Y benchmark auction. And they had a good reason to be: the just concluded 10Y auction was not pretty.

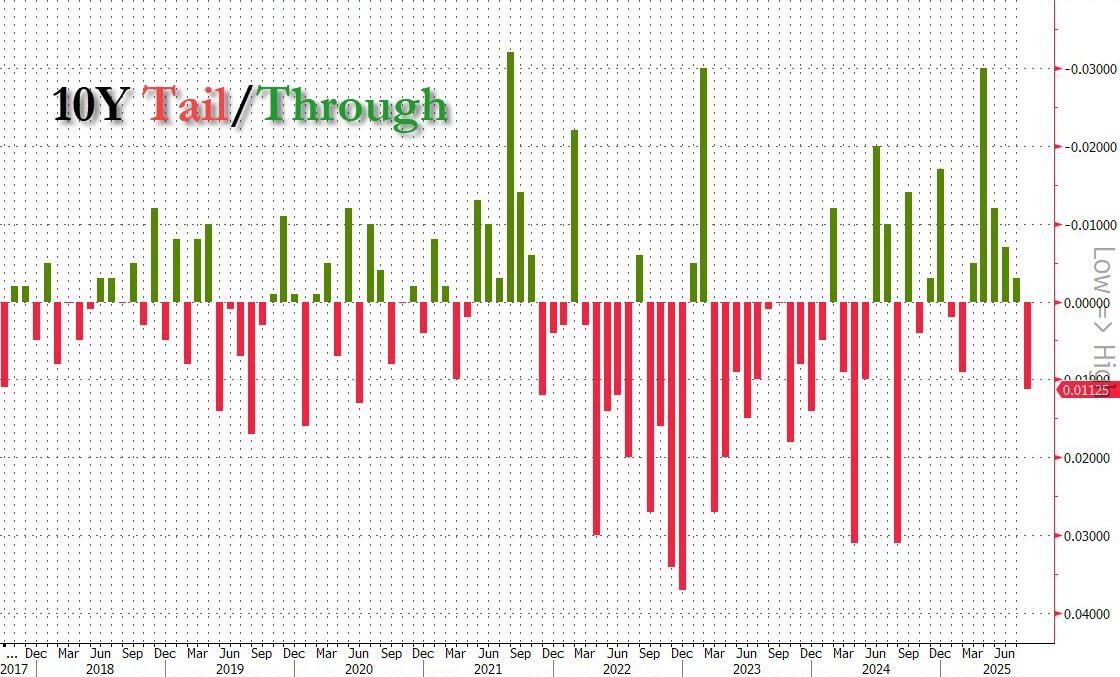

Starting at the top, the auction stopped at a high yield of 4.255%, down from 4.362% in July, and the lowest since December. So far so good, however, the yield also tailed the 4.2440% When Issued by 1.1bps, the first tail since February, and follows 6 stop throughs.

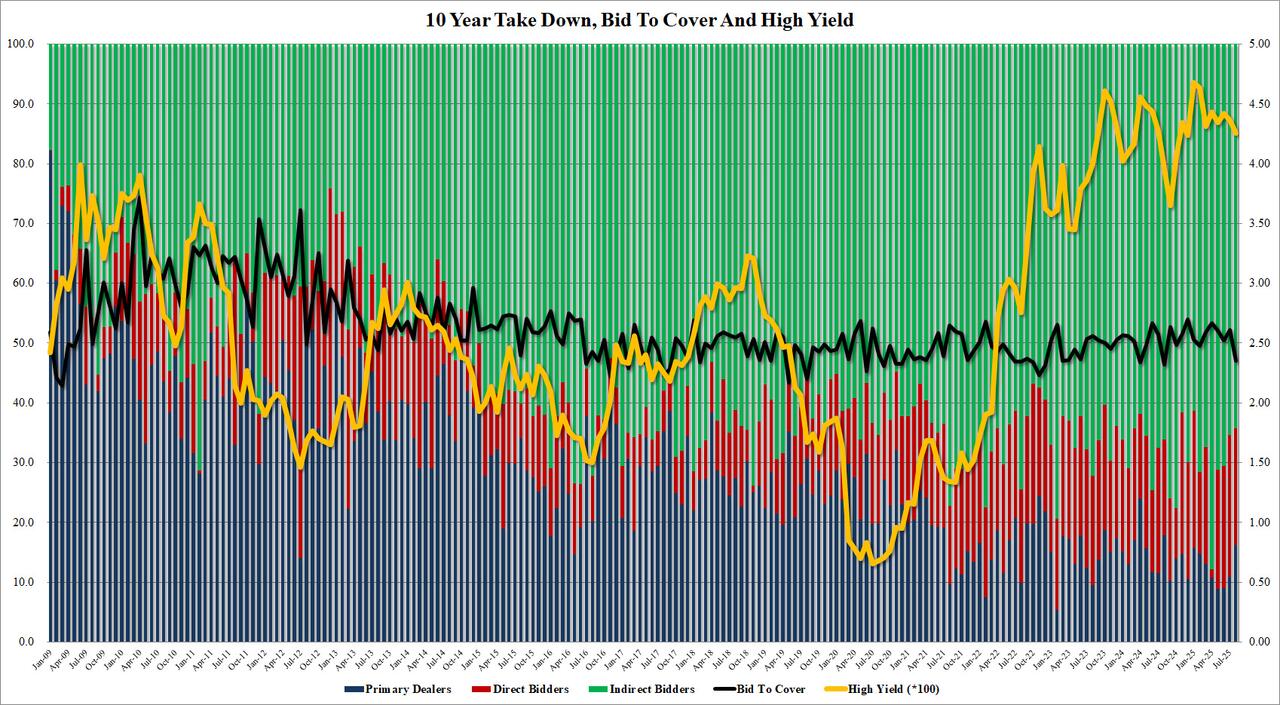

The bid to cover dropped bigly, from 2.611 to 2.351, the lowest since August 2024, and clearly well below the six-auction average of 2.58.

The internals were just as lousy, with Indirects sliding to 64.2, down from 65.4 and the lowest since Jan. And with Directs awarded 19.6%, or the lowest since April, Dealers were left holding 16.2%, the highest since August 2024.

Overall, this was a surprisingly ugly auction: with the first tail in 6 months, with very poor buyside demand, with a slide in foreign buyers, with the lowest bid-to-cover in one year, and with a surge in Dealers take down to offset the lack of demand elsewhere. And, as one would expect, yields are now rising to session highs.

More By This Author:

WTI Prices Hold Post-India Decline Despite Big Crude Draw, Production Drop

12-Year Cattle Cycle Bottoms: Tyson CEO Predicts Rebuild Phase Beginning Next Year

Swiss President Rushes To Washington In Last Ditch Attempt To Appease Trump And Lower 39% Tariff

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more