Verizon And AT&T: Big Dividends, New Risks And Yahoo

Verizon (VZ) and AT&T (T) are big dividend telecom stocks with a reputation for safety. Many investors own them specifically for the high dividend yields (4.4% and 5.2%, respectively) and the low betas (0.2 and 0.3, respectively). However, both companies are being forced to deal with the same fundamental challenge: declining wireline business and dwindling wireless growth. The companies are dealing with the challenge differently, but the result is the same: more long-term risk. We consider whether a Yahoo acquisition makes sense for either company, and also address two big questions for shareholders: 1) How will “more long-term risk” impact price appreciation for Verizon and AT&T, and 2) How will it impact the dividends.

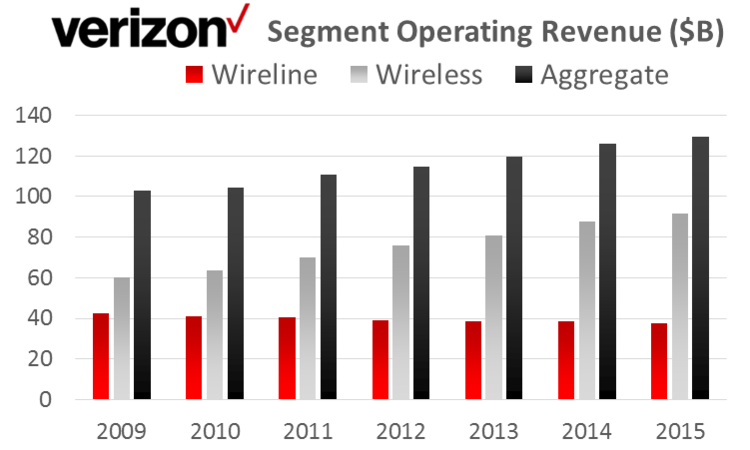

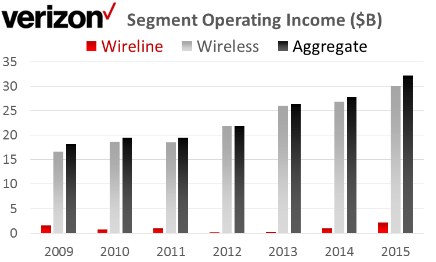

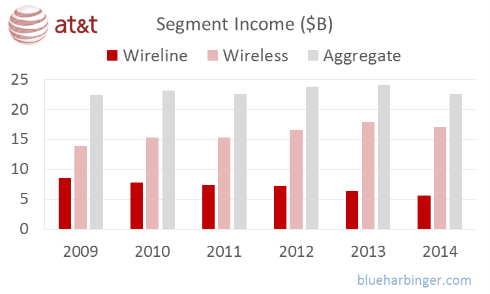

For starters, let’s look at the wireline results for both companies. As the charts below show, it is in decline for both Verizon and AT&T.

Note: AT&T’s segment income only goes through 2014 because in 2015 they changed their strategy (because it was struggling). Specifically, they acquired DirectTV for $48.5 billion, and they revised their operating segment breakdown into Business Solutions, Entertainment and Internet Services, Consumer Mobility, and International (more on AT&T’s new strategy later).

And regarding wireless business, the charts suggest that it is holding up. However, according to Verizon CEO, Lowell McAdam (Annual Report, p.3):

“New entrants are disrupting the wireless and broadband space. Competition is putting pressure on prices and margins... this suggests to investors that growth will be more challenging going forward.”

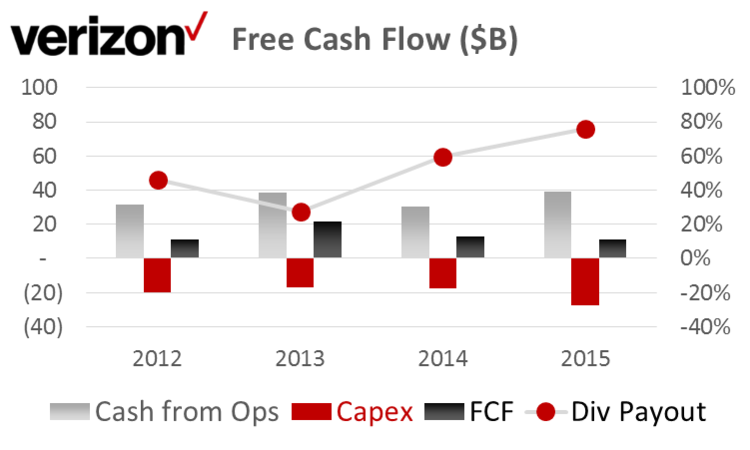

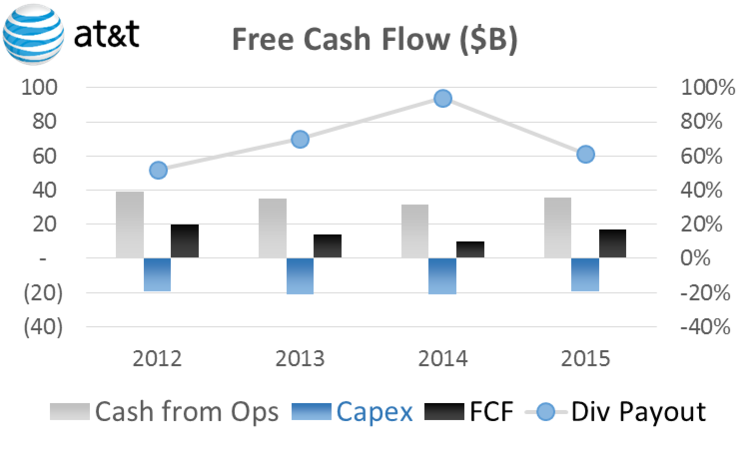

Next, let’s look at the free cash flows (FCF) for both companies. This is critically important for both companies because their long-term ability to pay dividends is dependent on their ability to generate sufficient free cash flow.

AT&T’s Evolving Strategy and New Risks:

As the free cash flow chart above shows, AT&T was paying out nearly 100% of their available free cash flow as dividends in 2014. And at the rate of increase in previous years, AT&T would have soon not been able to continue paying its big dividend if they didn’t do something drastic. And considering AT&T had already cut costs to the bone, their desperate action was to purchase DirectTV. And they did it NOT because it was a compelling long-term investment, but rather because it allowed them to structure the acquisition deal in a way that would increase the FCF available to AT&T shareholders and decrease the dividend payout ratio.

In our view, AT&T’s solution (buying DirectTV) was made just to keep the dividend safe for a few more years by kicking their problems down the road. DirectTV is not a long-term solution. You can read our more thorough analysis here. Also worth noting, DirectTV is not AT&T’s only attempt at inorganic growth; they also recently purchased two cell companies in Mexico (more on this later).

Verizon’s Slowing Telecom Business

As the FCF chart (above) shows, Verizon’s dividend payout ratio (as a percent of FCF) is increasing steadily. It hasn’t yet reached the dangerously high level that AT&T reached in 2014, but it will be there soon if Verizon doesn’t do something to address it. Particularly, Verizon’s wireline margins are razor thin, and competition and demographics will continue to pressure its wireless business further. And considering Verizon’s investor base owns the stock largely for the big dividend, strengthening FCF is of paramount importance for Verizon. Verizon’s 2015 acquisition of AOL (for $4.4 billion) was a small step towards addressing the future, and it is perhaps a foreshadowing of what is to come. Specifically, if Verizon can’t do something to organically address their growth and cash flow needs, they’ll likely look to grow inorganically via bigger acquisitions. And this is where Yahoo comes into consideration.

Where will Yahoo go to Die?

Yahoo’s (YHOO) board recently announced it is looking to sell its core business, and they are excluding CEO Marissa Mayer from the process (she’s been excluded mainly for “conflict of interest reasons,” i.e. she may be incentivized to try to keep her CEO job instead of selling the company). Considering Yahoo’s current market capitalization (~$30 billion) relative to Verizon’s ($207 billion), Yahoo may be a good acquisition target for Verizon, especially considering its increasingly challenging search for growth. What makes Yahoo even more attractive is that it doesn’t pay a dividend. This makes an acquisition attractive in much the same way DirectTV was attractive to AT&T. Specifically, a deal can be structured so Verizon gets Yahoo’s future free cash flows, and simultaneously decreases its payout ratio. Yahoo doesn’t currently pay a dividend because it uses its free cash flow to try to grow. If acquired by Verizon, Yahoo’s growth spending would be dramatically reduced, and instead used to support Verizon’s dividend.

Essentially, if Verizon acquires Yahoo, then Verizon is where Yahoo’s big growth dreams will go to die. The cultures of the two firms are dramatically different (Yahoo likes to spend liberally on growth, and Verizon is extremely cost conscious and cheap).

Another alternative for Yahoo is an acquisition by a private equity firm. For example, the Wall Street Journal reports that private equity firm TPG has expressed an interest in Yahoo over the last few months. A private equity acquisition would probably be a better deal for Yahoo shareholders because the private equity firm would likely have a more optimistic vision for Yahoo’s future whereby they’d cut costs and then try to resurrect growth. Verizon, on the other hand, would likely just cut Yahoo’s costs to the bone and turn it into a value company instead of focusing on a return to big growth.

What are Verizon and AT&T Worth?

Basic discounted free cash flow models suggest the market is expecting both Verizon and AT&T to shrink in the low single digits. Specifically, if we assume Verizon’s weighted average cost of capital (WACC) is 4.54% (source: GuruFocus), and then discount 2015 FCF of $11.2 billion by the WACC minus a negative 1% growth rate, we arrive at Verizon’s current market capitalization. Similarly, if we assume AT&T’s WACC is 3.52% (source: GuruFocus) , and then discount 2015 FCF of $16.7 billion by the WACC minus a negative 4% growth rate, we arrive at AT&T’s current market capitalization. This is just one method to gauge valuation, but it suggests the market believes both companies face challenges in growing their businesses.

Unique Legacy Risks that Hamstring AT&T and Verizon:

Worth considering, both AT&T and Verizon are hamstrung by unique legacy risks including defined benefit pensions, unionized workers and heavy telecom-related regulations. For example, as we wrote about here, AT&T often must make big contributions to its pension plans, especially when the market delivers lower returns. This creates a big risk (and expense) for AT&T that other newer companies don’t have to deal with because they use defined contribution plans instead of defined benefit plans (Verizon is also hamstrung by legacy defined benefit plan obligations). Similarly, AT&T and Verizon both have a significant union presence within their workforce. This is perhaps good for many workers job security, but it’s a risk for AT&T and Verizon due to potential work stoppages and a less flexible workforce. Lastly, both companies are subject to strict and costly telecom industry regulations. For example, on page three of Verizon’s most recent annual report, CEO Lowell McAdam explains:

“One thing that could have a negative impact on our future network investments is the FCC’s stated intention to reclassify broadband services under Title II of the 1934 Communications Act, which would impose rigid 20th century rules on a dynamic 21st century industry. Such a move could depress long-term capital investment in infrastructure, discourage innovation in broadband Internet and related services, and cost the economy thousands of middle-class jobs. We urge the Congress to enact legislation that will clarify the rules of the road and pave the way for continued investment in high-quality open networks that will secure America’s leadership in the global digital economy.”

New Risks from new business strategies:

The fundamental risk profiles of both AT&T and Verizon are changing as the companies are forced to take on new risks just to maintain their high dividends.

More Volatility:

For example, the companies they are acquiring (e.g. AOL and DirectTV) are more volatile and have higher betas than the traditional telecom businesses of AT&T and Verizon. Further, AT&T’s acquisition of Mexican cell companies increases foreign currency risk and volatility. And if one of the companies purchases Yahoo (AT&T might also be interested in Yahoo as another source of free cash flow to feed the dividend), then that too will increase volatility and risk.

Losing "Fixed Income Proxy" Status:

As Verizon and AT&T continue to invest in new types of businesses, they run the risk of losing their status as a fixed income proxy. Specifically, many investors have flocked to AT&T and Verizon over the last decade as interest rates have fallen so low. The historical low volatility and high dividend payments of telecom companies have been particularly attractive to income investors that might have previously purchased bonds. However, AT&T and Verizon are likely increasing their future volatility by investing in riskier businesses. The good news is that they still have a lot of low volatility telecom (wireless/wireline) revenues, and interest rates are likely to continue to stay low for quite some time.

Losing "Safe Haven" Status:

In a related point, Verizon and AT&T may be losing their status as a risk-off safe haven investment. As many investors pile into US treasuries when volatility picks up, so too do they pile into AT&T and Verizon. For example, as volatility has increased and the market has declined so far in 2016, AT&T and Verizon have performed well because many investors purchased them as a risk-off safety play. However, if the companies continue to purchase higher-risk, non-telecom companies then they may eventually lose their status as a safe-haven investment.

Two Big Risks to Shareholders:

As we combine the old unique legacy risks with the newer business risks, the result is a changed risk profile for AT&T and Verizon. And two big questions for shareholders are: 1) How will the new business strategies impact the dividend policies, and 2) How do they impact the total return potential of the stocks.

1) Risk of a Dividend Policy Change:

As the following chart shows, Verizon and AT&T have a history of healthy dividends and dividend increases. They understand that investors invest for the dividends, and the companies won’t ever cut unless there is truly no other option because they don’t want to violate shareholder trust.

(source: Nasdaq)

However, the evolving business strategies (as described previously) have increased risk. We believe the chance of a dividend cut for either company within the next few years is still remote, but it has increased. For example, if DirectTV turns out to be a flop then AT&T will be back in the same predicament it was in back in 2014 (i.e. running out of free cash flows from which to pay dividends). Similarly, if Verizon’s dividend payout ratio (as a percent of free cash flow) continues to increase then so too does the risk of a cut.

Much more likely than a dividend cut is the possibility of smaller (or nonexistent) dividend increases in the future. If the companies’ new business strategies demand more cash or involve more volatility then management will be hesitant to increase the dividend meaningfully because they’ll want to play it safe and preserve cash simply to maintain the dividend payment. We believe this is a real risk that investors should consider as the companies’ business strategies continue to evolve.

2) Risk of lower Total Returns:

We believe AT&T and Verizon’s legacy businesses (wireline/wireless) offer lower returns than other companies and industries simply because growth is slowing, margins are compressing, and legacy characteristics (e.g. defined benefit obligations, unionized workforces, and high regulation) are a drag on profitability.

We believe AT&T and Verizon’s new inorganic growth acquisitions (e.g. DirectTV, AOL, possibly Yahoo) run the risk of being simply a “kick the can down the road” strategy whereby they purchase business with un-compelling long-term prospects because they provide a short-term bump to free cash flows and help maintain the dividend payments. The jury is still out with the DirectTV acquisition (because it is still relatively recent), and the success of a potential Yahoo acquisition by either company depends on their ability to receive a good (low) purchase price. These aren’t the types of acquisitions that demand huge payment premiums because they don’t offer huge growth. Rather, they’re the types of purchases made at significant discounts because the acquire-ees don’t have a lot of other interested parties. The real question on future inorganic growth is whether the purchases can be made at low enough discount prices.

Conclusion:

The dividends at Verizon and AT&T are still safe for the time being, but the total risk-to-return profiles are evolving. Specifically, future stock price volatility may be higher (and dividend increases lower) than shareholders are used to because the business strategies are increasingly risky. Further, both companies run the risk of overpaying for acquisitions because they’re pressured to focus on shorter-term free cash flow needs (i.e. maintaining the big dividends) instead of long-term value. And if Verizon and AT&T want to maintain their long-term reputation for being big safe dividend growers, they may eventually need to find a better strategy than simply acquiring and managing businesses with shrinking growth.

Disclosure: None.

Excellent read, thanks.