Value Investor Index Update

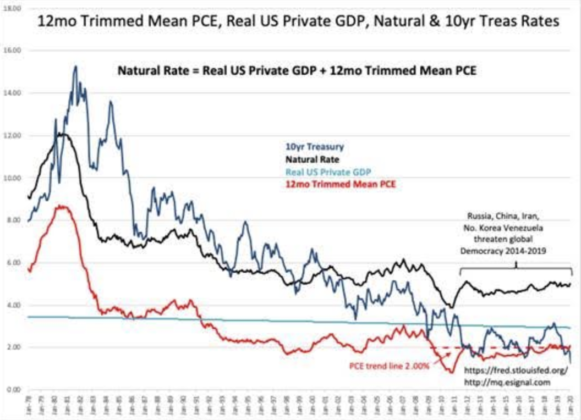

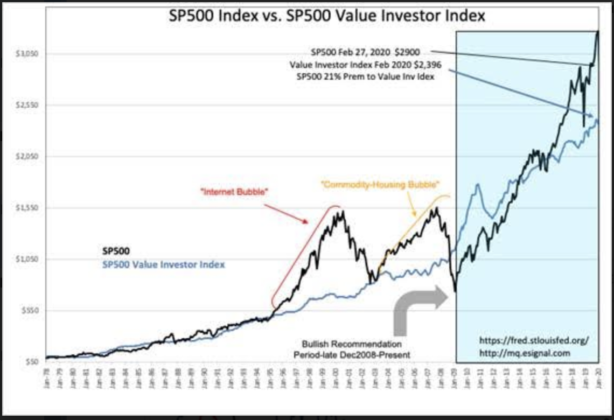

The Dallas Fed 12-month Trimmed Mean PCE, the Fed’s preferred inflation measure, is reported at 2.06% The Natural Rate, the long-term median earnings capitalization rate, is at 4.99%. The S&P 500 Value Investor Index (VII) is $2,396 which leaves the current S&P 500 at $2,920, a 21% premium. Recent market cycle tops have occurred when the S&P 500 exhibited rampant speculation of 65+ premium to the VII. That this level of speculation is not present in today’s markets indicates the potential remains for the S&P 500 to eventually shift towards $5,100 in 2024.

With 10-year Treasury rates at 1.2% in the current panic, it is tempting to contemplate a return to this rate shifting towards a premium to the Natural Rate. The issue remains that Sovereign Debt rates have been driven lower by capital flows the past 20 years as development of emerging markets sent a flood of capital back to western markets seeking safety. That flood of capital has intensified with multiple countries slipping towards autocratic governments especially with the coronavirus scare.

US equity markets remain attractive with sizable upside once the coronavirus scare has passed.

Comments

No Thumbs up yet!

No Thumbs up yet!