Value Factor Is Relative Haven For Stocks So Far In 2022

There’s no place to hide within the US equities risk factor spectrum, at least in absolute terms. But value stocks continue to shine on a relative basis via light losses this year. Will it last? More importantly, can value stocks regain their mojo and at some point outperform the growth factor with higher gains for an extended period? Or is the historical value premium destined to fade into a perpetual underperforming risk premium?

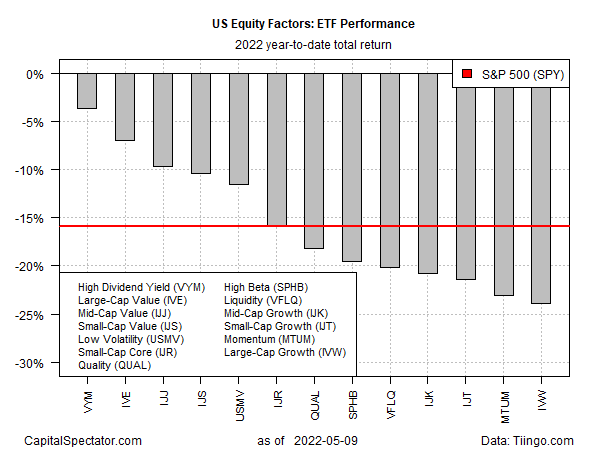

By some accounts, growth and other higher-risk slices of the market will regain the lead when the current selloff ends. Maybe, but at the moment, value and related equity factors have the upper hand in 2022, based on a set of ETFs through yesterday’s close (May 9). The top-performer year to date: Vanguard High Dividend Yield (VYM), which has shed a relatively light 3.6% so far this year. That compares with a near-16% year-to-date loss for US stocks overall (SPY) and even deeper declines in the worst-hit factors.

VYM’s trading near the bottom of its range this year, but that’s no small advantage in the current environment. Indeed, VYM’s overall profile is one of relatively stable this year.

(Click on image to enlarge)

VYM and comparable strategies are in high demand these days. “Investors want safety, they want security, and they want to go somewhere where they feel like their money is going to be a little more protected, even in a turbulent environment,” explains Ryan Jackson, an analyst of passive funds at Morningstar.

Safety in the stock market these days, however, is a relative concept. Indeed, VYM’s 3.6% year-to-date loss looks trivial compared with the near-29% tumble this year for iShares S&P 500 Growth (IVW), the hardest-hit ETF on our factor list.

Looking at VYM as a value-factor proxy relative to the broad equity market (SPY) suggests that these stocks are enjoying a renaissance after a long-simmering drought in the shadow of high-flying growth stocks.

(Click on image to enlarge)

But the advantage for value, so far, is measured only in relative terms. Losing less money is no trivial thing these days. The real test, however, still awaits, namely: Can value stocks outperform growth with higher gains? History suggests that’s possible, even likely. Whether it holds in the months and years ahead, however, is open for debate as the crowd considers the viability of a factor strategy that’s fallen on hard times in recent years.

Disclosures: None.