Utilities Stocks: Between Equities And Fixed Income

I am long the US utilities sector in my portfolio, thus it was not pleasant to see Utilities Select Sector SPDR ETF (XLU) close 3.49% lower last Friday. And this was on a day when broader US equities barely moved, with SPDR S&P 500 ETF (SPY) losing only 0.05%. The trigger behind this violent drop in utilities was the unexpectedly strong nonfarm payrolls report, which prompted market participants to reprice the probability of the Fed rate hike in December to 70%. This development encouraged me to do a bit of analysis on XLU price behaviour and clarify its role in my portfolio.

Factor analysis

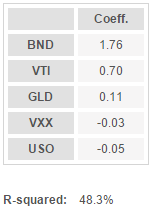

To better understand the driving forces behind XLU returns, I ran a simplistic factor analysis on InvestSpy.com. It uses 5 ETFs representing different market segments (equities, bonds, gold, oil and volatility) as explanatory variables in an unconstrained linear regression. Utilizing 1 year of historical data, the results are as follows:

(Click on image to enlarge)

What the table above means is that to replicate returns of $1,000 invested in XLU as closely as possible, one would need to go long $1,760 in bonds, $700 in equities, and $110 in gold, whilst shorting $30 of volatility and $50 of oil. The R-squared metric means that such a portfolio would have explained 48.3% of XLU performance. This leaves more than 50% of returns unaccounted for though and there are a couple of good reasons for that. Such a basic form of factor analysis possibly leaves out some other significant variables, whereas a portion of returns is naturally expected to be specific to the utilities sector only.

Statistics aside, the key practical takeaway is that XLU is primarily dependent on the bonds market at the same time exhibiting characteristics of equities. Given that stocks are substantially more volatile than fixed income securities, it is fair to say that XLU is a blend of both markets.

Correlation analysis

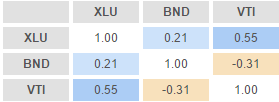

The conclusion from the previous section is reinforced by a closer inspection of the correlation coefficients presented in the table below:

(Click on image to enlarge)

Source: InvestSpy

Over the last 12 months, XLU had a positive correlation both with Vanguard Total Stock Market ETF (VTI) (0.55) and Vanguard Total Bond Market ETF (BND) (0.21). There are two interesting observations here. First, as I originally argued in my sector analysis article a couple of years ago, utilities have a surprisingly low correlation with the broad equities market. For a group of US stocks to persistently demonstrate a correlation coefficient below 0.6 with all other stocks is a remarkable feature. Second, XLU has a positive correlation with the bond market, which is untypical for an equities ETF. For instance, VTI demonstrated a correlation of -0.31 with BND. So it is clear that utilities stocks stand somewhere in the middle between equities and bonds.

Individual holdings

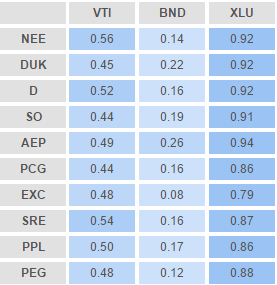

To dig a bit deeper, I have extended the analysis to the individual holdings level. XLU has 31 holdings, top 10 of which account for 60% of the fund’s assets. The table below contains correlation coefficients between top 10 holdings in XLU with VTI, BND and XLU itself.

(Click on image to enlarge)

It is interesting to see that all 10 largest components of XLU have positive correlations with both broad stock and bond markets. Correlation coefficients with VTI fall into a narrow range of 0.44-0.56 and are a bit more diverse for BND – 0.08-0.26. Not surprisingly, the result similar when aggregated at the ETF level as well.

Conclusion

Factor and correlation analyses of XLU performance over the last 12 months reveal that US utilities sector stocks act as a combination of stocks and bonds. The ETF and all of its top holdings demonstrate positive albeit reduced correlation with both broad US stock and fixed income markets. Therefore, I would argue that an investor may want to classify XLU as hybrid security for their portfolio analysis purposes. Without overcomplicating it with statistics, a 50/50 attribution to stocks and bonds would probably be a more prudent approach than simply assigning the full investment to the equities basket. Last Friday was a good proof of that.

Disclosure: None.