Tuesday, October 3, 2023 12:06 PM EST

Yen. Image Source: Pixabay

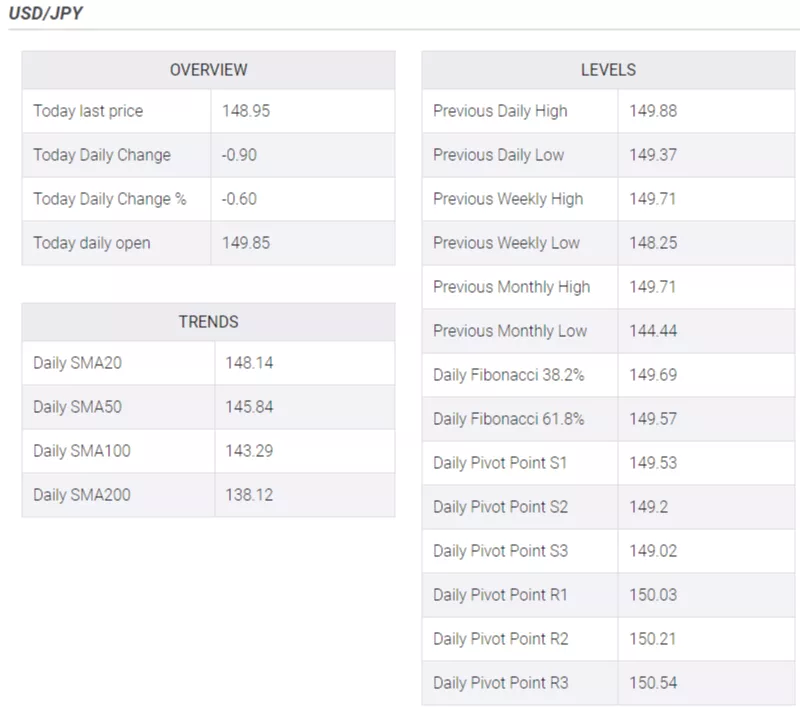

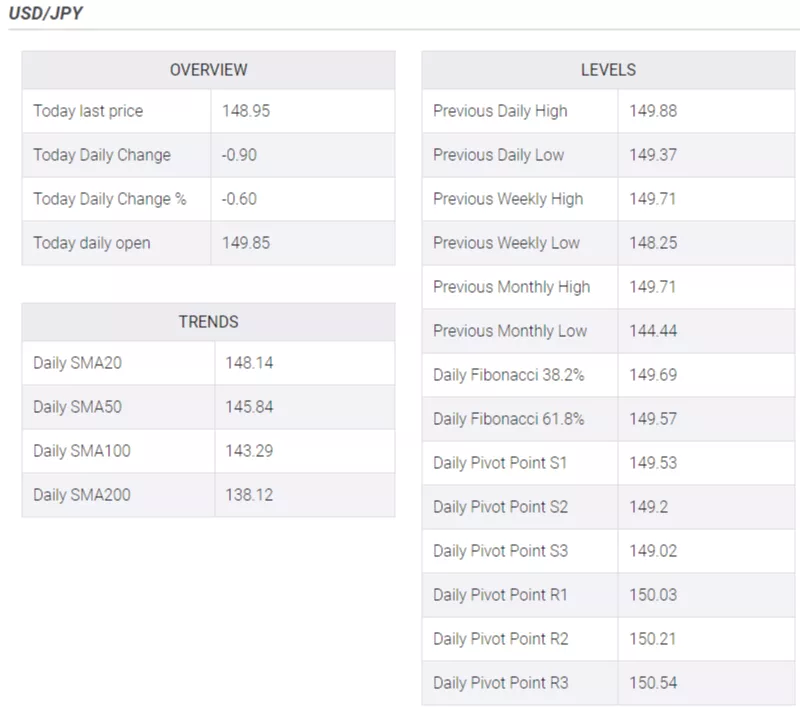

The USD/JPY experienced a sudden collapse, plunging more than 250 pips within a few minutes. The pair, which had been trading above 150.00 following the release of better-than-expected US data, sharply dropped to 147.28 and then rebounded to 149.00.

Significant volatility was observed in Yen crosses due to recent developments, indicating a potential intervention by Japanese officials to strengthen the currency. The trigger for this could have been the USD/JPY rising above 150.00 following the release of positive US economic data. However, no official announcement has been made thus far.

The US JOLTS Job Opening report exceeded expectations, coming in at 9.61 million in August, surpassing the consensus estimate of 8.8 million. Following the report, the US 10-year Treasury bond yield surged to 4.74%, reaching a new high not seen since 2007. This boost in yields propelled the USD/JPY above 150.00, with the pair peaking at 150.15, the highest level in almost a year, before the dramatic reversal occurred.

More By This Author:

USD/JPY Holds Ground Below 150.00, Awaits US Employment Data

Gold Price Forecast: XAU/USD Remains Depressed Near Multi-Month Low, Just Above $1,820 Level

Silver Price Analysis: XAG/USD Pillorying Continues, Silver Extends Decline Over 11%

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

less

How did you like this article? Let us know so we can better customize your reading experience.