USD/JPY Slides As BoJ Hawkish Shift Clashes With Fed Dovish Tilt

Yen. Image Source: Pixabay

USD/JPY is down for a second straight day on renewed expectations of the Bank of Japan (BoJ) tightening. The move is driven by hawkish remarks from Deputy Governor Shinichi Uchida and hotter-than-expected April PPI data, which contrast sharply with soft US inflation figures and growing speculation of Federal Reserve (Fed) rate cuts.

At the time of writing, USD/JPY is trading near 145.60, extending its decline from earlier at 146.00 as diverging central bank outlooks weigh on the pair.

BoJ hawkishness meets strong PPI

On Tuesday, Bank of Japan Deputy Governor Shinichi Uchida reaffirmed the central bank’s readiness to tighten policy further, even amid global uncertainties such as US trade moves. Speaking to lawmakers, Uchida acknowledged that Japan’s underlying inflation and long-term expectations may temporarily stagnate, but pointed to persistent upward pressure from a “very tight” labor market. He emphasized that rising wages and shipping costs will likely be passed on to consumers, supporting a sustainable inflation trend.

The Yen extended gains on Wednesday after Japan’s April Producer Price Index (PPI) came in as expected, up 4.0% YoY, highlighting ongoing upstream price pressures. The data, combined with Uchida’s hawkish tone, reinforced expectations that the BoJ may deliver another rate hike.

As a result, USD/JPY dropped below 146.00, driven by narrowing yield differentials and growing confidence in the BoJ’s tightening path.

Soft US inflation data and dovish Fed signals weigh on the US Dollar

Meanwhile, in the US, April’s Consumer Price Index (CPI) report came in below expectations on Tuesday. Headline inflation rose just 0.2% month-on-month, below the 0.3% forecast, while annual inflation eased to 2.3%, the lowest since early 2021. Core CPI also came in soft, reinforcing speculation that the Federal Reserve could begin cutting interest rates as early as September.

This disinflation trend, alongside dovish commentary from Fed officials, sent US Treasury yields lower and pressured the US Dollar. As a result, USD/JPY fell despite broader risk-on sentiment.

Looking ahead, Thursday’s US Producer Price Index (PPI) and Initial Jobless Claims will offer further insight into inflation and labor market trends. However, the key event will be Fed Chair Jerome Powell’s speech. Markets will be tuned in for confirmation of a dovish pivot—or any pushback against the growing expectations for rate cuts. His tone could be pivotal for short-term direction in USD/JPY and broader dollar sentiment.

USD/JPY - bullish or bearish at 146.00?

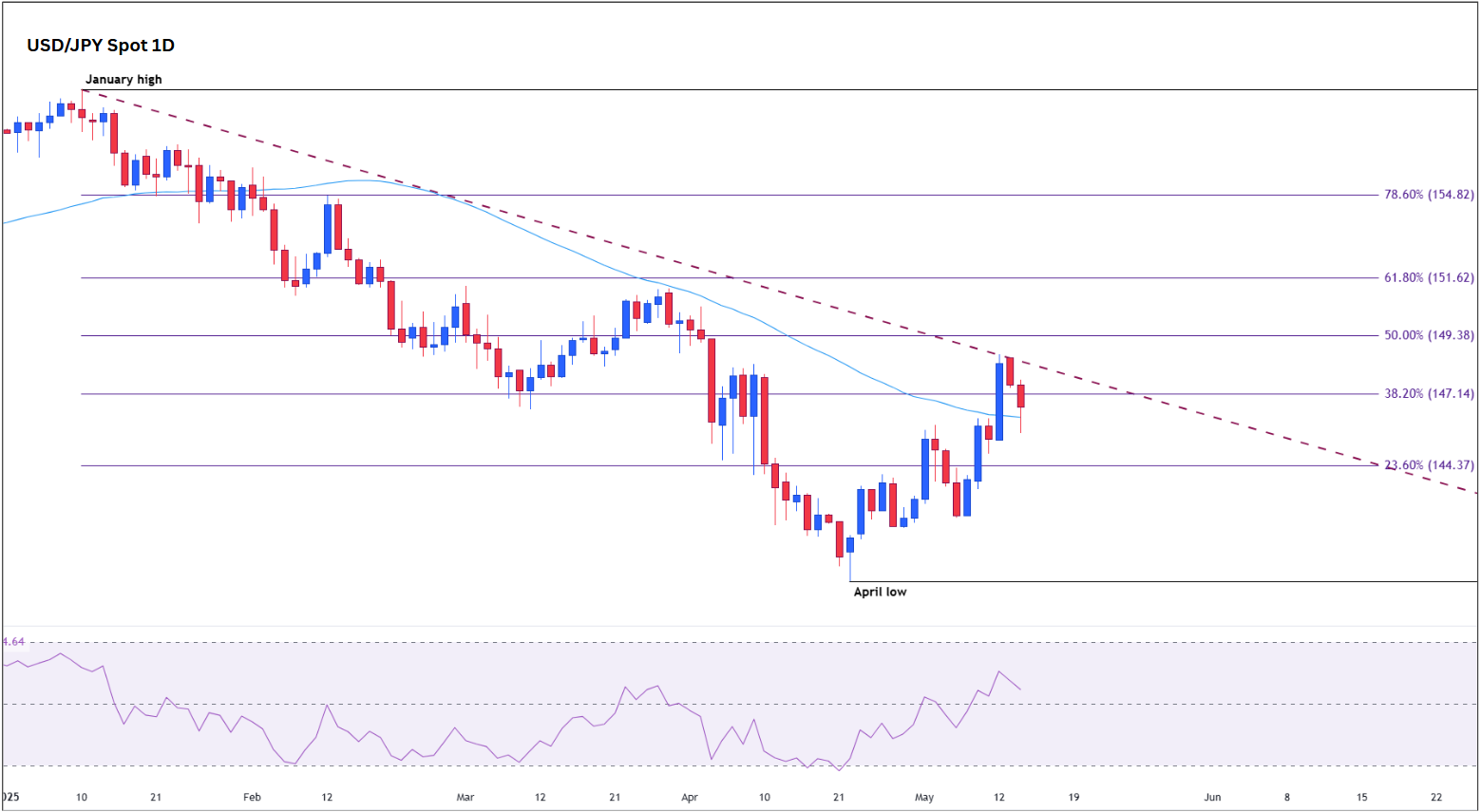

Technically, USD/JPY sits at a critical juncture. A confirmed breakout above the 50-day simple moving average (SMA) at 146.34 would signal renewed bullish momentum, opening the path toward resistance at 147.09—the 38.2% Fibonacci retracement of the January–April decline. Sustained strength could even target the psychological 150.00 level, particularly if US yields rebound or policy divergence between the Fed and BoJ widens.

USD/JPY daily chart

(Click on image to enlarge)

Conversely, failure to hold above 144.37 and a decisive break below the 20-day SMA would suggest fading bullish momentum, shifting focus toward 142.00 and potentially 140.00—especially if US data disappoints or market sentiment turns risk-off.

More By This Author:

Fed Rate Decision In Focus Post Elections, BoE Drives GBP/USD HigherDisclosure: The data contained in this article is not necessarily real-time nor accurate, and analyses are the opinions of the author and do not represent the recommendations of ...

more