USD/JPY Price Loses Steam Above 150.0, Eyes On US PCE

The USD/JPY price is trading in the red at 150.01. After the last rally, a downside correction was due. Still, the bias is bullish despite temporary retreats.

Yesterday, the price registered sharp movements in both directions, signaling an indecision. The DXY’s short-term retreat weakened the greenback, while the Japanese Yen Futures helped the Yen.

Surprisingly or not, the price retreated even if the US reported positive economic data in the last trading session. Also, don’t forget that the ECB meeting had a big impact.

Today, the Tokyo Core CPI registered 2.7% growth, beating the 2.5% expected and the 2.5% growth in the previous reporting period.

Later, the US data should drive the markets. The Core PCE Price Index is expected to report 0.3% growth versus the 0.1% growth in the previous reporting period, while Revised UoM Consumer Sentiment could remain steady at 63.0 points.

Furthermore, Personal Income may report a 0.4% growth again, while Personal Spending could announce a 0.5% growth.

USD/JPY Price Technical Analysis: Downside Prevailing

(Click on image to enlarge)

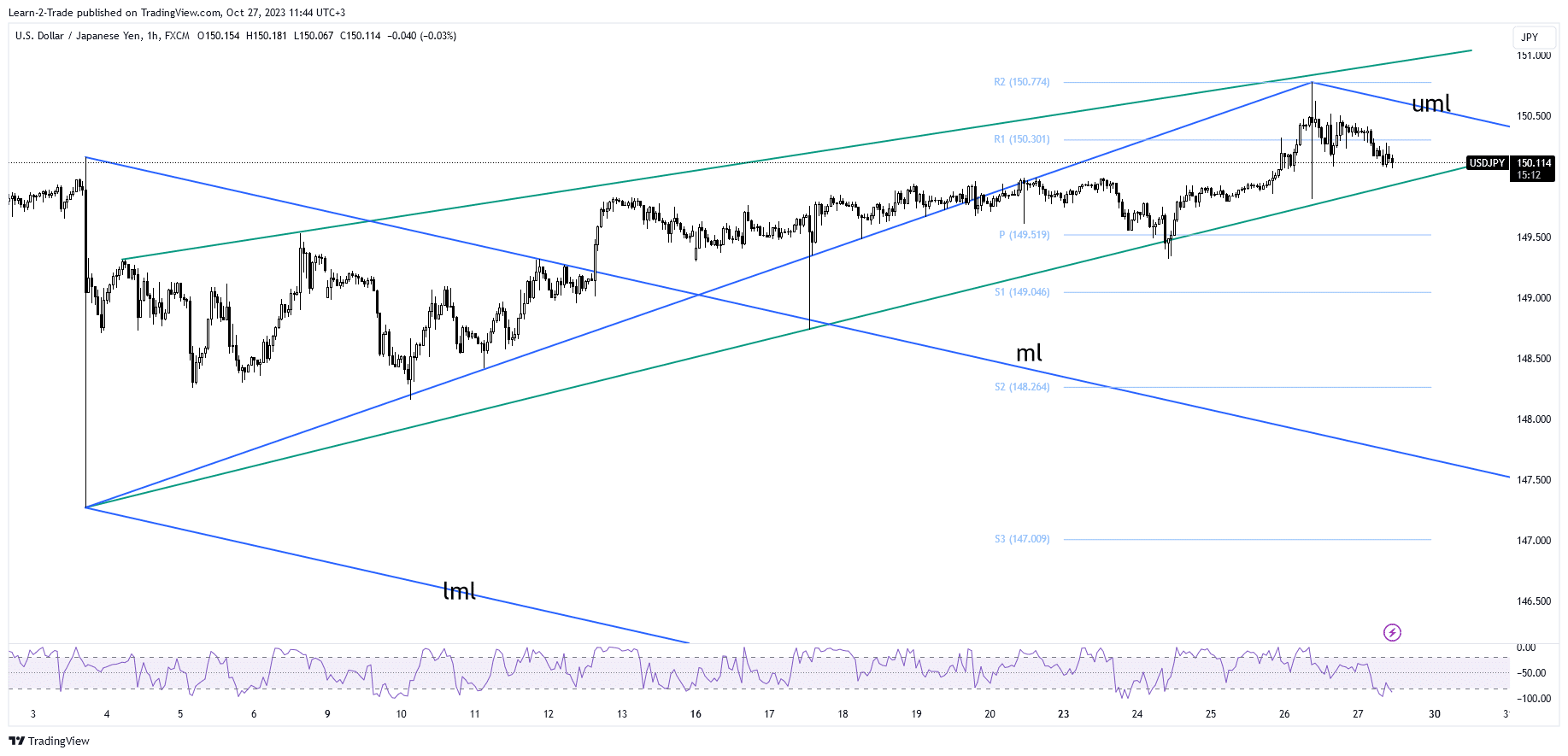

USD/JPY hourly chart

From the technical point of view, the USD/JPY pair retreated a little, but the bias remains bullish as long as it stays above the uptrend line.

The price action developed a potential rising wedge pattern, but the formation is far from confirmed. After its amazing upward movement, a corrective phase could be natural.

I’ve drawn a descending pitchfork, hoping to catch a new leg. Still, a potential larger correction could be activated only by a valid breakdown below the uptrend line and by the upper median line (UML) retest. Testing the uptrend line may announce new bullish momentum.

More By This Author:

USD/JPY Forecast: Marks Fresh 2-Week High Amid Rising YieldsEUR/USD Price Corrects Further As Greenback Leads The Market

USD/CAD Forecast: Bulls Picking Up Amid Rate Differential

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more