Tuesday, July 1, 2025 4:39 PM EST

Yen. Image Source: Pixabay

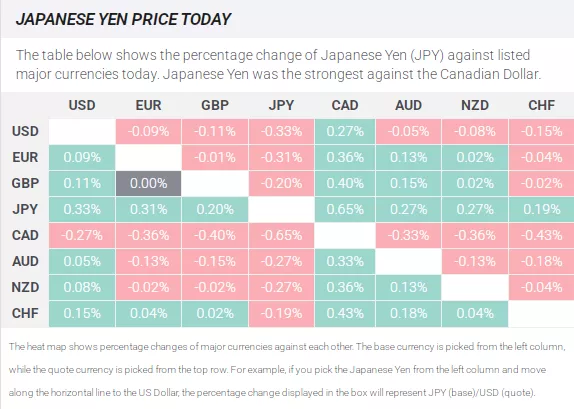

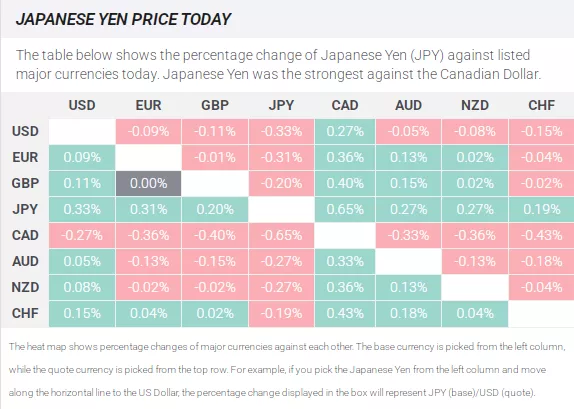

The USD/JPY posted mild losses of 0.17% after hitting a new four-week low of 142.68, sponsored by upbeat economic data in Japan. However, good US jobs and business activity data, along with a hawkish Fed Chair Jerome Powell, lent a lifeline to the US dollar, which staged a comeback versus the Japanese Yen (JPY). At the moment, the pair trades at 143.77.

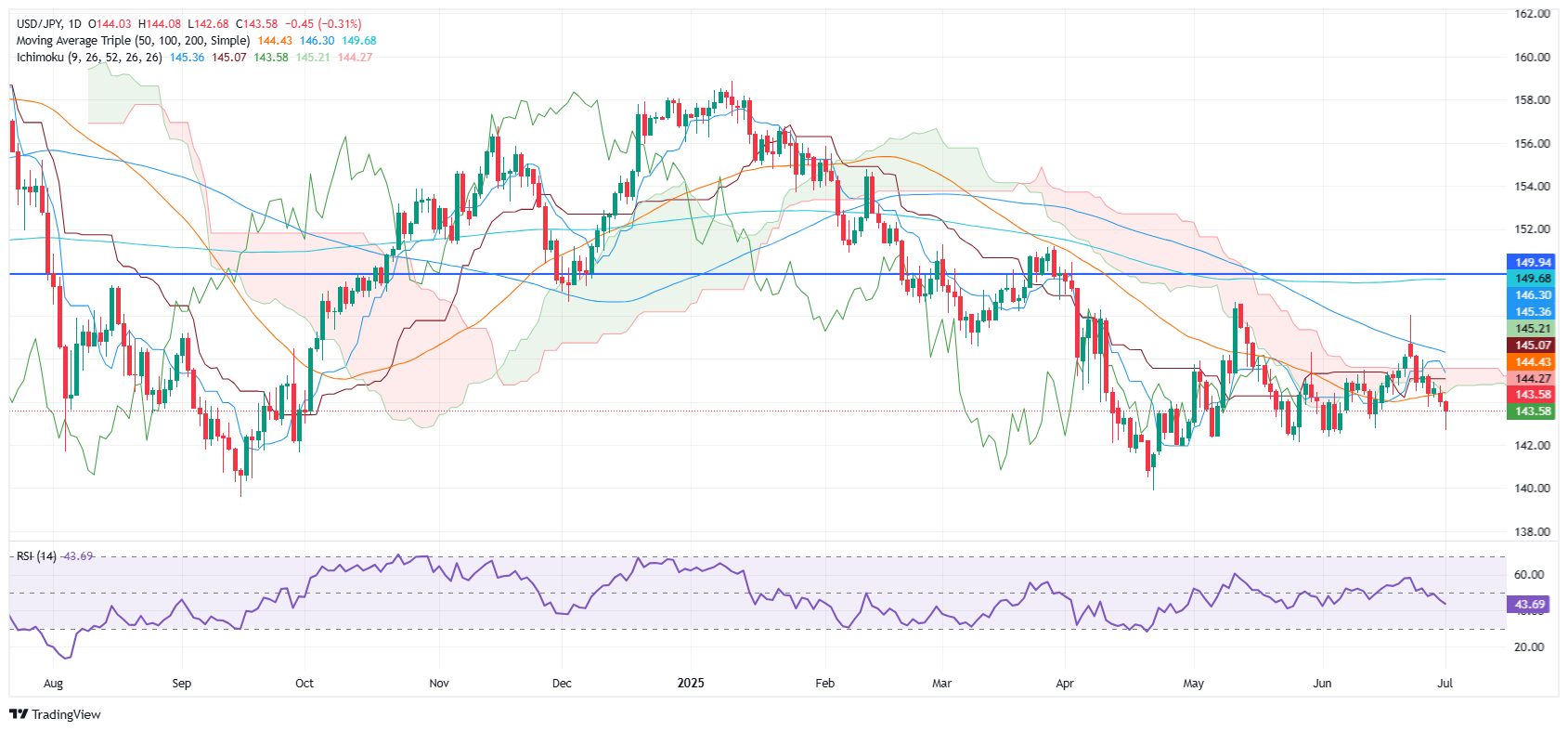

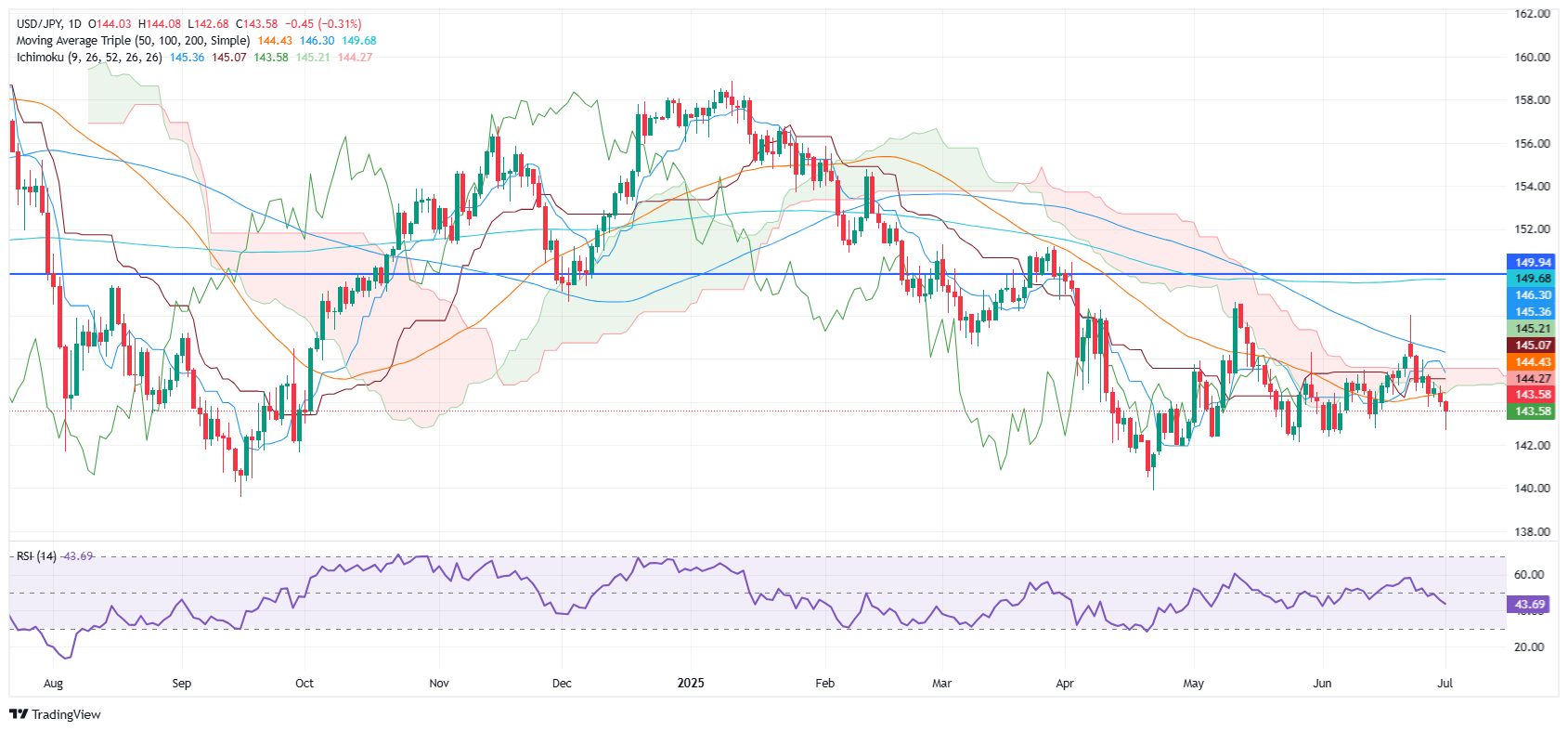

USD/JPY Price Forecast: Technical outlook

The USD/JPY remains neutral-to upward biased if the pair remains above the May 27 swing low of 142.11. However, upside movements could be capped by strong resistance at the bottom of the Ichimoku Cloud (kumo) at around 144.25-50. This, along with the Relative Strength Index (RSI) remaining bearish, suggests that consolidation lies ahead.

For a bullish case, the USD/JPY must clear 144.50, and the confluence of several moving averages, such as the 20- and 50-day SMAs. Once surpassed, the next area of interest would be the Kijun-sen at 145.07, ahead of the Tenkan-sen at 145.35. A breach of the latter will expose the 100-day SMA at 146.32, followed by the June 23 high of 148.02.

On the other hand, if USD/JPY falls below 143.00, a further downside is expected to occur, with a potential target of 142.00.

USD/JPY Price Chart – Daily

(Click on image to enlarge)

More By This Author:

Gold Creeps Up As Dollar Softens Ahead Of NFP Report Gold Firms As U.S. Dollar Slips — Markets Brace For NFP Volatility EUR/USD Soars To 1.1780 As U.S. Dollar Languishes On Fiscal And Trade Optimism

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

less

How did you like this article? Let us know so we can better customize your reading experience.