USD/JPY Price Analysis: Yen Slips As Focus Shifts To US CPI

The USD/JPY price analysis showed a bullish landscape on Tuesday as the dollar rose ahead of the US inflation report. Meanwhile, the yen continued its decline after BoJ policymakers pushed back expectations for an aggressive shift in policy. As a result, the pair is quickly approaching $150.

The inflation report will show whether high interest rates reduce price growth. Recently, Fed policymakers have emphasized the need for evidence of a sustained downtrend in inflation. A sustained downtrend would mean that when inflation reaches the 2% target, it will stay around that level. The Fed would then be confident enough to cut rates.

Therefore, if the report shows a decline in inflation, it would lead to a surge in rate cut expectations. On the other hand, if inflation comes in higher than expected, the Fed would be more reluctant to cut rates. Therefore, the dollar would surge, pushing USD/JPY beyond the 150 level.

Meanwhile, the yen has weakened as investors speculate on a looming BoJ policy shift. Policymakers have recently pushed back market expectations that the central bank will implement rapid rate hikes. Moreover, there is a chance that easy monetary conditions will remain. However, Japan’s economy is growing, and demand pushes inflation. Consequently, markets are pricing in an almost 33% chance that the BoJ will hike rates by 10-bps next month.

USD/JPY key events today

- US Consumer Price Index (CPI) Report

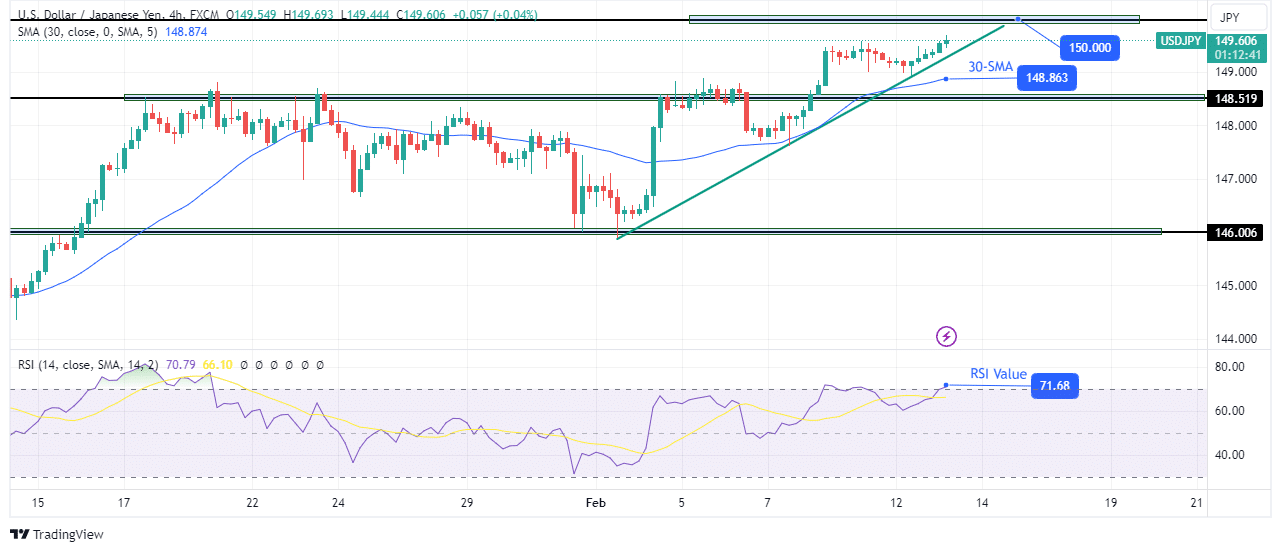

USD/JPY technical price analysis: Bulls make strides toward 150.00 resistance

USD/JPY 4-hour chart

On the technical side, the USD/JPY pair is in a solid bullish trend, with the price consistently making new highs. Moreover, the price has kept above the 30-SMA with the RSI above 50, supporting a bullish trend. The price recently broke above the 148.51 resistance level and made a new high before pulling back to retest its support trendline.

Currently, bulls are making a new leg with targets at the 150.00 resistance level. However, the price action shows that the bulls have weakened. The current swing has much smaller candles compared to previous bullish swings. This indicates that bulls are less enthusiastic about pushing the price higher. Therefore, the price might pause at the 150.00 resistance.

More By This Author:

USD/CAD Forecast: Upbeat Jobs Report Supporting Loonie

AUD/USD Weekly Forecast: RBA/Fed Embrace Hawkish Stances

GBP/USD Weekly Forecast: Rate Cut Bets Fade In The US And UK

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more