USD/JPY Price Analysis: Yen At Risk As Dollar Hits 11-Month Top

The US dollar soaring to fresh 11-month highs has turned Tuesday’s USD/JPY price analysis bullish. However, the probability of BoJ’s intervention is higher now than ever.

The Greenback strengthened amid robust US economic data. Consequently, there is more expectation that the US Central Bank will maintain higher interest rates for an extended period.

According to a survey, US manufacturing continued its recovery in September, with increased production and a rebound in employment. Additionally, the survey revealed a significant decline in factory input prices.

These figures mark the third consecutive month of improvement reported by the Institute for Supply Management (ISM). Therefore, it strengthened economists’ belief that economic growth accelerated in the third quarter despite higher interest rates.

Moreover, a Commerce Department report indicated solid construction spending in August, primarily due to the construction of houses and factories. The upbeat data release and a last-minute deal that averted a government shutdown led to a surge in US Treasury yields, further boosting the dollar.

Meanwhile, the yen faced increasing pressure due to the dollar’s rally, nearing the psychologically significant 150 level. Markets see this level as a threshold that could prompt Japanese authorities to intervene.

While Japanese officials have claimed they are not monitoring any specific level, interventions have historically occurred around the 150 mark.

On Tuesday, Japanese Finance Minister Shunichi Suzuki reiterated that authorities were closely monitoring the currency market and would respond appropriately. Furthermore, he warned against speculative moves that did not align with economic fundamentals.

USD/JPY key events today

Investors expect one major economic release showing the US employment state.

- The JOLTs Job Openings (Aug)

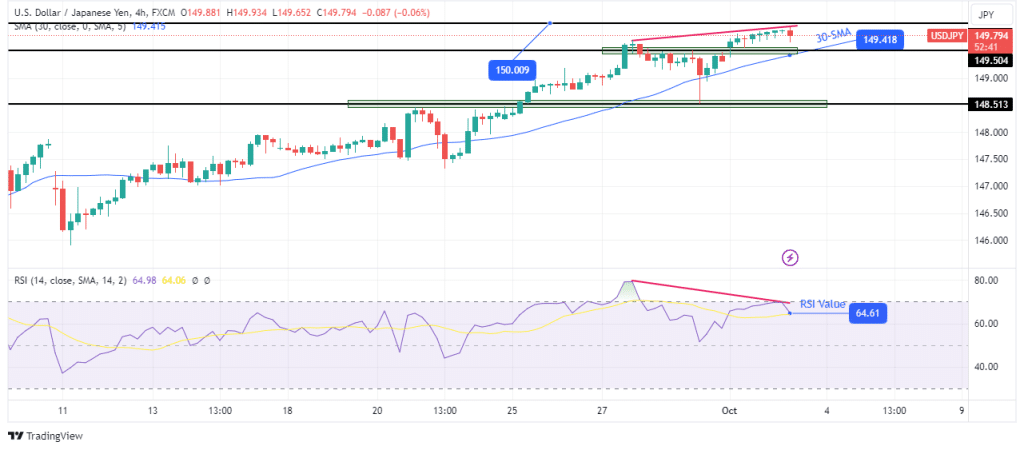

USD/JPY technical price analysis: Bulls weaken near critical 150.00 resistance.

USD/JPY 4-hour chart

On the technical side, the USD/JPY pair continues to inch higher as bulls near the key 150.00 resistance level. However, the bullish move is weak as the price is making small-bodied candles. Therefore, bulls are not making substantial swings above the 30-SMA. Moreover, the RSI continues to point to bullish weakness with a bearish divergence.

Consequently, bears might soon return with stronger momentum to push the price below the 30-SMA and the 149.50 support level. A bearish reversal would likely lead to a retest of the 148.51 support level.

More By This Author:

USD/CAD Outlook: Dismal Canadian GDP Weighing On LoonieUSD/JPY Outlook: Dollar Retreats From 10-Month Peak

GBP/USD Price Analysis: Pound Rises As UK Economy Recovers

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more