USD/JPY Price Analysis: Japan’s CPI Continues Rise In March

Today’s USD/JPY price analysis is bearish. On Friday, the dollar strengthened against everything except the Japanese yen.

Data released on Friday indicated that consumer inflation in Japan continued to rise in March, remaining over the central bank’s target.

This report increased pressure on the Bank of Japan (BOJ) to abandon its ultra-loose monetary policy approach.

Japan’s export growth slowed in March due to lower shipments of steel and autos to China. The slowdown highlights worries about slowing global demand amid rising interest rates and unease in the Western banking industry.

Due to the high cost of coal, crude oil, and oil products, import growth exceeded export growth in March. This saw the third-largest economy in the world record a 21.7 trillion yen ($161 billion) annual trade deficit. It broke the previous mark set in fiscal 2013 of 13.7 trillion yen.

The value of imports increased due to the yen’s 16.5% decline from the same month a year earlier.

Recession fears have increased after the release of poor US data on Thursday. The number of Americans submitting new claims for unemployment benefits grew slightly last week. This reflects a weakening of the labor market. An additional report from the Philadelphia Fed indicated a sharp decline in its indicator of factory activity in the mid-Atlantic region.

The recent failure of two US banks and issues at Credit Suisse have heightened concerns about a credit crunch. At the same time, a months-long tightening trend in global monetary policy has raised the specter of a global recession.

USD/JPY Key Events Today

Later on Friday, the US will release its flash PMI numbers, which will shed more light on the state of the economy.

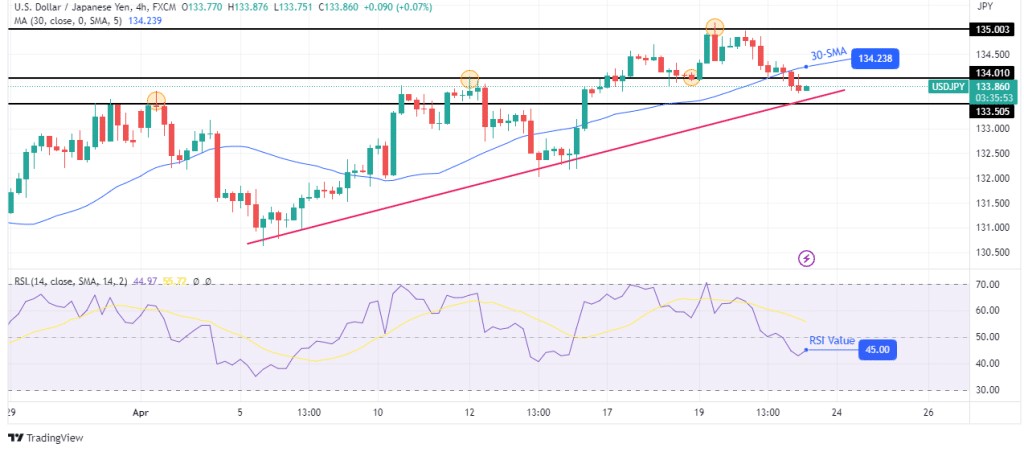

USD/JPY Technical Price Analysis: Bears Approaching Trendline Support

(Click on image to enlarge)

USD/JPY technical price chart

he long-term bias for USD/JPY in the 4-hour chart is bullish. This is because the price has made higher highs and lows, as seen in the bullish trendline. However, it is currently pulling back, and bears are in control below the 30-SMA.

The RSI has also crossed below 50, supporting bearish momentum. This pullback will likely pause at the trendline support, where bulls will return to push the price higher. Bears can only take over if the price breaks below the trendline support.

More By This Author:

GBP/USD Price Heading To New Lows Ahead Of US DataUSD/CAD Outlook: Soaring As Oil Prices Fall

GBP/USD Outlook: BoE Calls For Caution In Raising Rates