USD/JPY Price Analysis: Inching Closer To Pivotal 150 Yen Level

On Friday, the dollar was on the verge of reaching the closely monitored 150 level, painting a bullish picture for the USD/JPY price analysis. The dollar got support from a rapid increase in the US 10-year Treasury yield. It briefly touched 5% overnight, a level not seen since 2007.

Notably, the 10-year yield, currently at 4.9456%, has risen by over 30 basis points (bps) this week. This surge is attributed to growing expectations that the Fed will hold rates high for longer. Moreover, there are concerns about the US fiscal situation.

Consequently, there has been a lot of downward pressure on the yen. The exchange rate was 149.85 per dollar, close to the 150 per dollar mark. Some traders speculated that this level might trigger intervention by Japanese authorities, as it did last year.

Elsewhere, Powell emphasized that the US economy’s strength and persistent tight labor markets might necessitate tighter borrowing conditions. However, he noted that rising market interest rates could reduce the need for the central bank to take action.

As Powell spoke, investors increasingly placed their bets on the idea that the Federal Reserve has completed interest rate hikes. Meanwhile, futures are now pricing less than a one-in-three chance of another rate hike this year. This is down from around 40% before his speech.

USD/JPY key events today

Markets do not expect any key economic releases today, which might lead to a quiet trading session for USD/JPY.

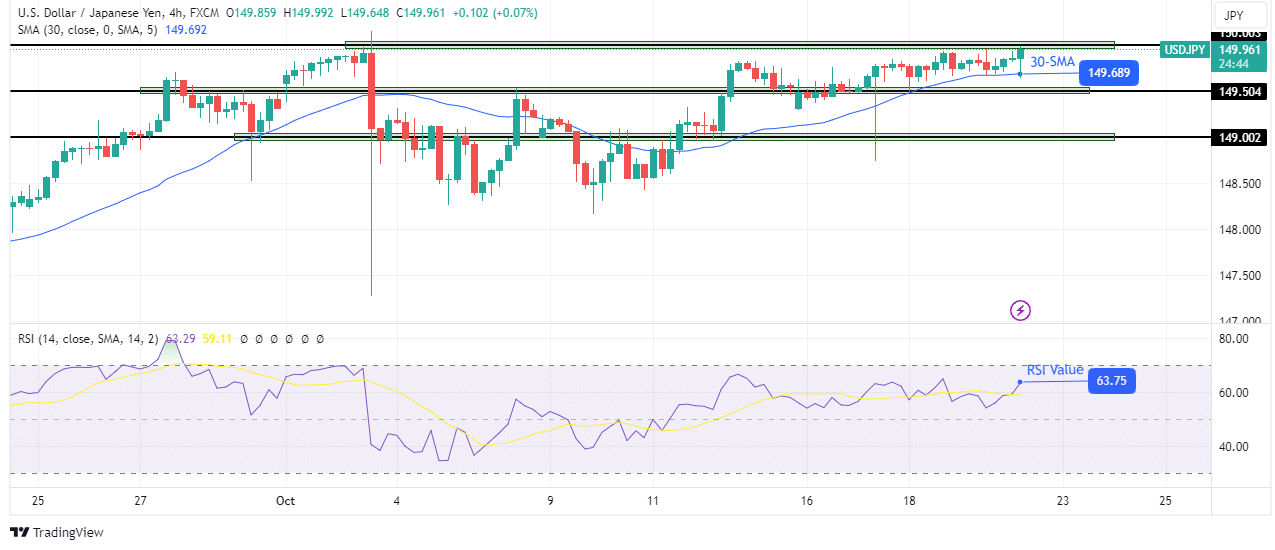

USD/JPY technical price analysis: Bulls lock horns with crucial 150.00 resistance level.

(Click on image to enlarge)

USD/JPY 4-hour chart

The USD/JPY bulls are retesting the key 150.00 resistance level. However, the bullish move weakened as the price got closer to the resistance. Bulls have stayed close to the 30-SMA while the RSI moves sideways in bullish territory. This indicates a weakening trend.

The last time the price touched the 150.00 resistance, bears emerged with an engulfing candle to reverse the trend. Therefore, this might happen again, especially since bulls have weakened. If bears resurface, the price will break below the 30-SMA and the 149.50 support level. Such a move would then allow bears to retest the 149.00 support.

More By This Author:

USD/JPY Forecast: FOMC’s Rate Outlook Keeps Dollar FirmEUR/USD Price Attempting Recovery, Eyes On Fed

AUD/USD Price Analysis: Upbeat Chinese Data Supports Aussie

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more