USD/JPY Price Analysis: Bulls Eying 5th Consecutive Weekly Gain

Friday’s USD/JPY price analysis unveils a bullish stance, driven by the dollar’s resurgence, setting the stage for a fifth consecutive week of gains. Yet, investors trod carefully in anticipation of the US wholesale inflation report.

On Thursday, USD/JPY fell after the US retail sales report missed forecasts. A significant drop in US sales in January indicated a slowdown in the economy. This led to a momentary pause in the decline of Fed rate-cut bets. Consequently, the dollar fell, allowing the yen to go below the $150 level.

However, the pair recovered on Friday as investors awaited more data for insights into the Fed’s rate-cut timing. Notably, Fed’s Raphael Bostic said on Thursday that he was not ready to endorse rate cuts. Still, he acknowledged that the Fed had made much progress in lowering inflation.

Meanwhile, investors are cautious as the yen hovers around the $150 level, which could prompt an intervention. Recent yen weakness has been a result of the stronger dollar. Moreover, investors are readjusting expectations on how aggressively the BoJ will hike rates. Recent data revealed that Japan’s economy slipped into recession at the end of 2023. Consequently, the BoJ might shift its policy slower than markets expect.

Japanese authorities have warned of possible action to stop excessive declines in the yen. However, as their verbal warning loses effectiveness, they might need to take action in the market to strengthen the yen.

USD/JPY key events today

- The US Producer Price Index report

- US preliminary UoM consumer sentiment report

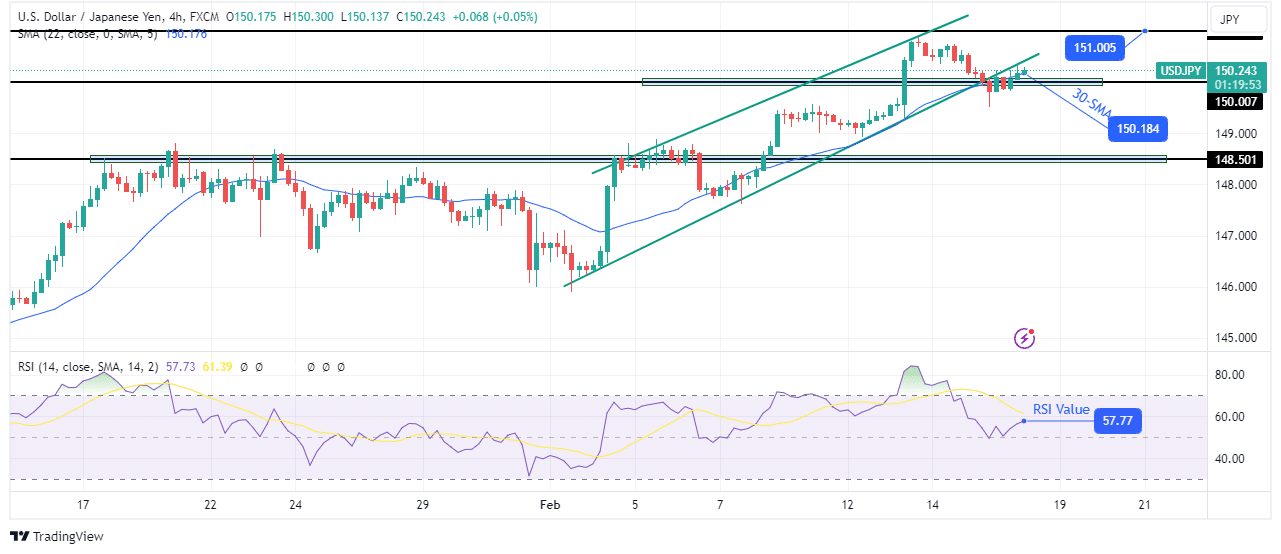

USD/JPY technical price analysis: Bears make a feeble effort to breach channel support

(Click on image to enlarge)

USD/JPY 4-hour chart

On the technical side, USD/JPY has made a weak attempt to break below its bullish channel support. At the same time, it punctured the 30-SMA support line. However, the RSI stayed in bullish territory above 50, supporting bullish momentum.

The price is trapped near the 150.00 critical psychological level. Therefore, bears must detach from this level and start making lower lows for the trend to reverse. Moreover, the price must start respecting the 30-SMA as resistance. However, if 150.00 holds firm as support, the price will soon rise to retest the 151.00 level.

More By This Author:

Gold Price Aims To Regain $2,000, Eyes On US Retail SalesAUD/USD Forecast: Profit-Taking In Dollar After Inflation Led Rally

USD/JPY Outlook: Yen Soars Amid Japanese Officials’ Concerns

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more