USD/JPY Price Accumulating Buying At 145.0, Eyes On US PPI

The USD/JPY price is trading at 145.21 at the time of writing, far below yesterday’s high of 146.41. The bias remains bullish. Surprisingly or not, the greenback depreciated versus its rivals even though the US reported higher inflation in December.

The Consumer Price Index announced a 0.3% growth, beating the 0.2% growth expected and the 0.1% growth in the previous reporting period. In comparison, CPI y/y rose by 3.4%, exceeding the 3.2% growth forecasted and the 3.1% growth in November.

In addition, the Core CPI aligned with expectations, while Unemployment Claims dropped to 202K from 203K, even if the specialists expected a potential growth to 209K.

Today, the Japanese Economy Watchers Sentiment and the Bank Lending came in better than expected, while the Current Account disappointed.

Later, the US data should move the markets. The PPI could announce a 0.1% growth versus the 0.0% growth in the previous reporting period, while Core PPI is expected to register a 0.2% growth.

USD/JPY Price Technical Analysis: Corrective Downside

(Click on image to enlarge)

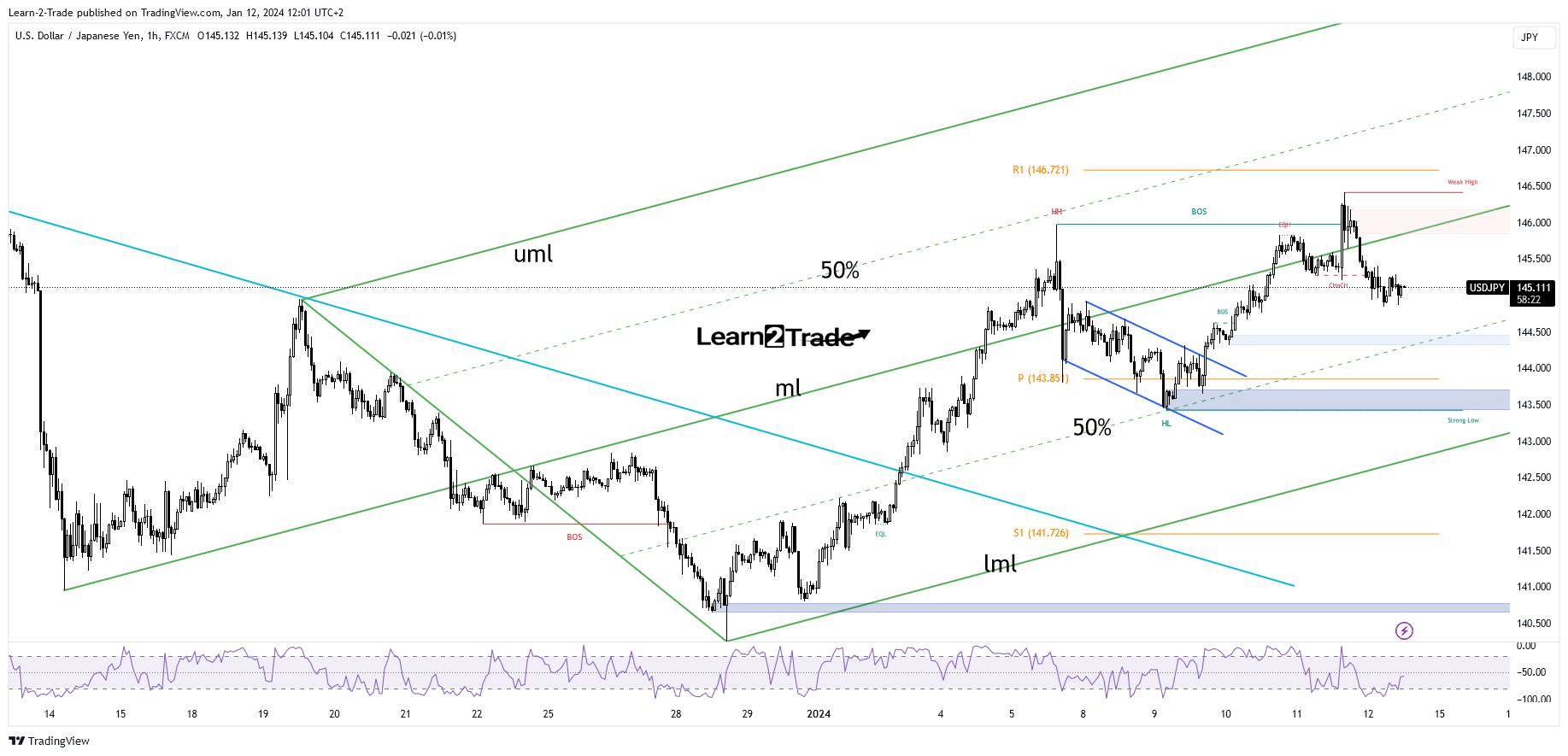

USD/JPY 1-hour chart

As you can see on the hourly chart, the price failed to stay above the median line (ml) of the ascending pitchfork, signaling exhausted buyers. Still, the correction could be only temporary.

The price may only test the immediate support levels or demand zones before developing a new bullish momentum. The 144.50 and the downside 50% Fibonacci line represent key downside obstacles. The bias remains bullish if it stays above the 50% line.

More By This Author:

USD/CAD Price Picks Momentum Near 1.3375, Eying US CPIUSD/JPY Forecast: Dollar Pares Gains Ahead Of US Inflation

Gold Price Struggling to Rebound, Eyes On US Inflation

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more