USD/.JPY Outlook: Yen Heads For A Stellar Week Against The Dollar

As the week drew to a close, the USD/JPY outlook took a bearish turn, driven by the yen’s formidable rally. The currency surged, poised for its most impressive performance against the dollar in nearly five months. This surge came from increased bets that Japan’s ultra-low interest rates are approaching their end.

Moreover, the yen’s overall strength restrained the dollar, which weakened before the awaited US nonfarm payrolls report later in the day.

On Thursday, Bank of Japan (BOJ) Governor Kazuo Ueda mentioned that the central bank had various options for targeting interest rates once it lifted short-term borrowing costs from negative territory. Notably, it was the most explicit indication that the BOJ might soon phase out its ultra-loose monetary policy. Consequently, the yen surged to multi-month highs against major peers. Moreover, it experienced its most significant daily rise since January, with a gain of over 2% on Thursday. As such, it was poised to end the week with a more than 2% increase.

Now, attention shifts to the upcoming two-day monetary policy meeting of the BOJ on Dec. 18 for indications of a potential policy shift.

Meanwhile, revised data on Friday revealed that Japan’s economy contracted more rapidly than initially estimated in the third quarter. It complicates the central bank’s efforts to phase out its accommodative monetary policy, particularly as the household sector struggles.

USD/JPY key events today

Investors expect key events from the US, including

- Average hourly earnings

- Non-farm employment change

- Unemployment rate

- Consumer sentiment

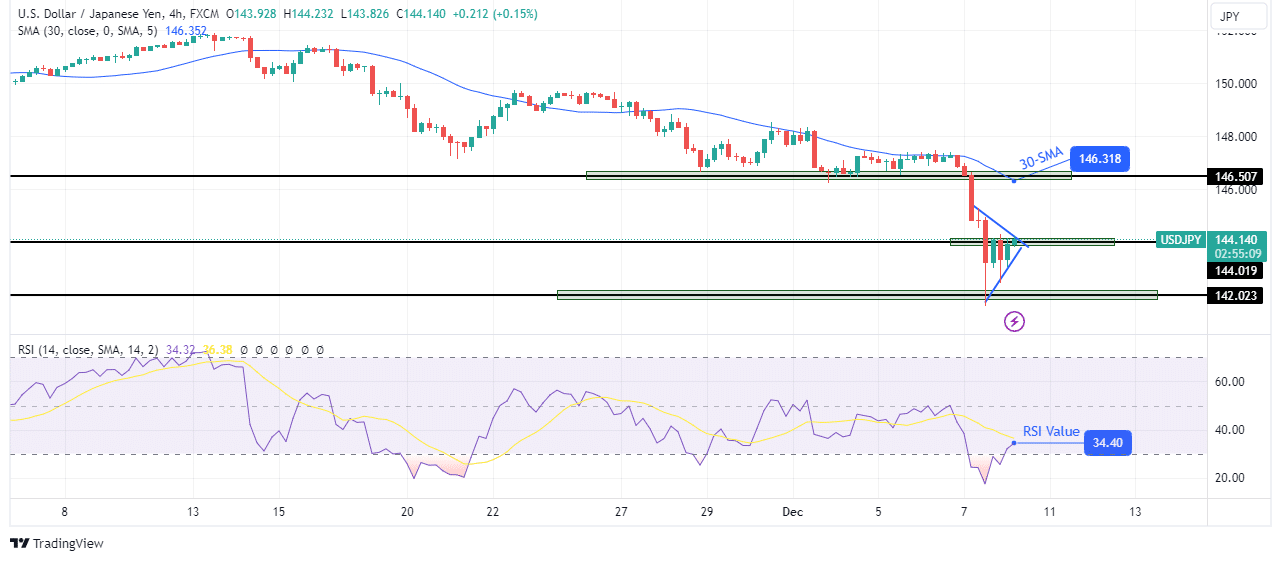

USD/JPY technical outlook: Price pattern hints at more downside

USD/JPY 4-hour chart

On the charts, the USD/JPY price has collapsed to new lows after breaking below the 146.50 key level. The breakout triggered a sharp decline that saw bears break below the 144.01 support. Furthermore, the fall allowed the price to make a big swing from the 30-SMA, confirming strong bearish momentum.

However, the collapse also pushed the RSI into oversold territory. This extreme level allowed bulls to return to the 142.02 level for a retracement to the 144.01 level. Still, the price has made a triangle, a continuation pattern likely leading to a retest and break below the 142.02 support.

More By This Author:

GBP/USD Price Analysis: Dollar Gains Before Critical US NFP DataUSD/JPY Price Aiming to Pounce 145.0 After Downbeat US ADP

USD/CAD Forecast: Loonie Loses Ground After BoC’s Pause

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more