USD/JPY Outlook: Yen Firm Despite Downbeat Tokyo CPI

Despite a dip in Tokyo’s inflation, the yen flexed its muscle against the dollar on Tuesday, signaling a persistently bearish USD/JPY outlook. Moreover, the pair stayed close to the three-month low of 146.235 yen recorded in the previous session.

In November, core inflation in Tokyo decelerated, supporting the central bank’s belief that cost-push pressures in the world’s third-largest economy will gradually diminish.

Meanwhile, service prices, closely monitored by the central bank for signs of wage-driven inflation, experienced their quickest rise since 1994. Analysts attribute this surge to a spike in hotel fees amid a surge in tourist numbers.

Still, inflation has surpassed the Bank of Japan’s (BOJ) 2% target for over a year. Consequently, many market participants anticipate gradually phasing out of the bank’s extensive stimulus in the coming year. Furthermore, BOJ Governor Kazuo Ueda has emphasized maintaining an ultra-loose policy. The BOJ is waiting for demand-driven price increases to replace recent cost-push inflation.

Additionally, Ueda believes that next year’s annual wage negotiations and the outlook for service prices, reflecting labor costs, will play an essential role in determining when the BOJ can exit its ultra-easy policy. The BOJ, in contrast to its global counterparts, remains a dovish outlier, persisting with an ultra-loose policy. At the same time, other major central banks have aggressively raised interest rates to ease widespread inflation.

USD/JPY key events today

- The US ISM services PMI

- The US JOLTs job openings report

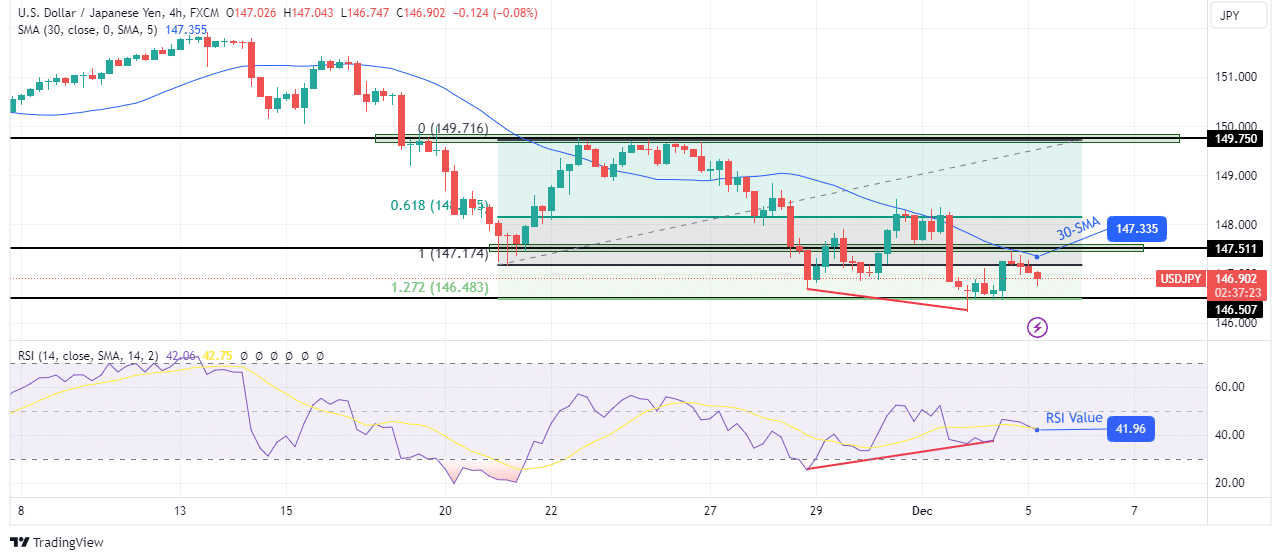

USD/JPY technical outlook: Growing signs hint at bulls taking the lead

USD/JPY 4-hour chart

On the technical side, the USD/JPY downtrend has paused at the 146.50 support level. Still, the bearish bias remains strong as the price has yet to break above the 30-SMA. Moreover, the RSI is still in bearish territory below 50.

However, there are growing signs that bulls might soon take charge. First, the RSI has made a bullish divergence with the price, indicating weakness in bearish momentum. Second, the price has extended to the key 1.27 fib level, a strong support. Finally, bulls have shown strength with a large-bodied candle after the 146.50 support level. Nevertheless, the bearish trend will continue if the price fails to exceed the 30-SMA.

More By This Author:

USD/CAD Outlook: Dollar Mounts A Comeback Post PowellAUD/USD Forecast: Markets Reflect On Powell’s Cautious Remarks

USD/CAD Weekly Forecast: US Inflation Data Weakens Dollar

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more