USD/JPY Outlook: Investors Flock To Dollar Ahead Of Powell

Today’s USD/JPY outlook is bullish. The US dollar strengthened, reaching a more than two-month high. Moreover, it is on track for its sixth consecutive week of gains. Notably, investors are seeking safety in the dollar as they await a speech from Federal Reserve Chair Jerome Powell. The speech will likely provide insights into the direction of interest rates.

The Jackson Hole Economic Policy Symposium will host Powell’s address on monetary policy at 10:05 a.m. ET. Furthermore, the speech will likely determine whether the Fed has concluded its rate hikes and the projected duration of elevated interest rates.

Meanwhile, most economists surveyed by Reuters predict that the BOJ will begin reducing its substantial monetary easing in a year. Moreover, speculation about future policy changes has lessened since a surprise adjustment to the yield control last month.

During the July 27-28 meeting, the BOJ altered its yield curve control strategy. Consequently, this modification permits more flexible increases in interest rates. The markets interpret this as a step towards gradually removing decades of stimulus.

Meanwhile, Takumi Tsunoda from the Shinkin Central Bank Research Institute suggests that the BOJ might maintain the current approach until next summer. This approach aligns with the uncertainty surrounding Japan’s wage trends for fiscal year 2024, which will only become apparent after spring.

Japanese policymakers emphasize the necessity of continuous wage growth to achieve inflation driven by economic expansion.

USD/JPY Key Events Today

Investors eagerly anticipate a speech from Fed chair Powell at the Jackson Hole symposium. This speech will probably have clues on the Fed’s interest rate path.

USD/JPY Technical Outlook: Bulls To Challenge 146.51 Resistance.

(Click on image to enlarge)

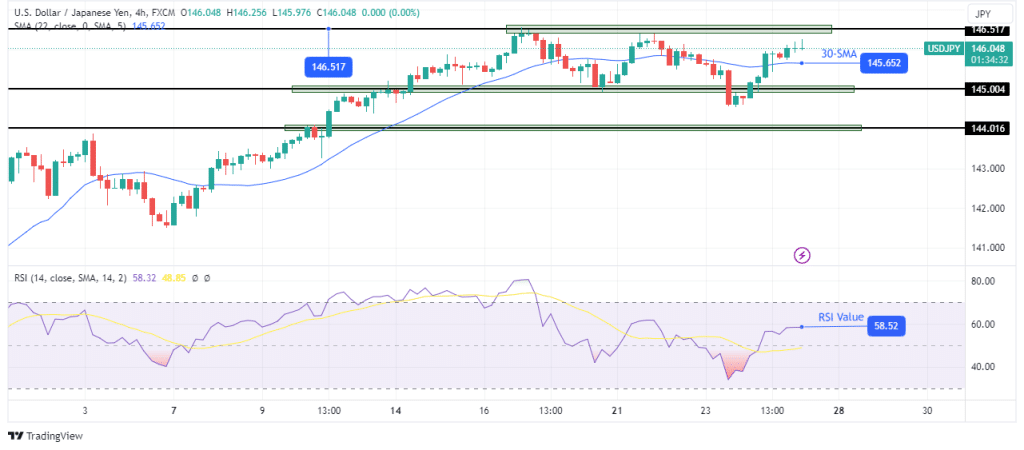

USD/JPY 4-hour chart

On the charts, USD/JPY is chopping through the 30-SMA, showing a lack of direction. At the same time, the price oscillates in a range with support at 145.00 and resistance at 146.51. This consolidation comes after a bullish trend and might, therefore, be a pause before the uptrend continues.

Within the range, the price trades above the 30-SMA, with the RSI in bullish territory above 50. Therefore, bulls might soon retest the 146.51 range resistance. A break above this level would signal a continuation of the previous bullish trend.

More By This Author:

AUD/USD Outlook: Dollar Slides Amid Weaker PMI DataGBP/USD Price Dips Below 1.27 Ahead of Jackson Hole

USD/CAD Forecast: Loonie Finds Bottom at 3-Month Low

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more