USD/JPY Forecast: Yen Surges On Intervention Fears

The USD/JPY forecast turned bearish as the markets plummeted from a whopping 160.00 level amid intervention fears. The pair pulled back sharply after breaching the $160.00 level as the yen got a big boost early in the session. Investors believe Japanese authorities intervened by buying the yen and selling the dollar.

The recent sharp decline to $160 came in the wake of the Bank of Japan policy meeting on Friday. The central bank held rates and gave little information regarding future rate hikes. As a result, investors were disappointed. The BoJ hiking cycle will likely be slow and gradual.

Therefore, the gap in interest rates between Japan and the US will remain wide. This gap is the reason for the recent weakness in the yen. Notably, the currency has lost nearly 11% against the dollar in 2024. Although the BoJ raised rates for the first time last month, they signaled a less aggressive policy outlook than expected.

Meanwhile, economic data has remained strong in the US, and inflation has been stubborn. The most recent inflation report was the core PCE price index, which was 0.3% from the previous month. Although it was in line with expectations, it showed that the decline in inflation has stalled. As investors prepare for the Fed meeting this week, they expect policymakers to keep delaying cuts until data shows a decrease in inflation.

USD/JPY key events today

Investors do not expect high-impact economic news from Japan or the US today. Therefore, the pair might continue reacting to the possible intervention.

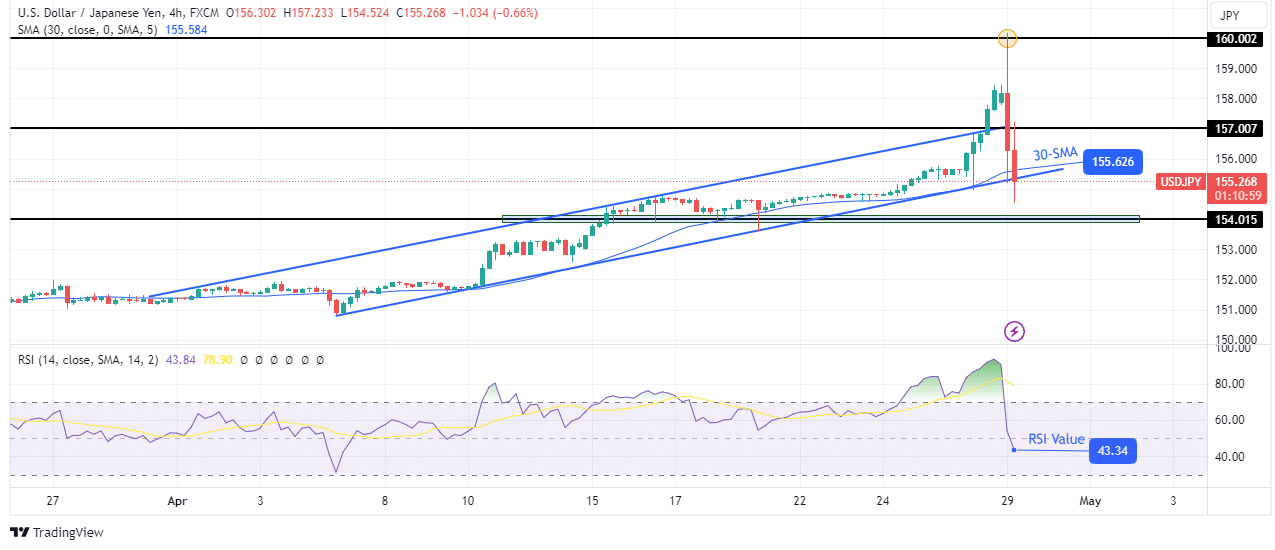

USD/JPY technical forecast: Sudden surge in bearish momentum threatens uptrend

(Click on image to enlarge)

USD/JPY 4-hour chart

On the technical side, the USD/JPY price has broken above its bullish channel before falling sharply. The break above the channel showed that bulls were ready to start a steeper trend. However, bears rejected such a move by reversing the direction at the 160.00 key psychological level.

Despite the increased volatility, the price has stayed above the channel support. However, it has broken below the 30-SMA and the RSI below 50. This indicates a shift in sentiment that could soon see the trend reverse. Moreover, bears might retest the 154.01 support level.

More By This Author:

USD/CAD Weekly Forecast: Slowing US Economy Dents Dollar

AUD/USD Forecast: Rallies as Rate Cut Bets Ease After Hot CPI

USD/JPY Outlook: Intervention Warnings Mildly Lift Yen

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more