USD/JPY Forecast: Yen Surges On Hawkish BoJ Remarks

In Thursday’s USD/JPY forecast, a bearish outlook prevailed as the yen surged following hawkish statements from the Bank of Japan. A BoJ policymaker emphasized the need to conclude the central bank’s ultra-easy monetary policy.

Notably, Bank of Japan board member Hajime Takata said there were signs that the central banks would soon achieve its 2% inflation target. As a result, the bank can finally start hiking interest rates. Analysts say the BoJ could surprise markets with a rate hike in March.

Still, the yen remains among the worst-performing G10 currencies against the dollar this month. In February, the dollar rallied as upbeat economic data led to a decline in rate-cut bets. Meanwhile, the yen weakened as policymakers dampened expectations for aggressive rate hikes from the BoJ.

On Wednesday, the dollar held steady as markets awaited the US’s core PCE price index report. This report will guide the Fed on the next policy moves to tame inflation. Notably, economists expect an increase of 0.4%.

Currently, expectations for a rate cut in May have fallen to 20%, while those for June are near 50%. A higher-than-expected reading on today’s inflation report could lead to a further decline in rate cut expectations. Consequently, the dollar would rally, putting pressure on the yen.

USD/JPY key events today

- US core PCE price index m/m

- US unemployment claims

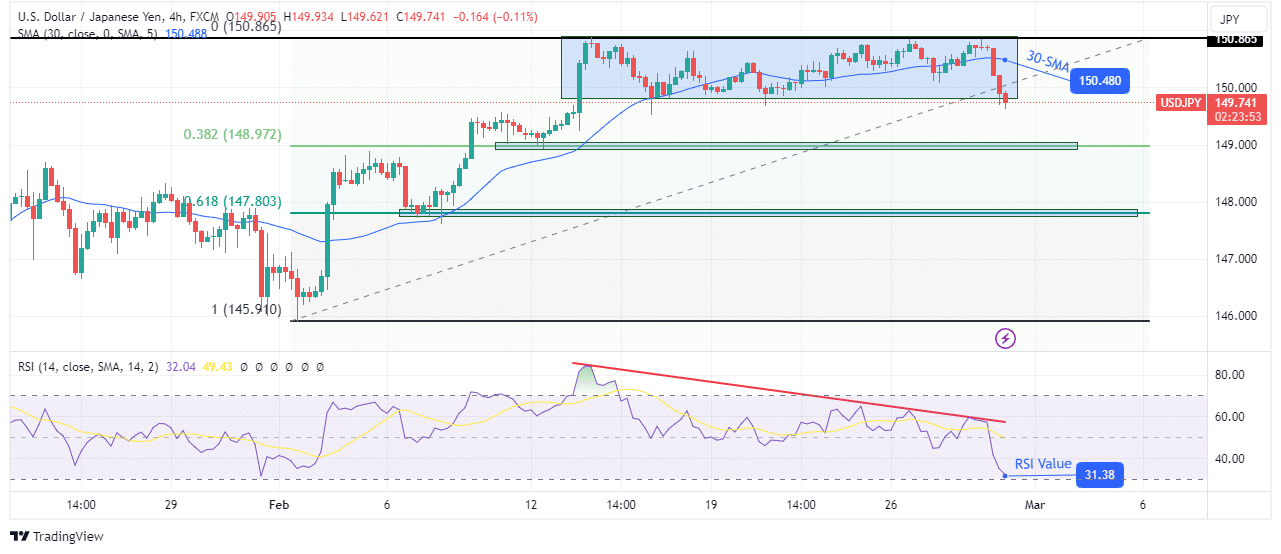

USD/JPY technical forecast: 150.86 Resistance Sparks Bearish Divergence

USD/JPY 1-hour chart

The price has made a bearish divergence on the charts after finding solid resistance at the 150.86 level. Initially, the price traded in a strong bullish trend that paused at the 150.86 resistance level. After pausing, it moved sideways in a rectangle with clear support and resistance.

However, the bearish divergence in the RSI showed that bullish momentum was fading. As a result, there was a strong break below the 30-SMA, indicating a shift in sentiment. At the same time, the RSI is nearing the oversold region, supporting strong bearish momentum. If the price breaks out of its rectangle, the first target will be at the 0.382 Fib level. Meanwhile, the second target will be at the 0.618 Fib level.

More By This Author:

GBP/USD Forecast: Sellers Emerge Ahead Of US Core PCE DataAUD/USD Price Analysis: Aussie Slides On Softer Inflation

USD/JPY Outlook: Yen Recovers As Greenback Retreats

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more