USD/JPY Forecast: FOMC’s Rate Outlook Keeps Dollar Firm

Thursday’s USD/JPY forecast paints a bullish picture as the greenback stands firm against its global counterparts. The escalating confidence in the US central bank’s commitment to sustaining higher interest rates is a key driver behind this positive projection. Moreover, the greenback kept the yen near a two-week low from Wednesday, hovering close to the psychologically significant 150-mark.

Additionally, the dollar was strong due to rising US Treasury yields, which continued to climb in the Asian trading session. Markets bet that Federal Reserve Chair Jerome Powell would adopt a hawkish stance in his speech on Thursday.

Nevertheless, Fed officials have been signaling a temporary halt in interest rate hikes as they grapple with mixed economic signals. These include robust US economic data and persistent inflation concerns. Notably, the next monetary policy meeting is scheduled for October 31 – November 1.

Meanwhile, the Japanese yen saw a slight strengthening to 149.8 per dollar, rebounding from Wednesday’s two-week low of 149.94. However, it was still near the critical 150-level that traders consider a potential trigger for intervention.

The future movement of the dollar/yen exchange rate will depend on whether US yields continue to rise at a faster pace than their Japanese counterparts. This is according to Carol Kong, a currency strategist and economist at the Commonwealth Bank of Australia.

USD/JPY key events today

Investors will watch key events from the US, including:

- The initial jobless claims report.

- The Philadelphia Fed Manufacturing Index.

- The existing home sales report.

- Fed chair Powell’s speech.

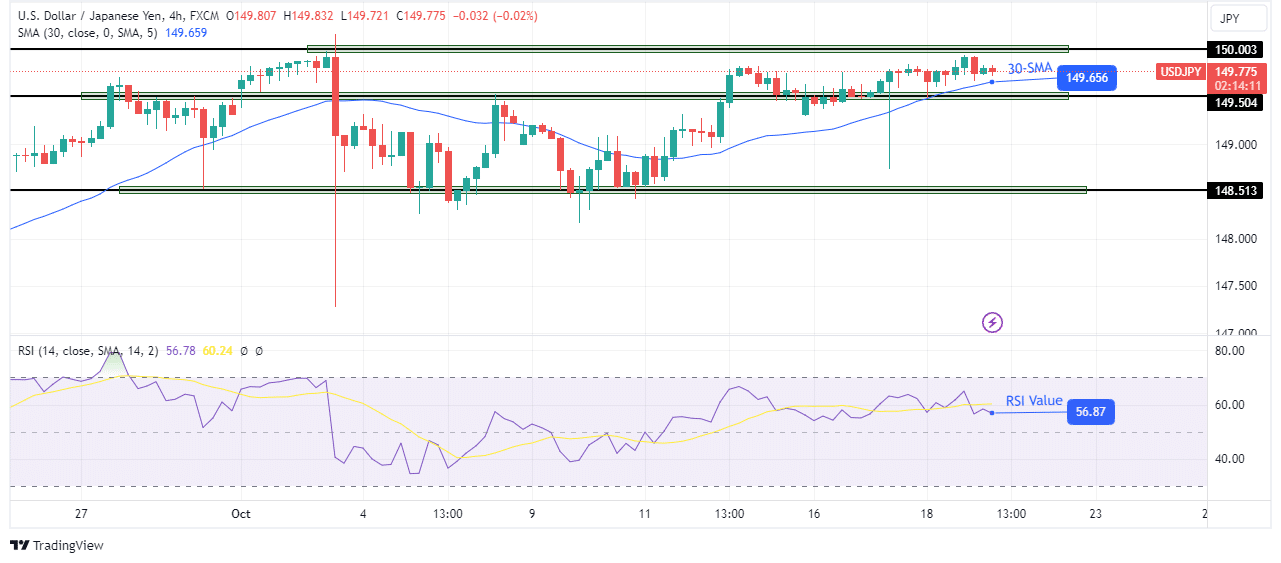

USD/JPY technical forecast: Bulls lose momentum as price clings to 30-SMA.

USD/JPY 4-hour chart

On the technical side, the yen has slowed down its climb near the 150.00 key resistance level. The bias is bullish because the price has maintained its position above the 30-SMA. At the same time, the RSI trades in bullish territory above 50.

However, bulls have weakened. They are no longer able to push the price too far above the 30-SMA. As a result, the price is mostly riding on the SMA. Given the price trades near a strong resistance level, bears might take this chance to push it below the SMA and the 149.50 support level.

More By This Author:

EUR/USD Price Attempting Recovery, Eyes On FedAUD/USD Price Analysis: Upbeat Chinese Data Supports Aussie

EUR/USD Price Pares Gains, Eyes On EU CPI, FOMC Speech

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more