USD/JPY Forecast: Downside Risk Soars After BoJ’s Remarks

Today’s USD/JPY forecast is bearish. Notably, the yen surged, driven by remarks from Bank of Japan (BOJ) Governor Kazuo Ueda. His remarks fueled optimism that Japan might move away from negative interest rates. Simultaneously, the dollar declined in anticipation of this week’s crucial US inflation report.

The Japanese currency gained over 1%, reaching a one-week high of 145.99 against the dollar. Ueda’s weekend comments, stating that the central bank might abandon its negative interest rate policy when it approaches its 2% inflation goal, provided this boost. Moreover, Ueda mentioned that the BOJ could possess sufficient data by year-end to decide whether to end negative rates.

The yen has faced significant pressure against the dollar due to the growing interest rate gap with the United States. The Federal Reserve initiated an aggressive rate-hike campaign last year, while the BOJ maintains a dovish stance.

Takehiko Masuzawa, the trading head at Phillip Securities Japan, commented, “It appears that Ueda’s statements were aimed at halting the yen’s decline against the dollar. Moreover, his remarks have a similar effect to government intervention.”

Since the yen slipped below the critical 145 per dollar threshold last month, traders have been vigilant for any intervention indications. A year ago, this level prompted the authorities’ first yen-buying intervention since 1998.

Meanwhile, the dollar retreated ahead of Wednesday’s US inflation data. Traders monitored whether the world’s largest economy was truly heading for a “soft landing.” Moreover, they want to know whether the Federal Reserve has more room to raise interest rates.

USD/JPY key events today

Investors will keep absorbing BOJ governor Ueda’s remarks as no key reports are expected from Japan or the US today.

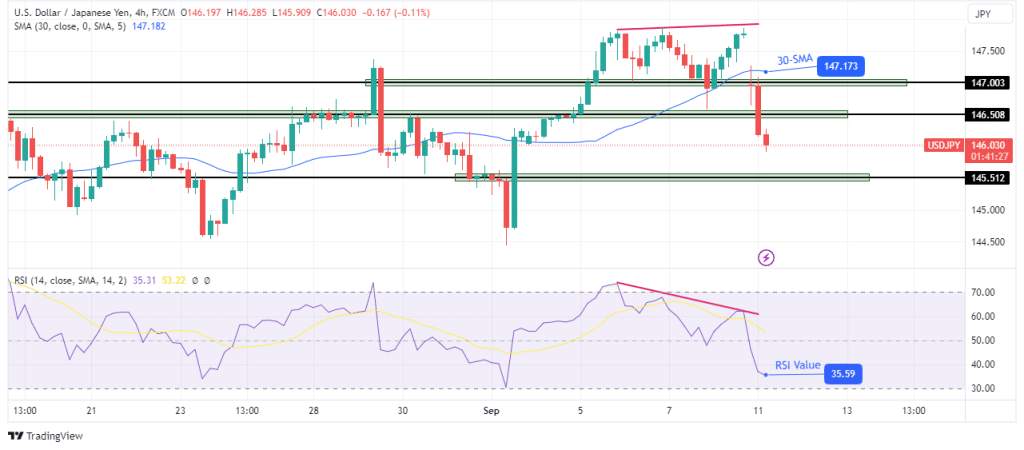

USD/JPY technical forecast: Gap signals strong bearish momentum.

(Click on image to enlarge)

USD/JPY 4-hour chart

The USD/JPY pair has suddenly collapsed on the charts, gaping below the 30-SMA. This comes after the RSI made a bearish divergence that pointed to bullish weakness. Moreover, the price broke below the 147.00 and 146.50 support levels.

The steep decline could be the start of a new bearish trend if the price stays below the 30-SMA. Currently, bears are targeting the 145.51 support level. The price might pause at this support before either breaking below or pulling back to retest the 146.50 key level.

More By This Author:

EUR/USD Weekly Forecast: ECB Expected To Retain RatesUSD/CAD Weekly Forecast: BoC Hike Odds Rise On Jobs Data

EUR/USD Price Analysis: Heading For Straight 8 Weeks Of Losses

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more