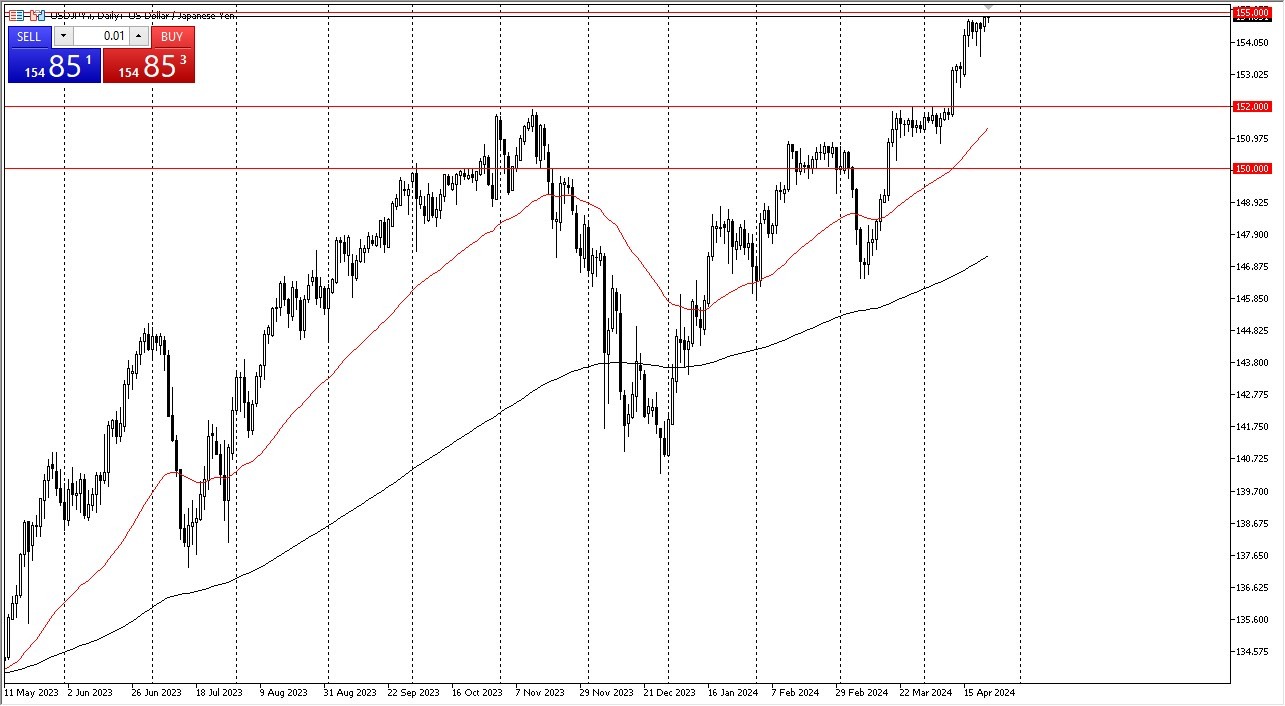

USD/JPY Forecast: Dips Are Opportunities

Short-term dips at this point in time continue to be buying opportunities and that's something I've been doing adding to a longer term trend. The 154 yen level underneath is significant support.

The 152 Yen Level

Right after that then we have the 152 yen level which i think is the floor in the market especially now that the 50-day EMA is starting to come back into the picture. In general, it's likely to be a scenario where value hunters continue to come in and pick up US dollars because they get paid at the end of every day to hold onto this pair. The Bank of Japan is nowhere near being able to tighten monetary policy, and it looks like the Federal Reserve is going to have to stay tight for longer. And that, of course, has a major influence on this market as well. All things being equal, I am a buyer only, and I look at each dip as an opportunity to pick up cheap US dollars.

(Click on image to enlarge)

The USD/JPY pair will continue to be a major area of investment and holding for myself, as it is the gift that keep on giving. Ultimately, even if the Bank of Japan were to raise rates, they are limited in doing so to 0.10% increments, meaning that they really won’t be able to do much, especially as the Federal Reserve will continue to see the need to stay “higher for longer.”

More By This Author:

GBP/CHF Forecast: British Pound Has A Wild Ride Against The FrancPairs In Focus - Sunday, April 21

BTC/USD Forecast: Bounces From Support

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals and ...

more