USD/JPY Drops As Dovish Fed Projections Weigh On Yields

Yen. Image Source: Pixabay

The Japanese Yen (JPY) has extended its advance against the US Dollar (USD) following the Federal Reserve’s policy decision, as traders shift focus to remarks from Fed Chair Jerome Powell.

USD/JPY dropped sharply after the announcement and is now trading around 144.50, down 0.45% on the day, as bond yields declined and rate-cut expectations firmed.

As expected, the Fed left interest rates unchanged at 4.25%–4.50%, with a unanimous decision. Policymakers cited persistent uncertainty surrounding fiscal policy, tariffs, and tax measures, making it difficult to offer clear forward guidance.

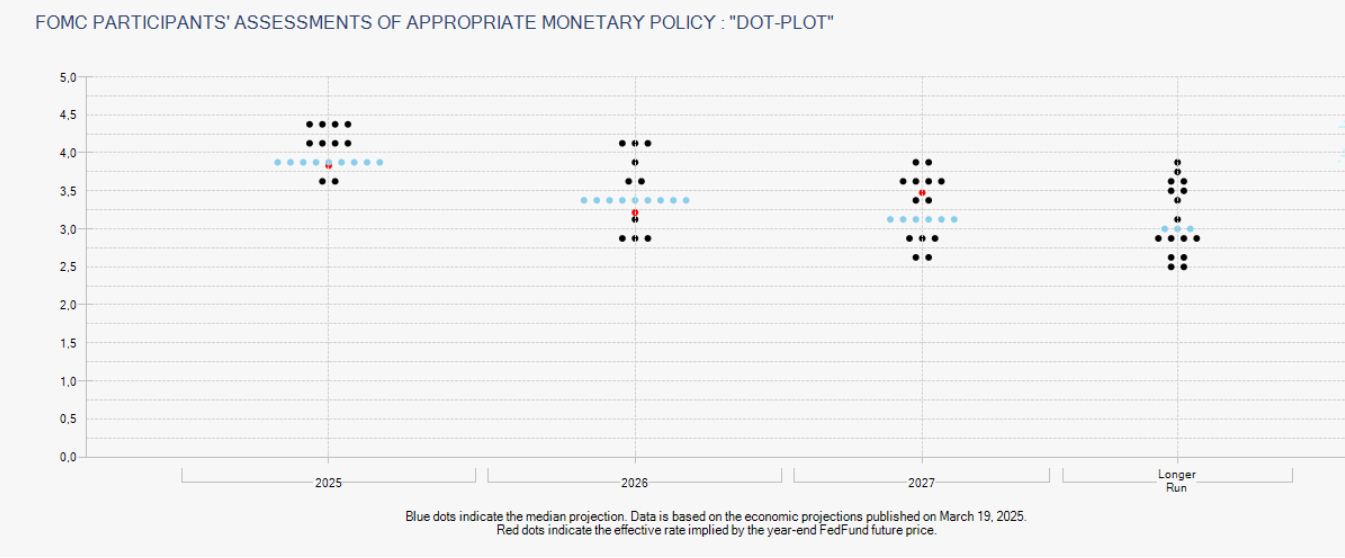

Markets interpreted the update as dovish. Treasury yields fell, with the 2-year note dropping nearly 5 basis points to 3.9%. The updated dot plot signals two rate cuts by the end of 2025, unchanged from the March forecast. Seven FOMC members expect two cuts, while four anticipate just one.

(Click on image to enlarge)

The Fed removed previous language that warned of rising risks from inflation and unemployment. Although uncertainty remains, the labor market is now described as “solid,” with unemployment projected to edge up to 4.5% by year-end.

Core PCE inflation is now forecast at 3.1%, up from 2.8% in March, while headline inflation is projected to reach 3.0%. Economic growth is expected to slow to 1.4% this year, down from the previously projected 1.7%.

All eyes now turn to Fed Chair Powell’s press conference for clarity on the policy outlook. His tone and guidance will be key in determining whether markets maintain expectations for near-term easing or adjust course.

More By This Author:

Gold Prices Steady As The US Dollar Softens, Fed Powell's Remarks In Focus

Gold Turns Cautious As Fed Decision Briefly Overshadows Middle East Tensions

USD/CAD Steadies As Traders Digest Mixed US Retail Sales Data Ahead Of The Fed

Disclosure: The data contained in this article is not necessarily real-time nor accurate, and analyses are the opinions of the author and do not represent the recommendations of ...

more