USD/JPY Could Resume Lower As U.S. Inflation Cools More Than Expected

Yen. Image Source: Pixabay

FX traders were awaiting the US CPI report this morning, with major pairs largely in a holding pattern. The dollar had bounced back ahead of the data release and the USD/JPY was trading near the 149.00 handle. As it turned out, the CPI report was cooler than expected, and this led to an immediate drop in the dollar across the board. But the greenback quickly rebounded, and the USD/JPY tested waters above the 149.00 level where it was holding at the time of writing. But despite recovering post CPI and remaining on the front-foot in the last couple of days, the USD/JPY trend remains mildly bearish in light of the weakness in US data. The downside pressure could persist should this week’s other economic indicators also point to a more dovish outlook for the US economy and Federal Reserve. Thursday brings the latest Producer Price Index (PPI) figures along with weekly jobless claims, while Friday’s University of Michigan consumer sentiment and inflation expectations survey will round off the week.

US CPI eases to 2.8% from 3.0%

While the inflation report was weaker, the USD/JPY was able to rebound fairly quickly following the initial drop. But it could resume lower again as we head deeper into the session.

Headline CPI was +2.8% vs +2.9% expected, dropping noticeably from +3.0% the month before. The month on month reading was +0.2% vs. +0.3% expected. Meanwhile, core CPI printed +3.1% vs +3.2% expected. Interestingly, this was the lowest core CPI print since 2021. The month-over-month core CPI was also weaker at +0.2% vs +0.3% expected.

Will softer US CPI force the Fed’s hand?

Well inflation had been creeping higher for five consecutive months, leaving the Federal Reserve in a precarious position. Today’s cooler CPI release will offer some relief but with Trump’s tariffs at full swing, the concern is that price pressures could persist. Plus, this is just one month’s worth of data. And while CPI has weakened and signs of economic weakness are emerging in certain sectors, inflation expectations among consumers are rising, fuelled in part by concerns over tariffs and Trump’s economic policies. The key question is whether this upward trend in inflation expectations will sustain inflationary pressures or if softer economic data and declining oil prices will provide some relief.

USD/JPY remains mildly supported by calmer market conditions

One reason why the USD/JPY was firmer despite the weaker inflation data was the fact that the market sentiment had taken a modest turn for the better, with equity markets on the rise, providing a lift to the USD/JPY and other yen pairs. The recovery comes after the US Dollar Index suffered its worst weekly performance since November 2022 last week.

Investors are grappling with a complex mix of factors, including escalating trade tariffs, the prospect of a ceasefire in Ukraine, ongoing recession fears in the US, and the much-anticipated inflation data due later today.

The European Union has announced €26 billion in retaliatory measures following President Trump’s tariffs on steel and aluminium imports, which officially take effect today. In response, Brussels’ countermeasures will be implemented from 1st April, allowing a brief window for negotiations and the possibility of a last-minute resolution. This follows Trump’s abrupt reversal on a proposed 50% tariff on Canadian steel and aluminium. Facing retaliatory measures from Ontario, the US President ultimately scaled back to a 25% tariff after Canada backed down.

Trump’s unpredictability continues to stoke market volatility, though this has been tempered somewhat by news that Ukraine is prepared to accept a month-long ceasefire in its conflict with Russia. The proposal, brokered by the US and Ukraine, is now set to be presented to Moscow. A ceasefire, if secured, could provide a further boost to sentiment.

More key US data ahead: PPI and UoM Consumer Sentiment

Later in the week, we will have more key data to look forward to, including PPI tomorrow and UoM Consumer Sentiment on Friday.

PPI data is due on Thursday

The PPI release is another significant factor for investors to consider, given its close correlation with the Fed’s preferred inflation gauge—the Core PCE Price Index. A stronger-than-expected PPI reading could alter expectations around the Fed’s next move, making this release particularly noteworthy. Any unexpected deviation in these numbers could spark volatility in the USD/JPY pair, as traders reassess the likelihood of near-term rate adjustments.

UoM consumer sentiment and inflation expectations out on Friday

Once the inflation data is absorbed, market focus will turn to Friday’s University of Michigan surveys. A sharp drop in last month’s consumer confidence reading raised concerns about the impact of Trump’s trade policies on economic sentiment. This widely followed survey, polling around 420 respondents on current and future economic conditions, will provide further insight into consumer confidence trends. Additionally, the inflation expectations component, which saw a sharp rise last month to 4.3% from 3.3%, will be closely watched for signs of persistent inflationary pressures. The implications of these figures could be significant, as investors weigh the potential impact on monetary policy and broader market sentiment.

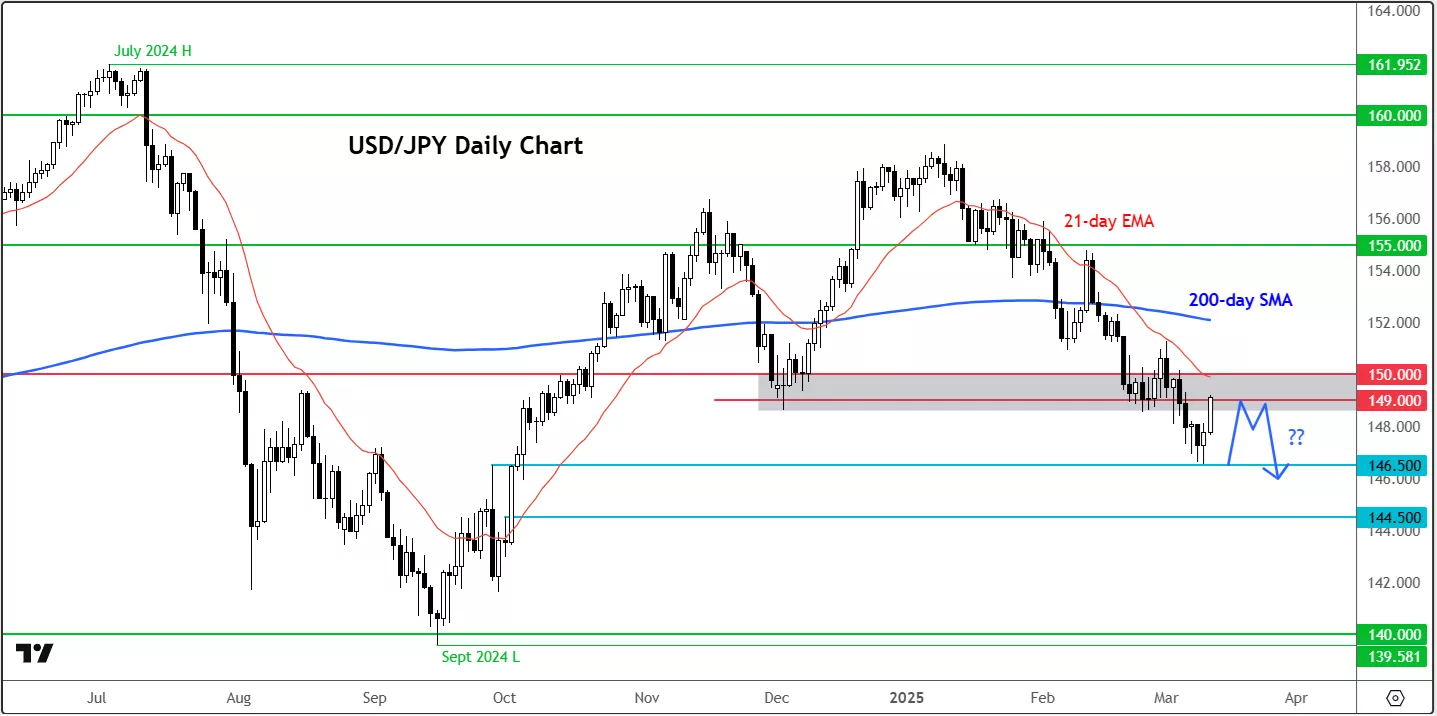

USD/JPY technical analysis and key levels to watch

The USD/JPY was testing the lower bound of a major resistance zone between 149.00 to 150.00. This area was previously a key support zone that gave way last week. Now testing the former support from underneath, we could see the resumption of the selling pressure here.

Source: TradingView.com

If the selling resumes, we could see a pit stop at 148.00 initially, before testing liquidity below this week’s low at 146.50 next. Then we have 145.00, the next big psychological level, followed by 144.50.

However, if the above-mentioned resistance in the 149.00-150.00 area gives way instead, then this could pave the way for a potential squeeze towards the 200-day moving average at 152.00 next.

More By This Author:

Gold Consolidates Ahead Of Key Data This WeekS&P 500 Bounces Back Amid Speculation On Tariffs Compromise And German Debt Plan

After Gold’s Big Surge, Can Gold Stocks Finally Catch Up?