USD/CHF Weekly Outlook: Investors Await Fed’s Stance On Hikes

The USD/CHF weekly outlook is bullish as the dollar rally resumes ahead of the Fed meeting. However, recession woes may hamper the bulls.

Ups And Downs Of USD/CHF

The pair moved in the past week, mainly driven by data from the US. The US economy had a robust recovery in the third quarter as the trade deficit decreased. The economy’s return to growth following two consecutive quarters of GDP reductions provided evidence that the economy was not in a recession.

The PCE price index, the Fed’s favorite tool for tracking progress toward its 2% inflation target, rose 0.3% from month to month and 6.2% from year to year in September, matching August’s gains.

Even though overall inflation is still high, there are signs that US price pressures are beginning to ease, which may persuade Federal Reserve policymakers to deliver smaller hikes after announcing their fourth consecutive 75bps hike next week.

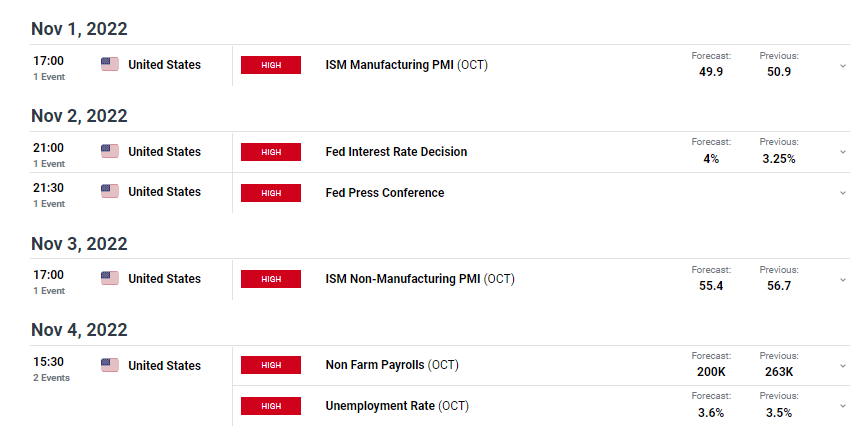

Next Week’s Key Events For USD/CHF

(Click on image to enlarge)

A fourth consecutive big 75bps hike is largely anticipated when the Federal Reserve meets on November 1-2. Investors are now concentrating on whether the Fed will slow the pace of future increases as it weighs the threats to economic growth against its success in taming soaring inflation.

The October US payrolls report is due out on Friday, and according to economists surveyed by Reuters, the economy added 200,000 new jobs.

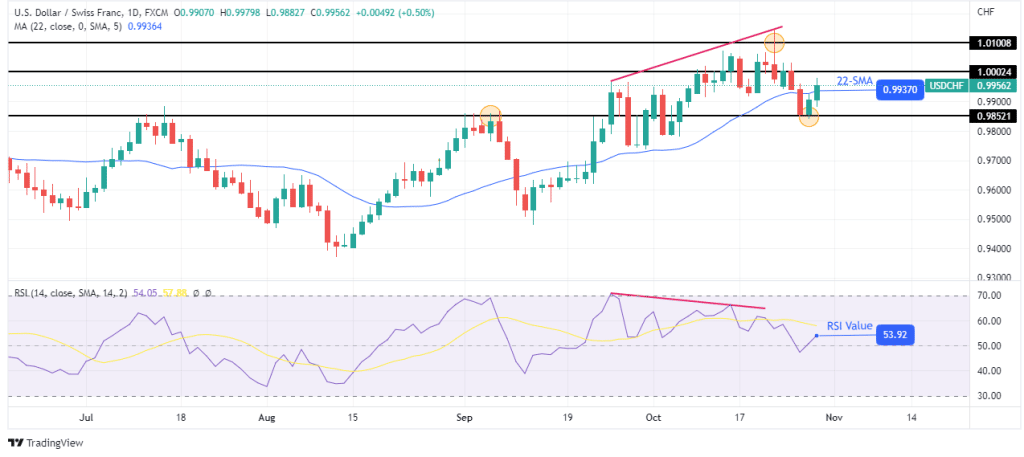

USD/CHF Weekly Technical Outlook: Uptrend Running Out Of Steam

(Click on image to enlarge)

Looking at the daily chart, we see the price trading close to the 22-SMA and RSI above 50, favoring bullish momentum. The price was in an uptrend for some time until it could not go beyond the 1.0100 key level. At this point, the RSI showed exhaustion in the bullish trend when it made a bearish divergence.

Since then, bears have come in and pushed the price back below parity and the 22-SMA. However, bears also found it hard to go below the 0.9852 support level, and the price looks set to retest parity before it falls further. The bullish trend can only continue if the price breaks above parity.

More By This Author:

AUD/USD Weekly Forecast: Inflation Peak Pushing For HawkishnessEUR/USD Weekly Forecast: Slowing Eurozone Economy Fuels Recession

USD/CHF Weekly Forecast: Fed Ready to Do More to Curb Inflation

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more